Indonesia’s mobile telecom subscriptions increased 5% YoY in Q1 2022 to reach 362 million, which is 33% higher than the country’s population of 273 million. However, Indonesia wants to accelerate digitalization keeping in view Industry 4.0. In this regard, the country’s mobile network operators (MNOs) are upgrading infrastructure to expand internet coverage through 4G and selective development of 5G networks.

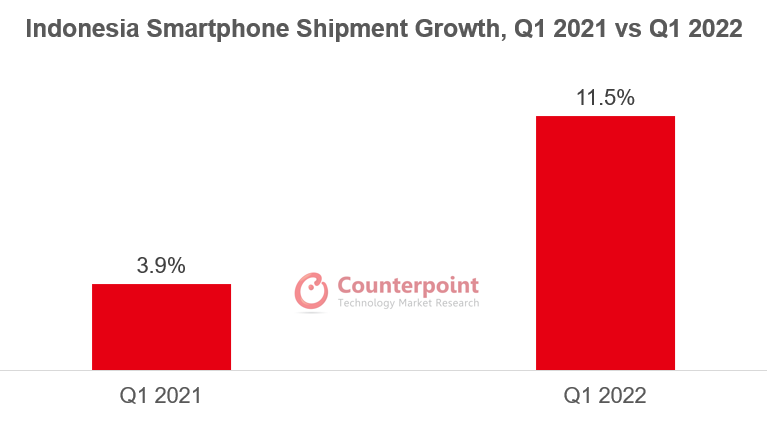

The country’s smartphone shipments increased 11.5% YoY in Q1 2022, according to Counterpoint Research’s Monthly Indonesia Smartphone Channel Share Tracker. Demand for smartphones increased during the pandemic. It grew even further with the economic recovery that started in the second half of 2021. New mobile subscriptions are mostly coming from new and existing smartphone users. A smartphone requires a data plan to access the internet if not using Wi-Fi.

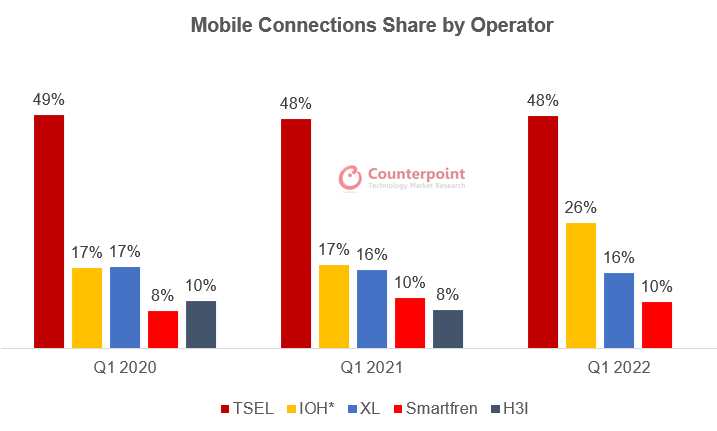

There are currently four MNOs in Indonesia after the merger of Indosat Ooredoo (ISAT) and Hutchinson 3 Indonesia (H3I) in early 2022. They will play an important role in expanding and improving mobile internet connectivity across the country.

Telkomsel is the largest MNO and covered 48% of the market in Q1 2022. 68% of its 174.5 million subscribers are mobile data users. Telkomsel has base transceiver stations (BTSs) at 247,000 locations across the country, out of which more than 60% are 4G BTSs. Telkomsel has launched low-denomination data plans to attract more middle-class and younger consumers, which resulted in an ARPU decline of 5% YoY in Q1 2022 to $2.87 (IDR 41,000).

The combined ISAT and H3I, named Indosat Ooredoo Hutchinson (IOH), is the second-largest MNO with 94.6 million subscribers. Its blended ARPU fell 2.1% YoY in Q1 2022 to reach $2.24 (IDR 32,000), thanks to low-denomination data plans. After the merger, reallocation of ISAT and H3I BTSs is required. The combined network will bring a wider range for a better 5G rollout as the two had 1800 MHz in different sub-ranges.

XL Axiata’s subscriber base has been almost stable over the past two years with a blended ARPU of $2.52 (IDR 36,000). XL’s 4G BTSs increased by 47% YoY in Q1 2022 to reach 83,000 (61% of its total BTSs). Its focus on customer needs makes XL offer attractive and relevant products and services from time to time. This helps it to retain its customer base.

Smartfren is a full 4G network operator. It shifted from CDMA to 4G in 2015 at 850 MHz and 2300 MHz frequencies. It had around 44,000 4G BTSs by the end of 2021. Smartfren has shown stronger performance since 2020 and had a 10% share of the market in Q1 2022. The operator is known for its affordable internet packages and for its focus on low-mid consumers. Even though its ARPU is the lowest at around $1.75 (IDR 25,000), its 4G quality is good thanks to the aggregation of 850 MHz and 2300 MHz frequencies.

Source: Company annual reports and Counterpoint Research analysis

During the pandemic restrictions, MNOs launched various digital services and partnered with other digital ecosystem players to support consumer activities through smartphones. This MNO push was triggered by the increased demand for cellular connectivity both in quality and quantity terms.

The MNOs are now focusing on two major steps in terms of increasing mobile internet penetration – 4G network expansion and 5G network development with a focus on the industrial sector.

Mobile internet spread via 4G

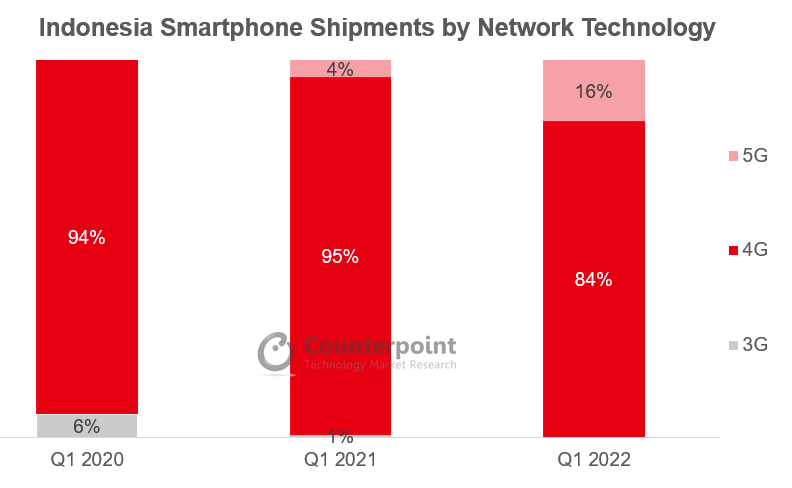

During the COVID-19 restrictions in 2020 and 2021, the need for a better mobile internet experience was felt more strongly as people were forced to remain indoors. Some customers were also prompted to upgrade from 3G to 4G. As a result, the MNOs were prompted to adopt 4G technology faster to improve customer experience.

The MNOs have been improving their network quality by increasing the capacity of internet gateways, adding 4G BTSs and strengthening networks, especially in residential areas. The MNOs’ preference for 4G networks, which also requires switching from 3G to 4G infrastructure, will improve mobile internet reach and quality in the country.

The MNOs aim to complete the migration from 3G to 4G by the end of 2022. The 3G shutdown has also been triggered by the fact that the 3G customer base is now comparatively small and shrinking. A 3G shutdown also allows for achieving network efficiency by maximizing the 4G spectrum and helps in 5G allocation. Indonesia’s government too looks at this migration from 3G to 4G as a step towards accelerating digital adoption in the country.

As MNOs switch from 3G to 4G, all new smartphones in the market are now 4G or 5G.

Selective 5G network development

While 4G migration is near completion, 5G technology is gradually being introduced in Indonesia. So far, 5G has been commercially introduced by Telkomsel, IOH and XL (all in 2021). Smartfren has just received approval for a commercial launch in 2022.

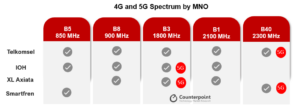

As of now, 4G technology can mostly address the digital needs of the consumer segment, but it may not be sufficient for the industrial sector to usher in Industry 4.0. The MNOs are developing 5G infrastructure carefully while building relevant use cases to promote the latest network technology. This approach will limit 5G coverage but optimize its benefits. Allocation of a limited spectrum to deploy 5G networks is one reason for being selective in expanding 5G coverage, apart from developing a 5G backbone, which requires laying of fiber optic cables throughout the country.

The table below shows smaller spectrum allocation for 5G deployment. Due to this limitation, the MNOs have chosen select cities and areas for 5G coverage. While discussions on opening other potential 5G bands continue, the government aims to complete analog TV shutdown in 2022 and use its 700 MHz frequency for 5G.

The industries that can gain the most from 5G technology are the ones that require machine-to-machine connectivity, automation and low latency. 5G private networks can also be chosen to meet these and other specific needs. The Indonesian government has selected five industries as priority industries for 5G private network development – residential; industrial area and fabrication with automation; high-risk mining; health; and tourism. MNOs and enterprises can proactively collaborate in generating use cases for 5G technology.

What next?

While 4G remains the backbone of mobile connectivity in Indonesia, the digital ecosystem must be ready to face the next wave of technology – 5G. From its initial use in the industrial sector to welcome Industry 4.0, the 5G coverage can be gradually expanded to other sectors. Here, it is important that the network technology of 5G devices in the market must be compatible with the 5G bands available in Indonesia. One of the media that can bring 5G technology closer to consumers is the metaverse. Metaverse applications are expected to drive 5G growth in the consumer sector.