According to the latest research from Counterpoint’s Market Monitor service, the smartphone shipments in India grew a healthy 20% annually and 12% sequentially in Q3 2015 (July-Sept). More than one in three mobile phones shipped in India is now a smartphone.

The Indian mobile phone market demand is back on track after declining for two consecutive quarters fueled by cheaper smartphones as more and more feature phone users quickly upgrade to smartphones for the first time.

Market Summary for Q3 2015:

- Smartphones: More than One in Three mobile phones shipped were smartphones

- Online Sales: One in Three smartphones sold were through online channels such as Flipkart, Amazon, Snapdeal and so forth

- 4G LTE Smartphone: One in Three smartphones shipped were LTE smartphone

- Make in India: One in Four mobile phones sold during the quarter was “Made in India”

Samsung

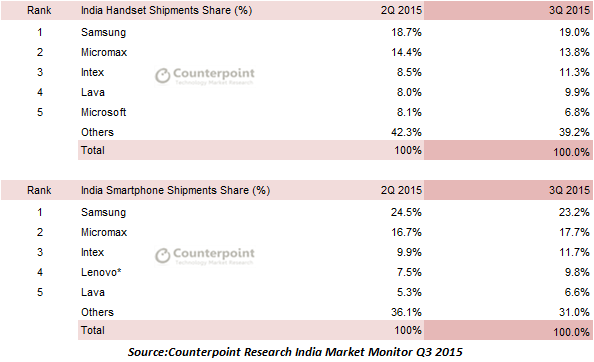

- Samsung continued to lead the overall mobile phone market and the smartphone segment during the quarter with market shares of 19.0% and 23.2% respectively

- Samsung benefitted from expanding its critical mid-tier portfolio with launch of J series during the quarter which drove smartphone volumes for the vendor

- However, the Korean vendor lost share sequentially with minor presence in sub $100 smartphone segment which is fastest-growing and dominated by Indian and Chinese brands

- Samsung’s A series brought in a welcome design change for Samsung with thinner and flatter designs in the mid- to high tier becoming the ‘halo devices’ taking focus away from S6 series. This design language is also trickling down to the new J series helping to strengthen its position in this segment. Additionally, strong offline distribution has also helped Samsung drive J series shipments during the quarter

- Though Samsung led the LTE smartphone segment as most of the mid-to high-tier Galaxy models are LTE ready.

Micromax

- Micromax maintained the second position in both overall mobile phone market and the smartphone segment with a market share of 13.7% and 17.7% respectively.

- The brand’s share from online channel increased during the quarter. However, it is now facing pressure competition in $50-$100 price segment from Intex, Lava and others.

- Micromax’s Cyanogen based online only brand ‘Yu’ launched its cheapest LTE model ‘Yunique’ during the quarter and the brand has been growing steadily ever since its launch.

- Micromax Yu brand alone is now selling more smartphones than Xiaomi online, depicting it’s going to be challenging even for popular brands such as Xiaomi to scale in Indian market

Intex

- Continuing its momentum from Q2 2015, Intex cemented its position in top three brands in India third spot in both overall and smartphone segment.

- Intex’s smartphone market share jumped to double digit level for the first time ever capturing close to 12% of the smartphone market during the quarter.

- Demand for Intex products in the fastest growing sub-$100 smartphone price band remains strong which is the key reason for its growth. However, the vendor needs to improve its position in “affordable premium” segment.

- Intex also expanded its LTE portfolio during the quarter and remained aggressive in terms of promotional activities with “key feature” focused SKUs such as bigger batteries, bigger memory and so forth.

Others:

- Lava (excluding Xolo) surpassed Microsoft for the first time and thereby capturing fourth spot in the overall handset market.

- Lava managed to increase its smartphone market share to 7% level with healthy demand for Lava IRIS series, especially the ATOM 2 and X1 selfie smartphone were among the bestselling models

- Lenovo including Motorola raced to fourth position in smartphone segment, primarily due to strong sales of its K3 Note

- Lenovo’s K3 Note was the best-selling smartphone in India during Q3 2015 hitting the sweet spot in terms of specs vs price among all vendors.

- Lenovo (incl Motorola) crossed 2 million units in India for the first time ever continuing its momentum in India offsetting weakness in its home market China

- However, Lenovo will need to realign its offline vs online strategy going forward to position the two brands separately and overlapping of SKUs across brands affects the operational performance which has been weakened since Motorola’s acquisition.

- Xiaomi underwent its first sequential decline in India since its debut. The upstart Chinese vendor smartphone shipments declined by almost 46% due to fierce competition from Lenovo and Micromax’s Yu brands especially in the higher volume sub-$100 segment.

- Meanwhile, Apple’s finished its Fiscal year in India with record 1.7 Million units in India for the first time ever due to strong sales of its new iPhone 6 series

- However, Apple’s volume market share remains around 1% level but in terms of revenue share it is the third largest brand with almost 9% share which depicts the prowess of Apple’s brand equity and premiumness

- Microsoft also found its place among top five overall mobile phone brands during the quarter but Lumia shipments declined sequentially.

- Meanwhile, the other brands which grew significantly during the quarter were Panasonic, Vivo and Oppo

The comprehensive and in-depth Q3 2015 Market Monitor is available for subscribing clients. Please feel free to contact us at analyst@counterpointresearch.com for further questions regarding our in-depth latest research, insights or press enquiries.

The Market Monitor research is based on sell-in (shipments) estimates based on vendor’s IR results, vendor polling triangulated with sell-through (sales), supply chain checks and secondary research.