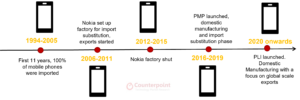

Who would have ever known that a scheme introduced to drive the Indian government’s dream of making the country an electronics manufacturing hub would become so successful that it would be extended to other sectors? Within a year of its implementation, the Production Linked Incentive (PLI) scheme has proved to be a roaring success. It is easily the government’s best foot forward so far for the manufacturing industry. Now, this scheme also covers the white goods, telecom equipment, solar modules and many other sectors.

Government’s ‘Self-reliant’ Vision

Launched under the ‘Aatmanirbhar Bharat’ (Self-reliant India) initiative, PLI is one of the three main schemes announced by the government after the Scheme for Promotion of manufacturing of Electronic Components and Semiconductors (SPECS) and the Electronics Manufacturing Clusters (EMC 2.0). These schemes came into being to encourage large mobile phone and component manufacturers to invest in the country. Unlike earlier schemes which were input-based and mostly relied on capital subsidy or funding assistance (like the M SIPS and EMC schemes), PLI is output-oriented.

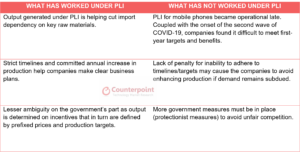

PLI Scheme Analysis

The PLI scheme is indicative of the government’s strong intention towards becoming self-reliant. What makes it even more relevant is its timing of introduction. There is no denying that the onset of COVID-19 has only ripped open the overdependence of the supply chain ecosystem on one single market.

Considering the above, did this realisation came in a little late? Maybe yes. Why? Because in order to build a successfully working nucleus around the manufacturing ecosystem, expecting overnight results is unrealistic. At a time when India is undergoing the crisis caused by the second wave of COVID-19, handset manufacturers are already predicting their inability/delays in meeting the desired targets and investments under PLI for FY21 (India’s government follows April-March financial year). The scheme which was considered to be a game changer in its early days is now showing signs of falling apart in its goals unless the government decides to intervene and makes relevant regulatory changes. Given the uncertainties surrounding the manufacturing ecosystem, even participants as big as Foxconn and Wistron have now decided to cut production by almost half. But all this should be considered as a part of the evolutionary stages that a scheme passes through.

India’s 25 Years of Mobile Journey

PLI Potential and India’s Economic Resilience

As global participants of the PLI scheme, be it Foxconn, Samsung or Wistron, pledge to lead a total production of more than INR 10,50,000 crore (INR 10,500 billion) in the country, we expect a significant increase in India’s manufacturing capacity over the next five years. Increase in export potential, which also forms one of the major driving forces of the PLI scheme, is also seeing exponential growth. As much as 60% of the production target under the scheme is expected to be contributed by exports of the order of INR 6,50,000 crore (INR 6,500 billion).

Such promising participation is also leading the country towards the goal of domestic value-addition, which is projected to grow from the current 15-20% to 35-40% in the case of mobile phones and 45-50% for electronic components. Capitalizing on these projections, India has already come out as a resilient economy amid the global pandemic and trade shocks. Official statistics suggest India’s cumulative value of exports (merchandise and services) during April-March FY21 stood at $493.19 billion compared to $528.37 billion during April-March FY20. Indeed, factors like improvement in ease of doing business, creation of plug-and-play investment and manufacturing environment, and launch of PLI scheme across various sectors have played an important role in helping India recover from the downturn due to COVID-19.

Disabilities With and Beyond PLI

Even as PLI promises to make India competitive in the global market, a need is being acutely felt to minimize the cost of disabilities still faced by the sector. For example, India’s Special Economic Zones (SEZs) have a major role in electronics manufacturing. SEZs allow for a faster setting up of manufacturing plants and duty-free imports of capital machinery and components for them. However, the sale of finished goods from these SEZs in the Indian market is treated on a par with the export of the same products to India. This places SEZs at a disadvantage since they end up attracting customs duties. Therefore, a policy optimization is required for such a distinction between domestic and SEZ produce.

The cost of disabilities incurred by manufacturers is not only restricted to schemes like PLI but also at the central and state levels, like land and labour subsidies, interest on working capital, land rental, high capital cost, power, logistics and insufficient R&D. Such issues have to be jointly addressed yet independently handled by the central and state governments.

Momentum of PLI and Conclusion

Given PLI’s momentum in the mobile phone and electronics sectors and subsequently in other ‘sunrise’ sectors, the government stands on safe ground to achieve its vision of making India an export-based manufacturing hub and a preferred alternative in the China Plus One strategy. India’s business ecosystem is gaining traction with the growing presence of global manufacturers, and changes in export policies with the formulation of schemes like the Remission of Duties and Taxes on Export Products (RoDTEP) and the Import of Goods at Concessional Rate of duty (IGCR Rules).

One may say that a scheme like PLI and its focus on export-oriented measures is a far-fetched goal in a post-pandemic world. But as we observe other economies reviving on newer resilient strategies, India too has a lot to benefit from, be it in terms of more production, large companies, technology upgradation or even employment opportunities.