- MEA smartphone sales grew 35% YoY during Q2 2021, making it the best Q2 on record.

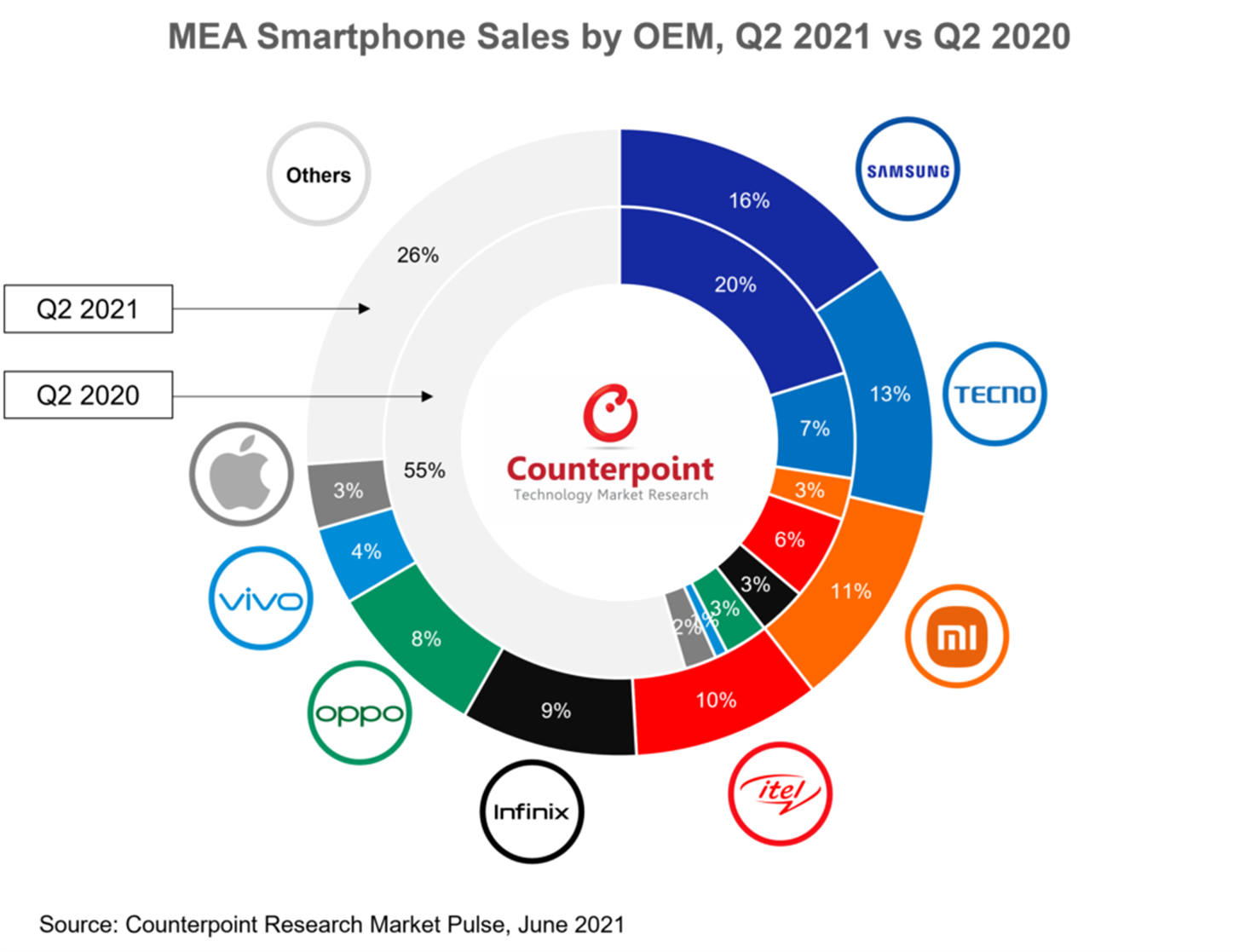

- Samsung continued to hold the top spot in the region by capturing a market share of 16%.

- TECNO solidified its second position by capturing a market share of 13%.

- New Chinese brands Xiaomi, OPPO and vivo have all made impressive gains, with the three capturing 23% market share in Q2 2021.

Boston, Toronto, London, New Delhi, Hong Kong, Beijing, Taipei, Seoul – August 5, 2021

Smartphone sales in the MEA (Middle East and Africa) region grew 35% YoY but declined 3% QoQ in Q2 2021, according to the latest research from Counterpoint’s Market Pulse service. This was the best second quarter ever in terms of unit sales. Smartphone demand has been strong throughout the first half of the year with economic rebound gathering pace and boosting employment levels and consumer sentiment. The gradual relaxation of coronavirus-related lockdown measures across the region, rapid vaccination in key Middle East markets, and a rebound in commodity prices have all helped the sales levels.

Zooming into the MEA region, Middle East smartphone sales retreated marginally by 0.8% QoQ while Africa dropped 3.9% QoQ. But looking at the YoY numbers, both regions have rebounded strongly, with the Middle East up 34% and Africa 36%.

Commenting on the overall market dynamics, Senior Research Analyst Yang Wang said, “Positive momentum from the end of 2020 has been maintained throughout the first half of the year, with the best Q1 and Q2 on record. Smartphones are becoming an integral part of daily life. COVID-19 has helped consumers discover many practical use cases that were not immediately obvious before the pandemic. While the economic and pandemic situation has improved, demand has been further driven by renewed competition from the new Chinese entrants, wider product availability at multiple price points, and continued channel penetration into previously untapped markets.”

Commenting on OEM dynamics, Wang further noted, “Samsung retained the top spot, but its market share slid by 4% points to 16% in Q2 2021. The company boosted market spending at the start of the year, leading to good performance in Q1. However, sales trended down in Q2 due to production disruption in Vietnam following COVID-19. We expect further difficulty in early Q3.”

“The Transsion brands, namely TECNO, itel and Infinix, almost doubled their cumulative market share from 16% to 32%, as they continued to dominate the lower-priced segment in Africa while making successful entries in some Middle East markets. From a pricing point of view, some of Transsion’s market share in the sub-$100 segment has shifted upwards to the $100-$200 segment. This means itel, the incumbent in the ultra-affordable segment, lost some share to TECNO and Infinix, which make smartphones with higher specs.”

“Xiaomi, OPPO and vivo have also made substantial gains thanks to aggressive entry initiatives in key Middle East and North Africa markets, and the misfortunes of Huawei and HONOR, whose cumulative quarterly market share shrunk to 2.2% from 8.2% a year ago.”

It should be noted that while there is more competition than ever among the big brands, the Top 8 now account for 74% market share as compared to 52% a year ago. Smaller and local brands are finding it difficult to respond to the onslaught of big brands, which have the resources to add key distribution partners and bring more products to the market quickly. Additionally, smaller brands have been impacted by the global semiconductor shortage far more than the bigger ones, whose scale has enabled them to get ahead of rivals in securing key components, widening product availability at multiple price points and applying flexible channel inventory management. Market consolidation is a phenomenon that has been observed in other more developed markets before, and we expect it to happen naturally in the MEA region too.

Looking toward the rest of the year, we expect consumer demand to remain robust, especially in some Gulf Cooperation Council (GCC) countries where vaccination progress is leading the world. This may lead to faster than expected resumption of international travel, which is a crucial driver for economic growth in the Middle East. On the other hand, Africa is currently undergoing the most severe COVID-19 wave on record. Governments, however, have not returned to the stringent lockdown measures seen in 2020. As a result, economic growth trajectories and consumer demand are expected to remain elevated.

Counterpoint Research’s market leading Market Pulse service for mobile handsets is available for subscribing clients.

Feel free to contact us at press(at)counterpointresearch.com for questions regarding our in-depth research and insights, or for press enquiries.

You can also visit our Data Section (updated quarterly) to view the smartphone market share for World, USA, China and India.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Yang Wang