London, Hong Kong, Boston, Toronto, New Delhi, Beijing, Taipei, Seoul – September 9, 2021

- TSMC’s recent adjustment on wafer prices indicates that the price hikes in the foundry industry will continue into 2022.

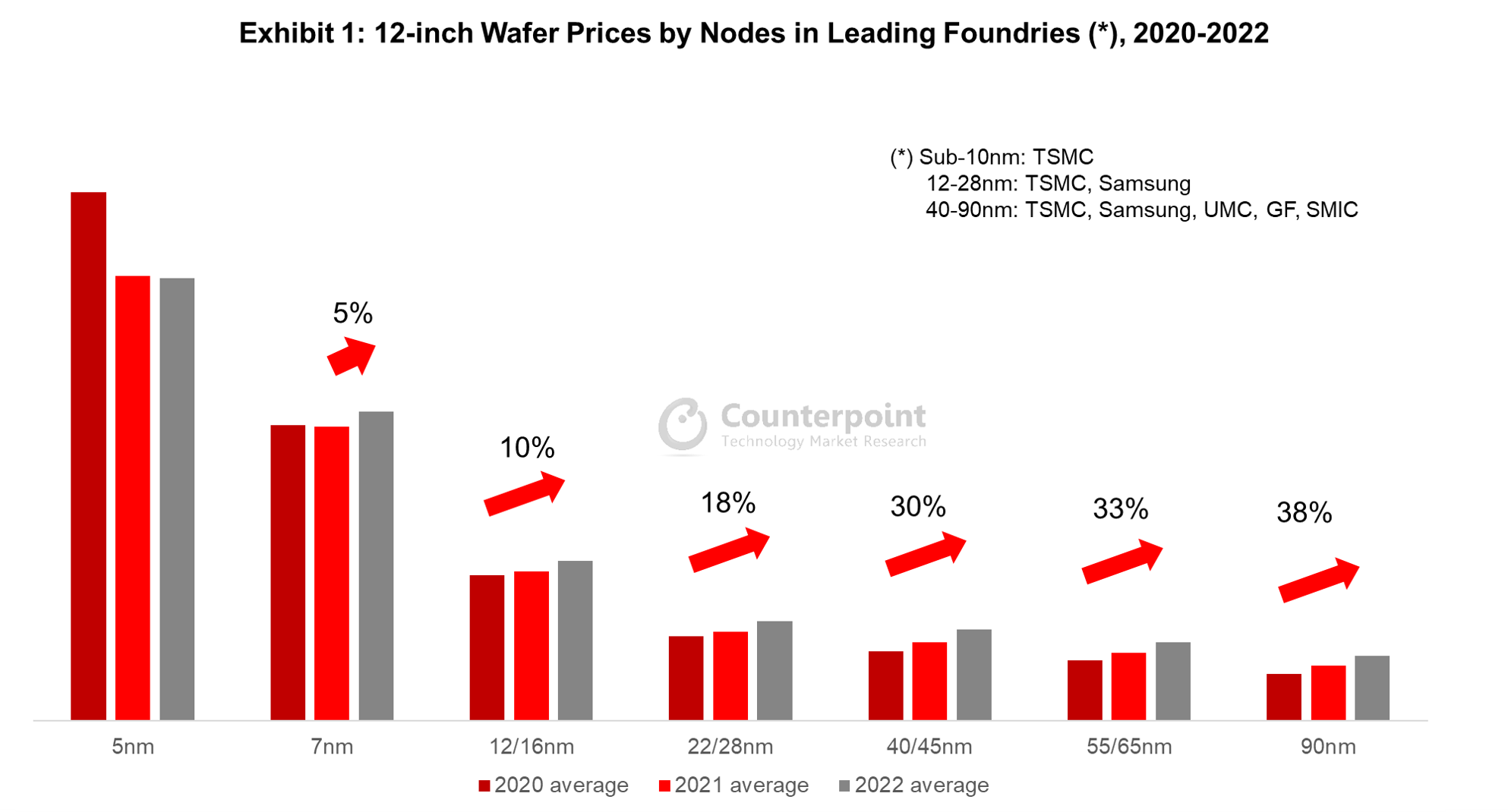

- Wafer prices at matured nodes have increased by 25-40% between 2020 and the current quarter, and are likely to rise another 10-20% by 2022. We do not expect a similar magnitude in advanced/leading-edge nodes (10nm and below) since both TSMC and Samsung focus more on customer relationships and cost-down executions to maintain profitability.

- Smartphone IC vendors will seek to pass some of the rise in wafer/packaging costs to their OEM customers, but more in low-price chips. Overall, we expect a 5-12% cost increase in 2022 from logic ICs (non-memory, non-RFFE) on premium smartphones, 6-14% on mid-range and 8-16% on low-end smartphones.

- At the tail end of the supply chain, smartphone OEMs suffer most on margins if they fail to increase prices for end users. But if they do, smartphone growth, especially in 5G, may slow down in 2022 and eventually see IC inventory piling up.

The prolonged IC shortage, which is expected to last till 2022, is the major driving force for wafer price hikes in the foundry industry, from most second-tier vendors during the past 1-2 years to TSMC recently. With the latest notices to its customers, TSMC will raise its wafer prices across the main nodes mainly from the beginning of 2022. The company has maintained its wafer prices for quite a long time when compared with its smaller competitors. The change in its pricing strategy from 2022 implies not only stronger market demand going forward, but also that the capacity tightness will persist in the next few quarters. Aside from the market mechanism, the new price strategy also protects foundries from both short-term and long-term uncertainties, such as double-booking effect (massive order cancellation), supply chain disruptions (increase in shipping cost) and geopolitical complexities, which may affect their production margins/profits.

We have seen wafer price hikes from second-tier vendors since 2020, especially in the matured nodes if we define them as the technology geometries at 22/28nm and (numerical) above. The price increases were 25-40% over the base of Q1 2020 and are likely to see another 10-20% hike in 2022. Relatively, wafer price hikes in advanced/leading-edge nodes below 10nm are milder, while we could see an average of 5% increase for 7/6nm nodes as per TSMC’s latest quotes for 2022. In Exhibit 1, we show the prices for various nodes for leading foundries during 2020-2022.

As we can see, matured nodes have seen wafer price hikes for almost a year, with the price gap in some nodes (like 28nm vs 40nm) narrowing driven by a higher percentage of price hike from smaller foundry players like UMC and SMIC, which enjoyed strong profit boosts during H1 2021.

As we can see, matured nodes have seen wafer price hikes for almost a year, with the price gap in some nodes (like 28nm vs 40nm) narrowing driven by a higher percentage of price hike from smaller foundry players like UMC and SMIC, which enjoyed strong profit boosts during H1 2021.

How to forecast wafer prices beyond 2022? It is largely subject to the demand and supply outlook on major IC products in each node. We have conducted an analysis of all matured nodes in our report published on August 26. In our view, while the ongoing global IC shortage will begin easing from late 2021, especially in DRAM/NAND, logic ICs fabricated in mainstream/matured nodes in the foundry will remain in a tight position and will not reach the demand-supply balance until mid-2023. For foundry customers (fabless and IDMs), the impact of supply shortage weighs much greater on their business compared to the 10-20% increase in wafer cost, which they might pass to their end customers (device ODMs/OEMs).

Impact on smartphone demand after wafer price hike

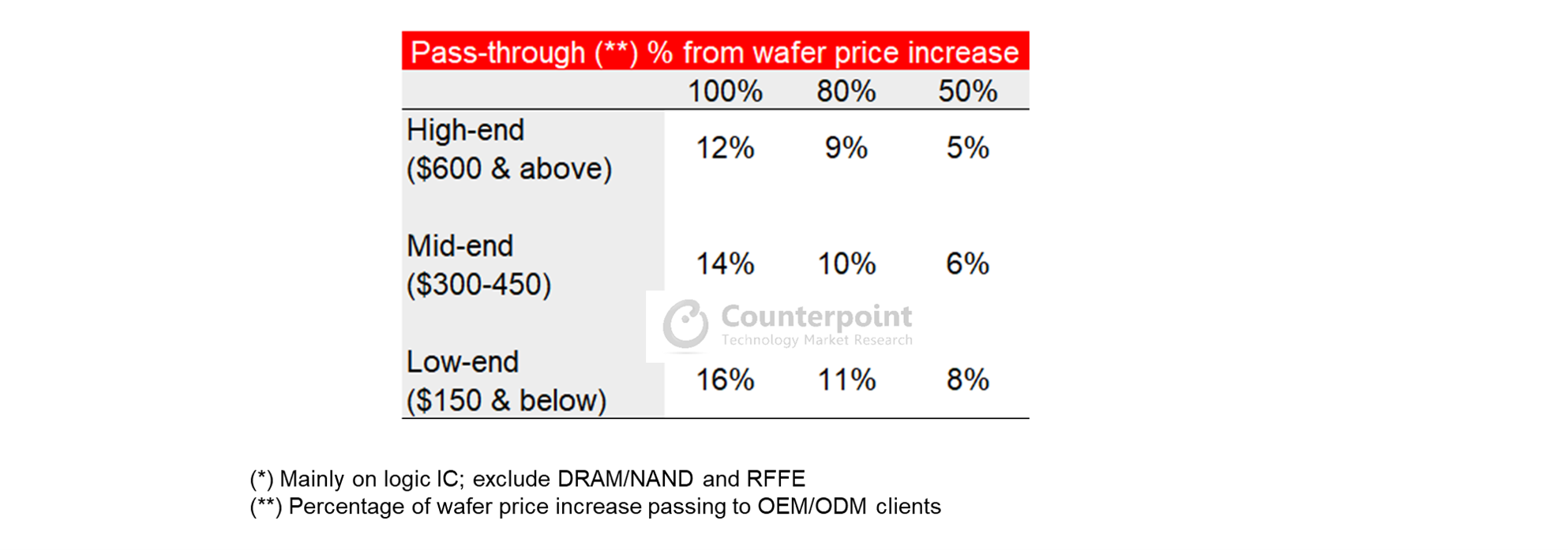

Logic ICs (the chips largely fabricated in foundries for smart devices) account for 30-40% of the total BoM (Bill of Material) cost depending on the selling price. Assuming other component and assembly costs are stable moving into 2022, logic IC price increases will be added to the total product cost for smartphone ODMs/OEMs. Analyzing this impact, we conduct a sensitivity check for different price segments of smartphones under different percentages of price pass-through from logic IC vendors. For example, in high-end/premium models, if all vendors (from AP processors to power management chips) pass wafer price increases to OEMs, the smartphone cost increase from logic ICs is about 12% in 2022, demonstrated in the upper-left cell in Exhibit 2.

Exhibit 2: Smartphones – scenarios of IC (*) cost increase from higher wafer prices

We conclude that the percentage of total smartphone IC price increase has a greater impact on low-end smartphone models since the chips from matured nodes (such as PMIC in 8-inch fabs, display TDDI from 90-65nm, and AP/SoC from 28-12nm) account for a larger portion of BoM in this segment. In the optimistic case for smartphone OEMs, the IC vendor might absorb half of the incremental cost, but we do not expect this to happen in early 2022 if smartphone IC supply stays tight.

We conclude that the percentage of total smartphone IC price increase has a greater impact on low-end smartphone models since the chips from matured nodes (such as PMIC in 8-inch fabs, display TDDI from 90-65nm, and AP/SoC from 28-12nm) account for a larger portion of BoM in this segment. In the optimistic case for smartphone OEMs, the IC vendor might absorb half of the incremental cost, but we do not expect this to happen in early 2022 if smartphone IC supply stays tight.

What are the implications for the smartphone industry in 2022? While it is still early to judge the overall impact on shipments due to higher component prices, the cost pressure on OEMs appears more unfavourable in the mid-end segment under severe competition. This year, for instance, mid-end 5G smartphone sales have failed to meet expectations in China, and the situation may possibly get worse next year. In case of another 10% price hike without any meaningful feature upgrade, smartphones in the mid-end segment may lose the battle to cheaper 4G and 5G models in many emerging markets. In developed countries and China, on the other hand, OEMs would prefer to promote more flagship/premium models, which generate higher sales dollars. We also expect 4G smartphone prices to increase, as OEMs are able to pass through the IC cost increase to end devices. As a consequence, the effect of wafer price increase might be negative on smartphone shipment growth but positive for the industry ASP (and net positive for the total market dollar size) next year.

Feel free to contact us at press(at)counterpointresearch.com for questions regarding our in-depth research and insights, or for press enquiries.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Dale Gai

![]()

Counterpoint Research

press(at)counterpointresearch.com

Related Posts

- Smartphone ODMs Achieve 7.2% YoY Growth in H1 2021, Show Resilience to COVID-19, Component Shortages

- MediaTek Captures Record 43% Share of Smartphone AP/SoC Shipments in Q2 2021

- Foundry Node Migration to Shape Smartphone SoC Zero-sum Game

- Foundry Capacity Shortage to Last Longer Than 1 Year Along With Increasing Foundry Costs

- Mobile Demand Raises DRAM Revenue by 30% YoY to $19 bn in Q1 2021

- Smartphones Beat DRAM Drum to Meet Performance Demand