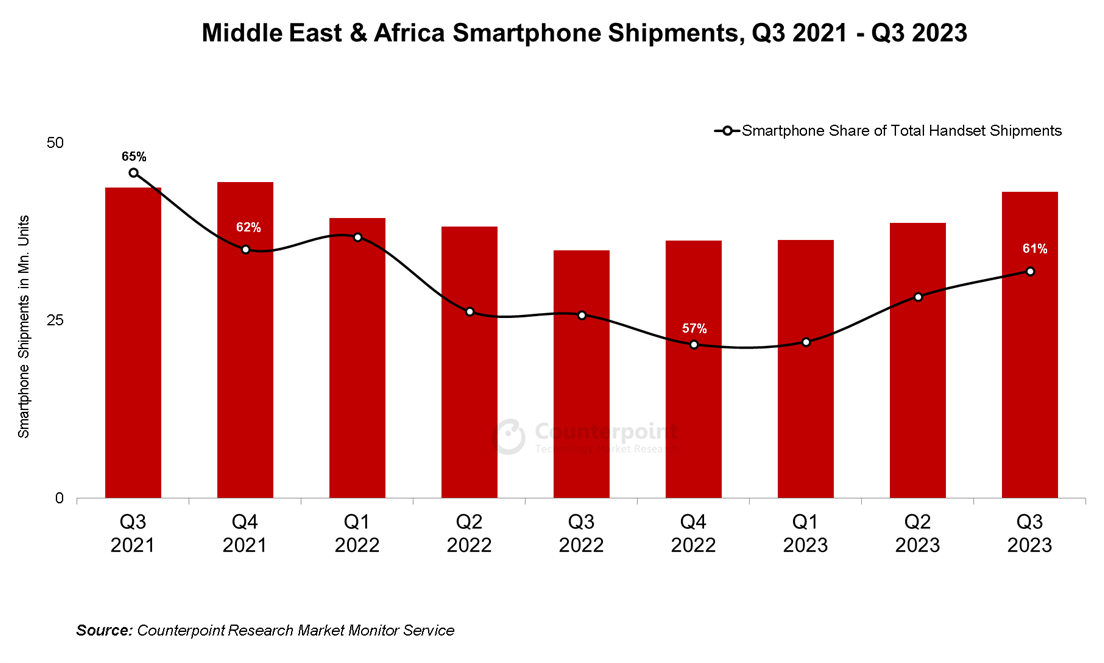

- MEA smartphone shipments grew 23% YoY and 11% QoQ in Q3 2023 to reach their highest levels since the onset of the global economic crisis.

- The feature phone-to-smartphone upgrade cycle observed in 2021 resumed in Q3 owing to improvements in macroeconomic conditions. The share of smartphones in total handset shipments reached 61%.

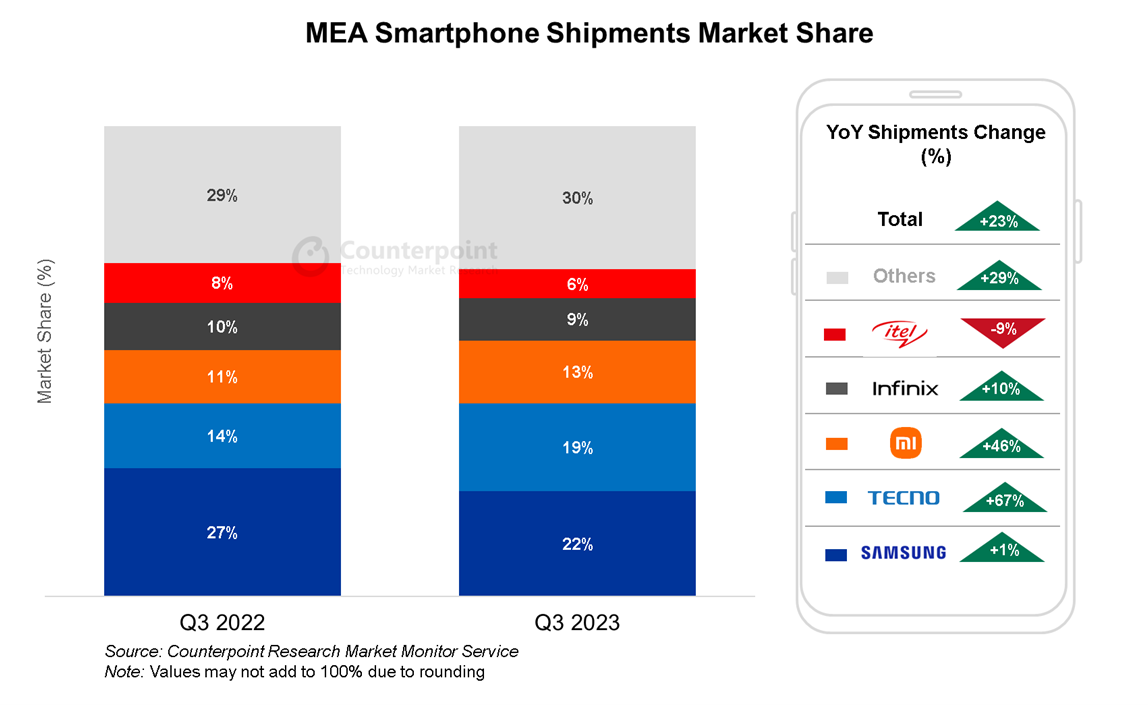

- Samsung led the market but Xiaomi, TECNO and HONOR were the biggest gainers. Transsion Group brands captured over a third of total MEA smartphone shipments.

- The wholesale average selling price of smartphones sold in the region continued to increase, with the price bands above $200 continuing to gain share.

London, Boston, Toronto, New Delhi, Hong Kong, Beijing, Taipei, Seoul – November 21, 2023

Smartphone shipments in the Middle East and Africa (MEA) region grew 23% YoY and 11% QoQ in Q3 2023, according to the latest research from Counterpoint’s Market Monitor Service. Many major markets recorded YoY improvements in their key macroeconomic indicators, like unemployment and inflation, which helped improve consumer sentiment during the quarter. This led to the resumption of the feature phone-to-smartphone upgrade cycle which was last observed driving the market in 2021. The smartphone share of total handset shipments rose to 61% in Q3 2023.

Commenting on the market’s performance, Research Analyst Ravyansh Yadav said, “The MEA region grew the fastest among all regions, building on the momentum from Q2 2023 as economies continued to recover. This also made OEMs aggressive in capturing demand. The market reached levels last observed in 2021, before the global macroeconomic crisis, from which many developed markets are still struggling to climb out. The MEA region has huge untapped potential, especially due to rapid digitalization and a rising services economy. The smartphone is becoming increasingly more essential in the region, a trend we observed nearly a decade ago in developed markets like North America, Europe and East Asia.”

Most major brands recorded YoY growth, rushing to fill channels with new launches to capitalize on the recovery in demand and the upcoming promotions season in Q4. Consequently, brands are likely sitting on some channel inventory going into Q4. Brands and channels are likely to host multiple promotional events through Q4, like the 11.11 and Black Friday sales in November hosted by major channels like eXtra and Jumia.

Samsung led the market, as shipments grew marginally YoY, with its 2023 A-series devices continuing to drive volumes. Samsung’s latest foldables outperformed their predecessors in the region, but volumes remained low.

HONOR was the fastest-growing top-10 brand, having increased marketing activities and improved device availability across channels over the past few quarters, largely in the Middle East and some African markets. HONOR made significant gains in South Africa in Q3, where it narrowly edged out Xiaomi for the #2 spot.

Xiaomi was aggressive with channel fills in the region throughout the quarter, likely in a bid to recapture share amid stiff competition from the regional stalwarts of Transsion Group. Xiaomi’s Redmi 12 and Note 12 series have been especially popular in the region, particularly in South Africa and Egypt.

TECNO was among the biggest gainers in Q3, benefitting from strong demand for its recent launches like the Spark 10, Pop 7 and Camon 20 series, particularly in Nigeria and other key markets in Africa. TECNO’s success has likely come at the expense of its sister brands Infinix and itel. While Infinix recorded YoY growth driven by multiple recent launches like the Hot 30 and Note 30 series, itel’s shipments declined YoY. While this is partly due to an ongoing shift in Transsion’s portfolio strategy, it also signals a broader market trend of demand moving to higher price tiers and consumer aspirations for better devices.

Commenting on the MEA smartphone market’s price trends, Senior Analyst Yang Wang said, “Consumers are increasingly opting for better devices, which have become more affordable owing to a rise in financing options. Apple has benefitted greatly from this, with its shipments steadily growing YoY over the past year. The wholesale average selling price (ASP) of smartphones sold in MEA has also grown 13% YoY, with the share of price bands above $200 continuing to increase. This trend is likely to continue as the MEA region, like many regions before, approaches maturity within the next decade driven by a rapidly rising digital economy.”

The MEA region represents the next big market opportunity for smartphone brands, as the feature phone-to-smartphone transition continues to drive demand. Furthermore, the market is expected to continue moving to higher price bands, eventually riding the premiumization wave seen in other markets across the world. While regional stalwarts like the Transsion Group brands and Samsung are likely to benefit most, there is an opportunity for new entrants as well as existing players in the market, as showcased by HONOR and Apple over the past few quarters. Brands with a streamlined and accessible portfolio, focus on building relationships with channel players and financial service providers, and strong distribution activities in the region are most likely to make gains as the MEA smartphone market continues to grow.

Counterpoint Research’s market-leading Market Monitor, Market Pulse and Model Sales services for mobile handsets are available for subscribing clients.

Feel free to contact us at press@counterpointresearch.com for questions regarding our in-depth research and insights.

You can also visit our Data Section (updated quarterly) to view the smartphone market share for World, USA, China and India.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research