- China’s smartphone market declined 17% YoY in 2020.

- China’s 5G smartphone sales accounted for more than 60% of total smartphone sales in Q4 2020.

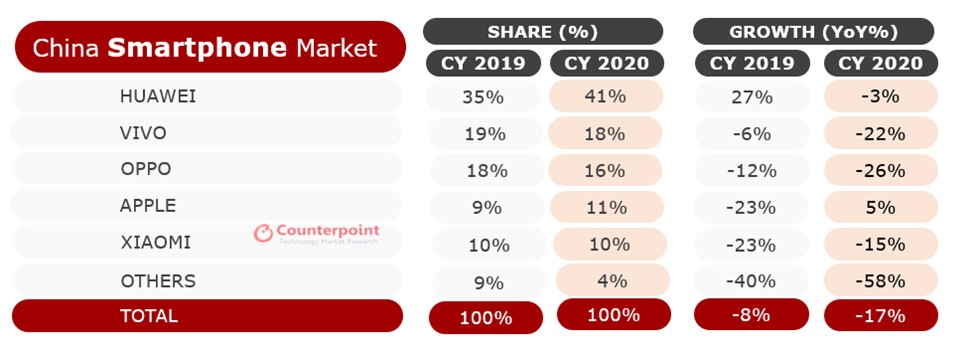

- Huawei and HONOR combined took the top spot in the market, capturing 41% share in 2020.

- Apple was the only brand to witness a positive YoY growth in the market in 2020.

Beijing, Hong Kong, New Delhi, Seoul, London, San Diego, Buenos Aires – January 28, 2021

China’s overall smartphone sales declined 17% YoY in 2020, the sharpest decline in the last three years, according to the latest research from Counterpoint’s Market Pulse – Monthly Smartphone Sales Tracking service.

Commenting on the market dynamics, Research Analyst Mengmeng Zhang said, “Though China recovered quickly from COVID-19, the overall demand for smartphones in the market remained weak and below the pre-pandemic levels. A weakened economy and longer smartphone replacement cycles all contributed to the lackluster demand. However, China’s 5G smartphone sales surged with Chinese OEMs aggressively rolling out more value-for-money offerings. 5G penetration rate became even more pronounced in Q4 with the launch of iPhone 12. 5G smartphones accounted for more than 60% of smartphones sold in China, up from just 5% in Q4 2019.”

Exhibit 1: Smartphone Shipment Market Share and Growth, 2020

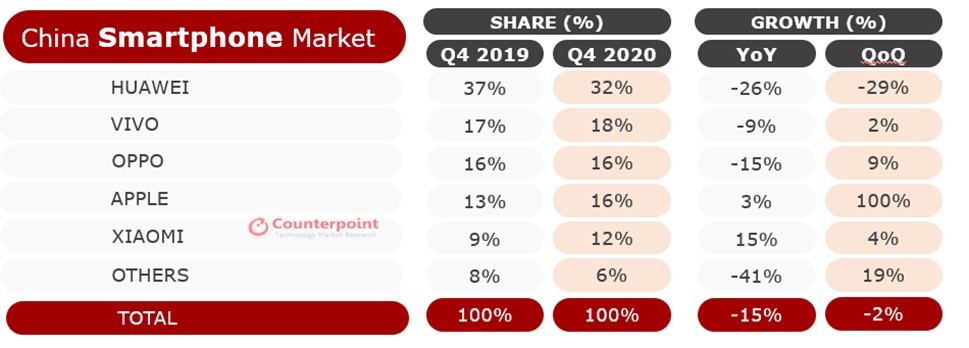

Commenting on the competitive landscape, Research Analyst Flora Tang said, “Huawei and HONOR combined were still the market leader in China’s market, capturing 41% share in 2020. However, following component shortages after the US trade sanctions effective September 15, sales of Huawei and HONOR dropped a staggering 26% YoY in Q4 2020. Their combined market share also slipped to 32% in the same quarter.”

Among major OEMs, Apple was the only one to enjoy a positive YoY growth in 2020. Apple’s strong growth was due to the debut of iPhone 12 series, which comes with 5G connectivity and models across a wider price range. In addition, thanks to heavy price cuts and promotions, the iPhone 11 series continued to do well even after the launch of iPhone 12s. The iPhone 11 was the best-selling model on JD.com during the e-commerce festival sales. The impressive growth of both iPhone 12 and iPhone 11 series helped push Apple’s market share in China to 16% in Q4 2020.

Exhibit 2: Smartphone Shipment Market Share and Growth, Q4 2020

Xiaomi registered a double-digit decline of 14% YoY in 2020, but still outperformed the market. Xiaomi‘s sales rebounded strongly starting H2 2020 on good performance of the Redmi 9A, Redmi Note 9 Pro, Xiaomi 10 series and Redmi K30 series. Xiaomi also benefitted from the weakening performance of its major rival HONOR.

OPPO and vivo sales declined in 2020 following the overall market trend. Nonetheless, OPPO had its strongest quarter in Q4, increasing 9% compared to Q3 on strong momentum from the OPPO A32, A72 and Reno 5 series. The new Reno 5 series (Reno 5, Reno Pro and Reno 5 Pro +) has been the best-performing Reno series since its rebranding, selling close to 1 million units in 12 days. OPPO’s strategy to reposition the Reno series as its mid-to-high end offering catering to more customers has started to pay off.

You can also visit our Data Section (updated quarterly) to view the smartphone market share Globally and for the US, China and India.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are experts in the high-tech industry with an average tenure of 13 years.

Analyst Contacts:

Mengmeng Zhang

Flora Tang

Ethan Qi

Follow Counterpoint Research

press(at)counterpointresearch.com