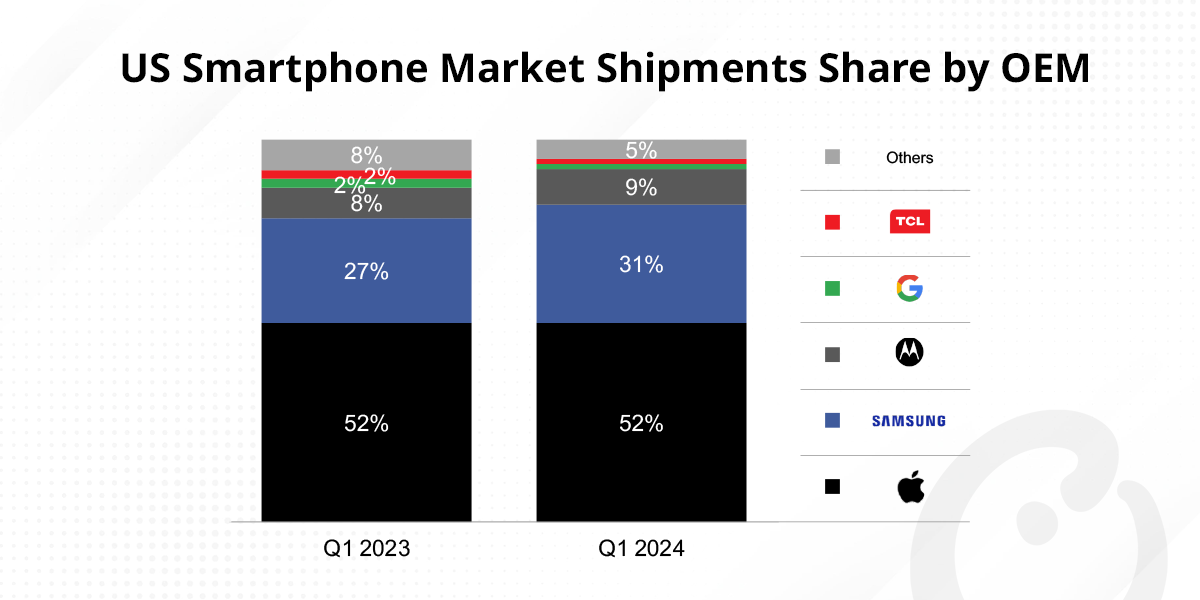

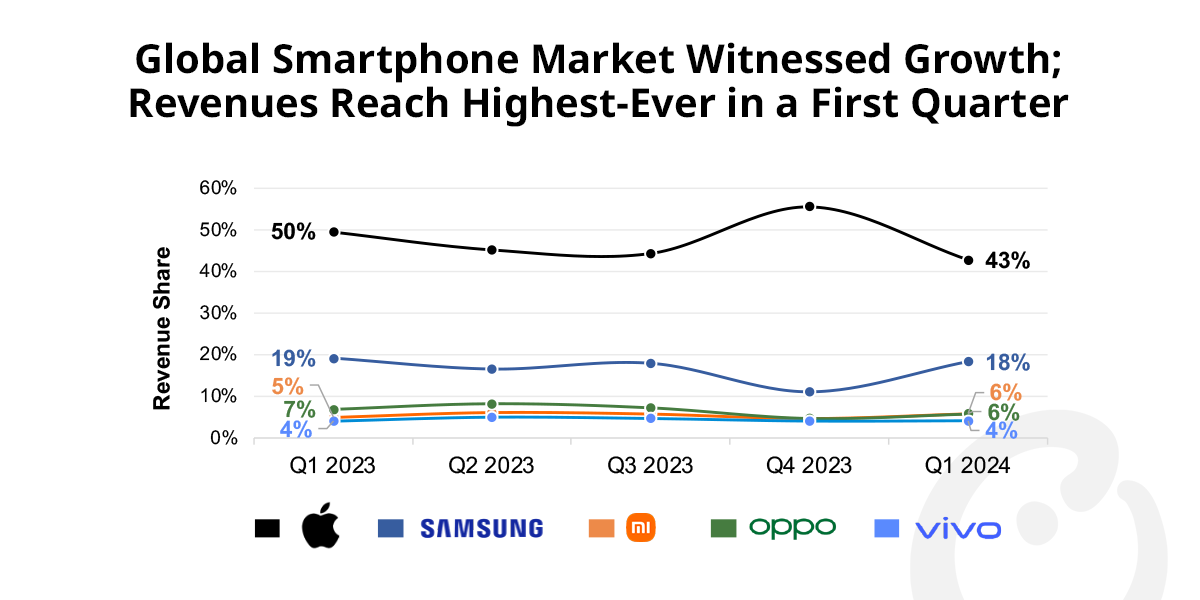

- US smartphone shipments declined 8% YoY in Q1 2024, the sixth consecutive quarter showing a YoY decline.

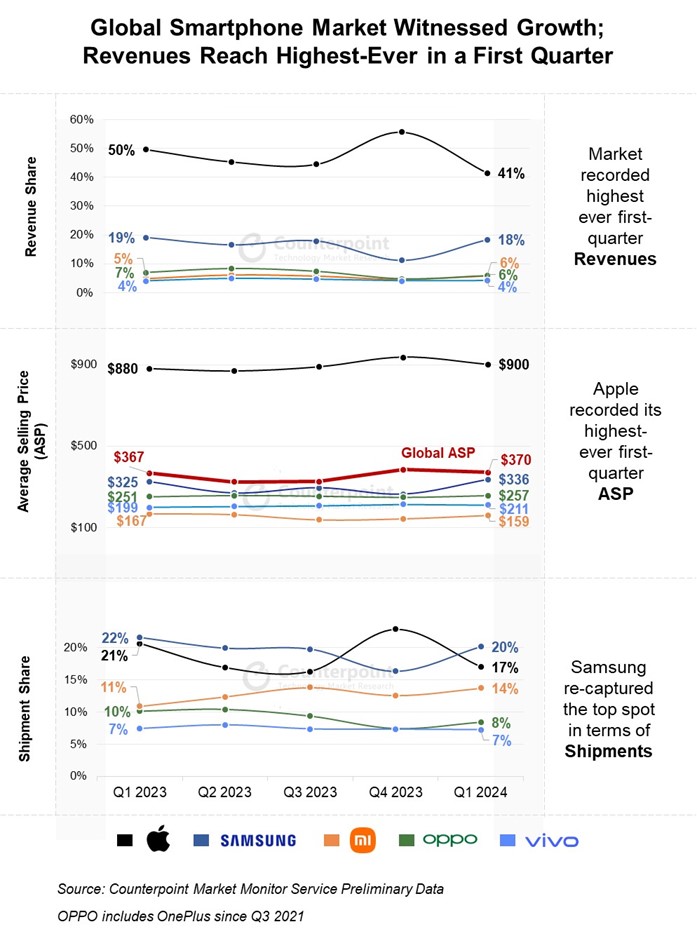

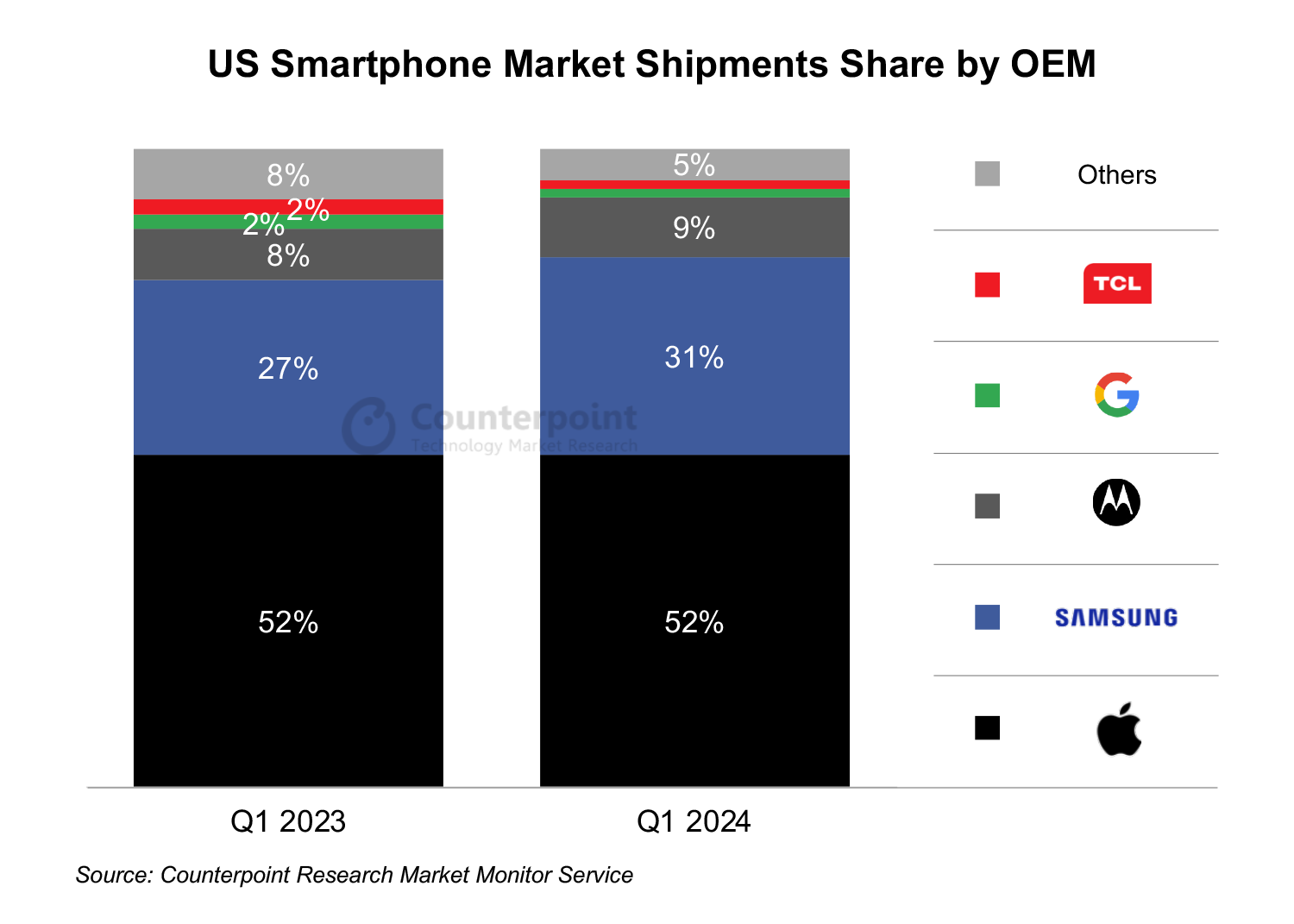

- Samsung’s market share grew to 31%, its highest Q1 share since Q1 2020.

- Apple’s market share remained flat at 52% in Q1 2024.

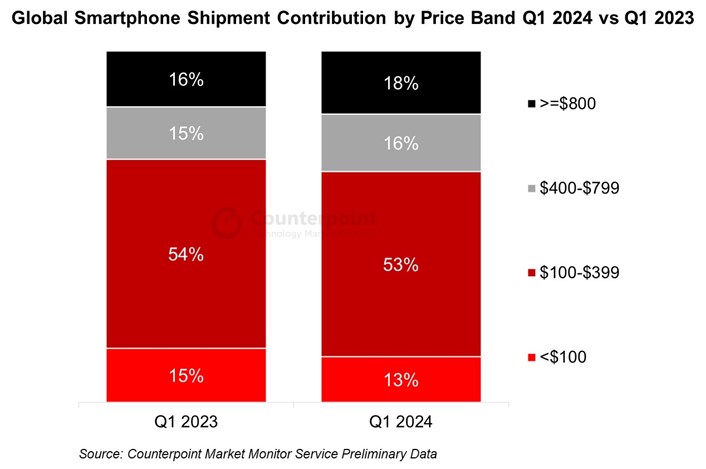

- Low-end shipments declined as carriers pushed for deeper 5G smartphone penetration.

Boston, Fort Collins, San Diego, Beijing, Buenos Aires, Hong Kong, London, New Delhi, Seoul – May 9, 2024

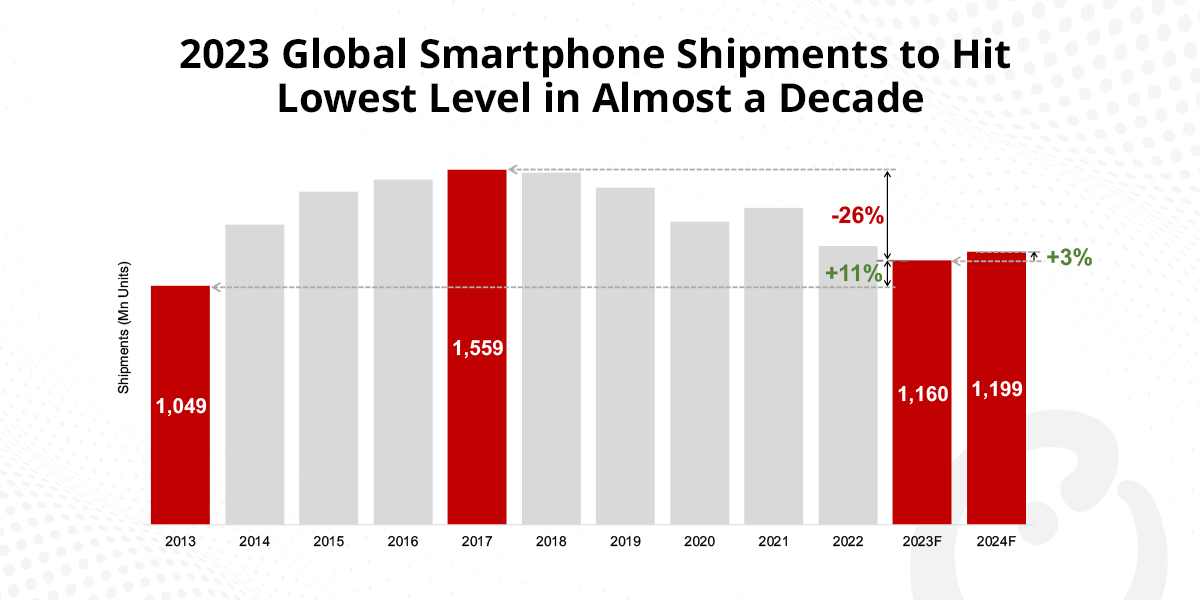

US smartphone shipments declined 8% YoY in Q1 2024, according to Counterpoint Research’s Market Monitor data. This was primarily due to stronger Q1 2023 shipments following COVID-19-related factory closures that pushed Apple shipments from Q4 2022 into Q1 of last year. The sub-$300 segment saw continued declines due to weakness in the prepaid market, with carriers pushing for 5G smartphone SKUs, causing some OEMs to pull away from the market.

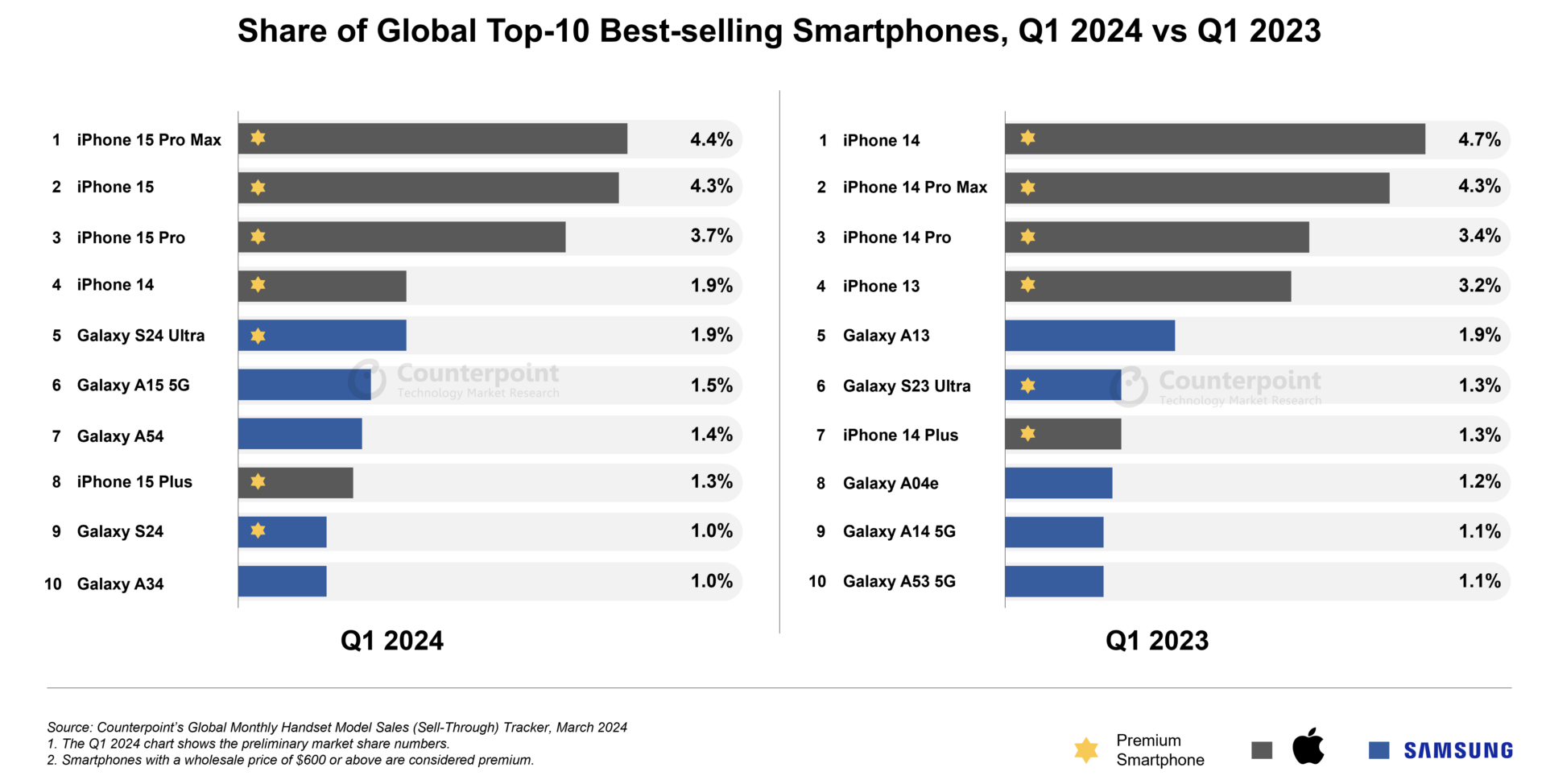

“Carriers saw declining upgrade rates and equipment revenues again in Q1 2024, showcasing the continued weak demand for smartphones in the market. Shipments were down YoY, with most of the decline being driven by an unfavorable YoY comparison due to iPhone 14 Pro and Pro Max launch quarter shipments being realized in Q1 2023,” said Jeff Fieldhack, Counterpoint’s Research Director for North America. “However, Apple maintained a healthy market share of 52% in the quarter as sub-$300 Android shipments saw declines.”

On Android shipments, Senior Analyst Maurice Klaehne said, “Overall Android shipments decreased YoY, with the market’s low end continuing to see consolidation and decreasing new product launches due to LTE devices being phased out in favor of 5G models in carrier channels. The added costs of 5G connectivity make it challenging for OEMs to compete in the low-end space. A bright spot in the market was Samsung, which grew shipments YoY with the earlier launch of the S24 series. It was Samsung’s best Q1 in four years as the brand grew its market share to 31%, the highest since Q1 2020. There was strong demand from older Samsung users looking to upgrade to a new device.”

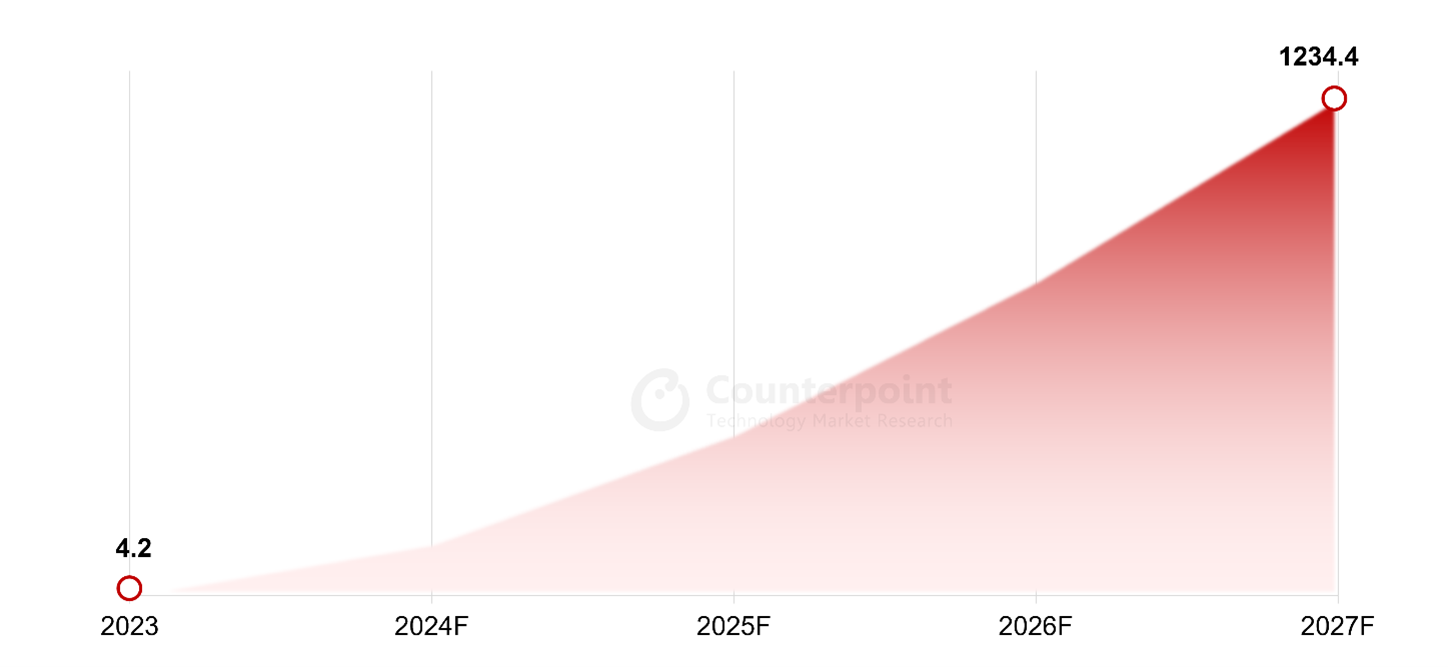

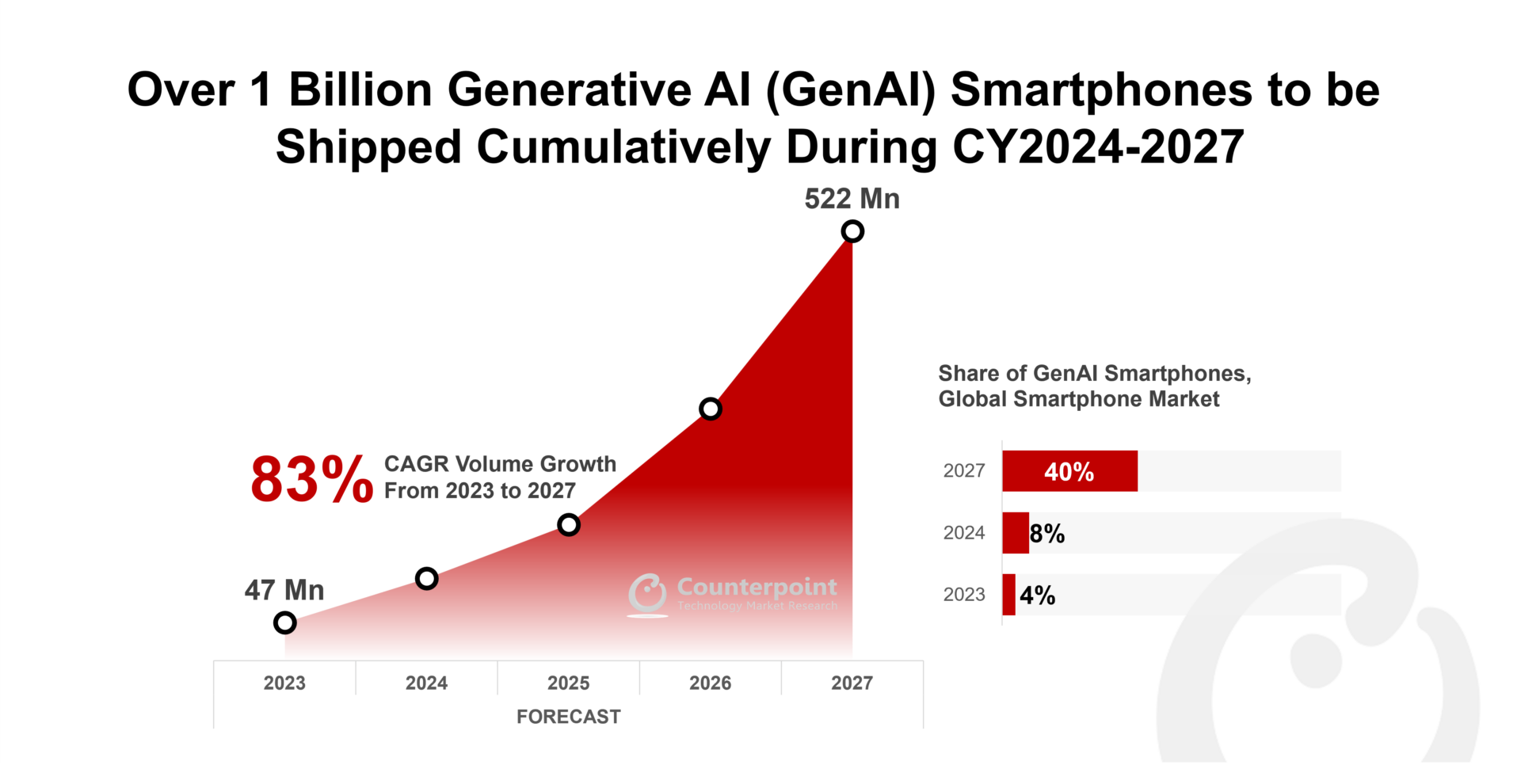

Commenting on the outlook for the remainder of 2024, Associate Director Hanish Bhatia said, “Q1 was the sixth consecutive quarter of YoY shipment declines and signs are that a recovery in the market has been postponed to at least Q3, when new device launches can stimulate demand. There will be seasonal growth drivers in Q3 and Q4 with the holidays and new product launches, especially if we see a strong push for GenAI features in new iPhones. Looking ahead, 2024 may remain a challenging year for OEMs given how upgrade rates have continued to remain low against the backdrop of macroeconomic headwinds triggered by high interest rates.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com