- Huawei’s 11% YoY growth in China helped it surpass Samsung to lead the Global Smartphone Market

- The global smartphone market declined the fastest ever, -24% YoY, during the quarter

- realme (11% YoY) was the fastest-growing brand during the quarter

- 5G shipments grew 43% QoQ reaching double-digit penetration

- Apple remained resilient as iPhone shipments grew 3% YoY during the quarter

New Delhi, Mumbai, Hong Kong, Seoul, San Diego, London, Buenos Aires –July 31st, 2020

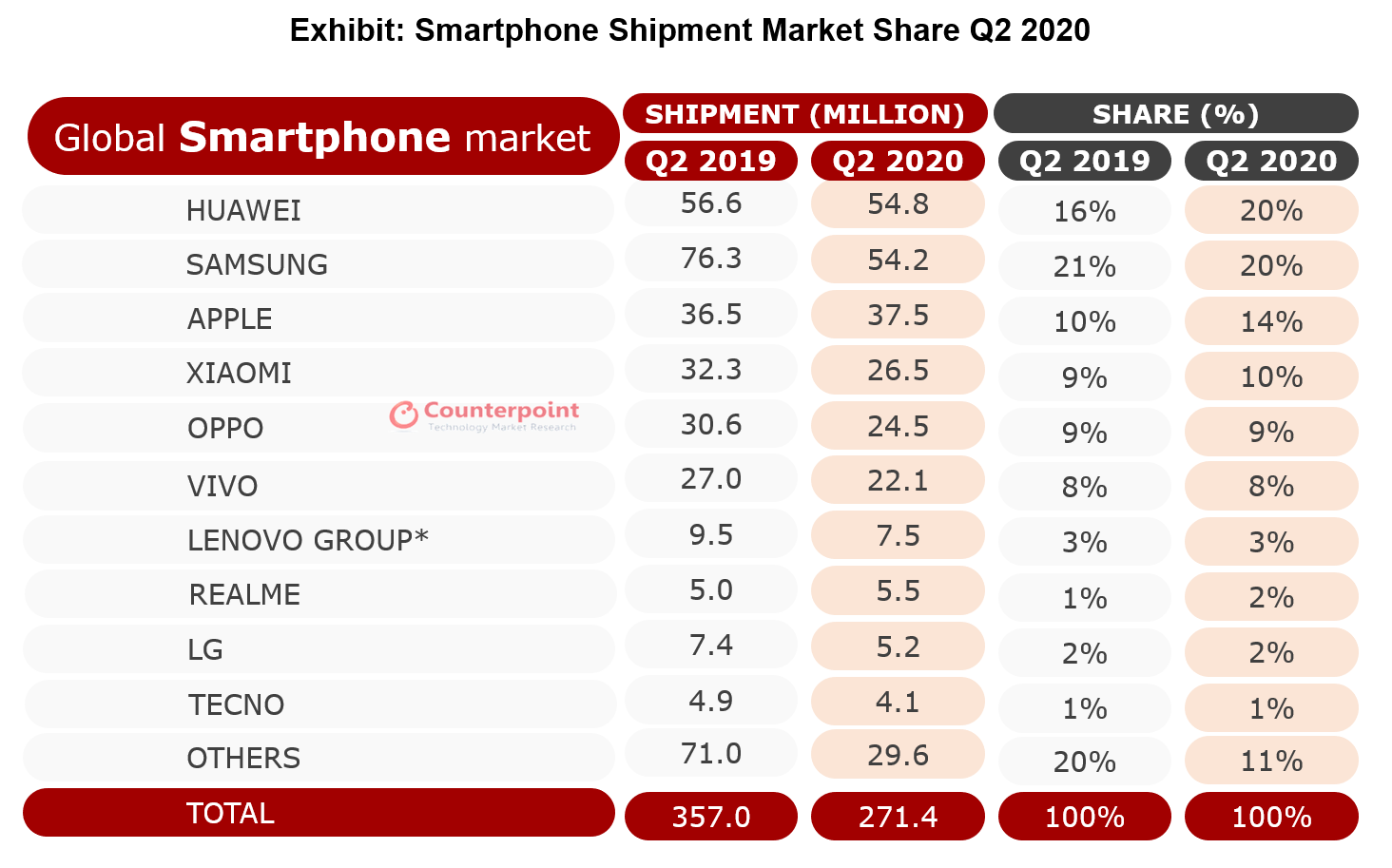

The global smartphone market declined at its fastest ever rate (-24% YoY) in Q2 2020, to 271.4 million units, according to the latest research from Counterpoint’s Market Monitor service, This was also the first time that Huawei, even after struggling with US sanctions, surpassed Samsung to become the top player in the global smartphone market in Q2 2020.

Commenting on Huawei’s lead, Tarun Pathak, Associate Director at Counterpoint Research noted “Huawei was able to attain this feat due to a unique market scenario created because of COVID-19. China, Huawei’s largest market, is now recovering from the pandemic compared to other markets like Europe, LATAM, and North America. Smartphone shipments in China declined 17% YoY, a more modest decline than the rest of the world that declined 28% YoY. Huawei continued its push in China, benefiting from the recovery. It now holds almost half (47%) the market in China, and this alone contributes to 71% of Huawei’s shipments compared to 62% a year ago. However, in markets outside China, its shipments declined 29% YoY. Huawei did well in some Eastern Europe markets like Russia and Ukraine. But as markets outside China recover, it will be difficult for Huawei to maintain this lead in coming quarters.”

Source: Counterpoint Research: Quarterly Market Monitor Q2 2020

Commenting on the market dynamics, Varun Mishra, Research Analyst at Counterpoint Research noted, “The impact of COVID-19 on the smartphone market was more evident in the second quarter compared to the first quarter. The world’s largest smartphone market, China, fared better and as a result China’s accounted for almost a third (31%) of global smartphone shipments; the highest since Q2 2017. However, despite daily COVID-19 cases in China falling to very low levels, the smartphone market is only running at around 85% of the pre-COVID-19 levels, indicating continuing consumer caution.”

Talking about overall market dynamics, Varun Mishra adds, “Shipments improved in each month through the quarter with global smartphone shipments in June rebounding by 34% over May. Markets like India reached pre-COVID levels in June due to pent-up demand. This is a positive sign as we head towards recovery.”

While the overall market declined, 5G continued to grow, driven by China. Commenting on the 5G scenario, Abhilash Kumar, Research Analyst at Counterpoint Research noted “5G smartphone shipments continued their growth streak globally; growing more than 43% sequentially for the quarter. The shipment penetration of 5G smartphones increased to over 11% of all smartphones in Q2 2020 from 7% last quarter. This was driven by growth in China where 5G is being pushed by attractive 5G plans from the operators and the availability of mid-tier 5G smartphones from several brands. China now accounts for more than three-quarters of 5G shipments. The price of 5G phones is also trickling down with Huawei, OPPO, vivo, Xiaomi all having 5G smartphones at mid-tier price points. This will further drive growth and facilitate market recovery in the coming quarters.“

Key Takeaways:

- The share of the top 10 brands reached 88% compared to 80% last year. Brands outside of the top 10 declined 55% YoY. The impact of COVID-19 was more severe on smaller brands that tend to have lower online presence and that tend to cater more to the entry-level segments.

- Huawei continued its push in China and surpassed Samsung to lead the global smartphone market. Huawei’s shipments declined only 3% YoY globally as it grew 11% YoY in China.

- Samsung declined 29% YoY as its core markets including LATAM, India, the USA and Europe were struggling from the effects of the pandemic and lockdowns. However, we believe that Samsung will recover in the coming quarters. As economies improve, Samsung will be aggressively able to cater to the pent-up demand in the post-lockdown period. For developed markets, the performance of its flagships (Galaxy Note and S series) will be the key driver for its growth together with the mid-tier 5G product portfolio. This is especially true in European markets where Chinese brands are entering with their mid-tier products.

- realme was the only major brand achieving double-digit annual growth. realme grew 11% YoY in the quarter as several markets in Europe and India recovered in June. realme was also the fastest-growing brand in the quarter and was number 7th in terms of sales.

- Apple iPhone shipments grew 3% YoY and revenues grew 2% YoY. The company saw sustained momentum of the iPhone 11 and a great sales start of the iPhone SE. All regions saw revenue growth.

- Xiaomi declined 18% YoY during the quarter. Xiaomi continued to lead the Indian smartphone market in Q2 2020. Xiaomi was also able to hold its market share in China driven by heavy promotions during the 618-e-commerce festival.

- Vivo declined 18% YoY during the quarter. Vivo has been steadily gaining market share in emerging markets, especially South East Asia. The V-series, with its unique positioning and price point has helped the brand gain share in markets such as Indonesia, Vietnam and India.

- Oppo declined 20% YoY during the quarter, however, it performed well in the European market driven by its enriched portfolio across A, Reno and Find series, as well as expansion into operator channels.

For press comments and inquiries please reach out to press (at) counterpointresearch.com

You can also visit our Data Section (updated quarterly) to view the smartphone market share Globally and from the USA, China, and India.

Some of our other regional smartphone market analysis for Q2 2020 can be found below:

- COVID-19 Caused European Smartphone Market to Decline 24% YoY for Q2 2020

- One in Three Smartphones Sold was a 5G Phone in China in Q2 2020

- US Smartphone Sell-Through Volumes Fall 25% in 2Q20; iPhone SE a Bright Spot

- Pent-Up Smartphone Demand after April, May Lockdown Pushes the June 2020 Volumes to Pre-COVID Levels & the Smartphone User Base in India Beyond the Half a Billion Mark

*Lenovo includes Motorola and we have revised Lenovo Group estimates.

Tarun Pathak

Shobhit Srivastava

Varun Mishra

Abhilash Kumar

Follow Counterpoint Research

press(at)counterpointresearch.com