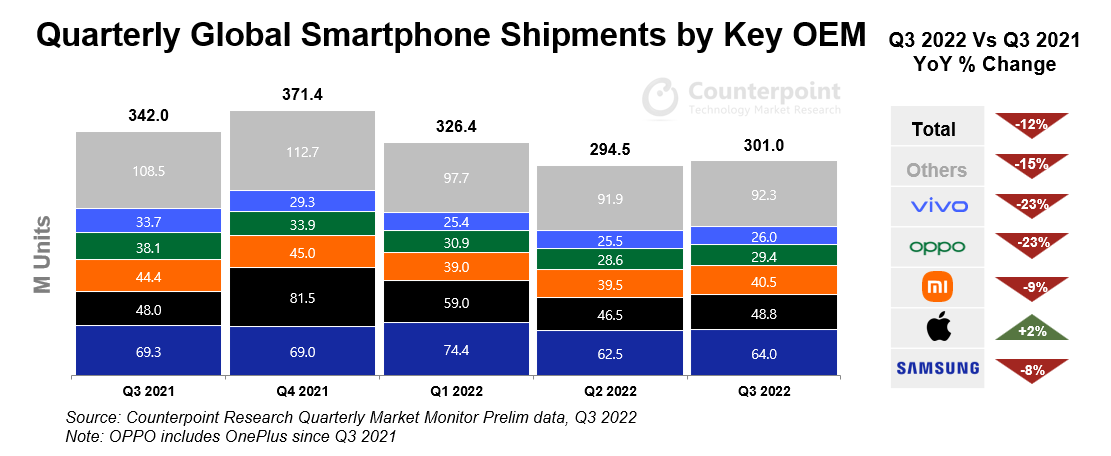

- The global smartphone market declined by 12% YoY even as it grew by 2% QoQ to reach 301 million units in Q3 2022.

- While quarterly growth in Apple and Samsung pushed the global smartphone market above 300 million units, a level it failed to reach last quarter, political and economic instability drove negative consumer sentiment.

- Apple was the only top-five smartphone brand to grow YoY, with shipments increasing 2% YoY, growing market share by two percentage points to 16%.

- Samsung’s shipments declined by 8% YoY but grew 5% QoQ to 64 million.

- Xiaomi, OPPO* and vivo, recovered slightly after receiving heavy beatings due to lockdowns in China in Q2, and as they captured more of the market ceded by Apple and Samsung’s exit from Russia.

London, New Delhi, Hong Kong, Seoul, Beijing, San Diego, Buenos Aires – October 28, 2022

The global smartphone market remained under pressure given deteriorating economic conditions with shipments declining by 12% year-on-year, reaching 301 million units in Q3 2022, according to the latest research from Counterpoint’s Market Monitor service. Ongoing international political tensions resulting in economic uncertainty hit the smartphone market even though it reversed its slide below the 300-million-mark last quarter thanks to a slight quarterly recovery in Apple and Samsung shipments.

Commenting on overall market dynamics, Senior Analyst Harmeet Singh Walia said, “Most major vendors continued experiencing annual shipment declines in the third quarter of 2022. Russia’s escalating war in Ukraine, ongoing China-US political distrust and tensions, growing inflationary pressures across regions, a growing fear of recession, and weakening national currencies all caused a further dent in consumer sentiment, hitting already weakened demand. This is also adding to a slow but sustained lengthening of smartphone replacement cycles with smartphones becoming more durable and as technology advancement slows. This is accompanying, and to a smaller degree advancing, a fall in the shipments of mid- and lower-end smartphones, even as the premium segment weathers the economic storm better. Consequently, and thanks to an earlier launch of the latest iPhone series this year, Apple emerged as the only top-five smartphone vendor to manage annual shipment growth in the quarter.”

While Samsung grew QoQ in Q3 2022 thanks to record presales of its premium fold and flip smartphones, compared with the same quarter last year, however, its shipments fell by 8% YoY. This is primarily down to dampening consumer sentiment in several of its key markets. This also affected top Chinese brands, whose shipments remained low compared with last year as they were getting rid of excess inventory and at the same time managing a slowdown in the home market, China. However, they were able to capitalise on Apple and Samsung’s exit from the Russian market, in which their share increased substantially.

Associate Director Jan Stryjak noted, “With the full force of the latest iPhone launch being felt in Q4, we expect further quarterly improvement in the coming quarter, although central banks’ attempts to control inflation will further reduce consumer demand. The channel inventory is still higher, and the OEMs will focus on getting rid of excess inventory in Q4 as well. Hence, shipments are unlikely to reach last year’s levels, let alone pre-pandemic Q4 levels of over 400 million units. Looking further ahead into 2023, we expect sluggish demand with lengthening replacement rates, especially in the first half of the year.”

*OPPO includes OnePlus from Q3 2021

Feel free to reach us at press@counterpointresearch.com for questions regarding our latest research and insights.

You can also visit our Data Section (updated quarterly) to view the smartphone market share for World, US, China and India.

Related Posts

- Premium Smartphone Average Selling Price Reaches Record Q2 High

- China Premium Smartphone Market Weathers Headwinds to Expand Share in Q2 2022, vivo Takes Second Spot for First Time

- Global Handset Market Operating Profits Grow 6% YoY in Q2 2022 Despite Declining Revenues

- Transsion Updates Q2 2022: Resilient Q2 Performance Driven by Pivot to Value, But Macroeconomic Challenges Remain

- Xiaomi Updates: Q2 2022

- iPhone 14 Pro, Pro Max Lead US Sales in Latest Apple Launch Day

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Harmeet Singh Walia

Jan Stryjak

Tarun Pathak