According to the latest research from Counterpoint Research’s Market Monitor service, for Q2 2015 (Apr-June), the overall India mobile phone market registered a Y/Y decline of 2% and Q/Q increase of 4%. However, the smartphone segment registered Y/Y increase of 34% and Q/Q increase of 25%. Feature phone segment saw a sharp decline with shipment volumes down 19% Y/Y and 9% Q/Q. After declining for two consecutive quarters both the overall handset market and smartphone market regained sequential growth.

Flipkart Captured 56% of those Smartphones ‘Exclusively’ Sold through E-Commerce Channels in India in Q2 2015

Market Summary for Q2 2015:

- Smartphones contributed close to 45% of the overall shipments in 2Q 2015

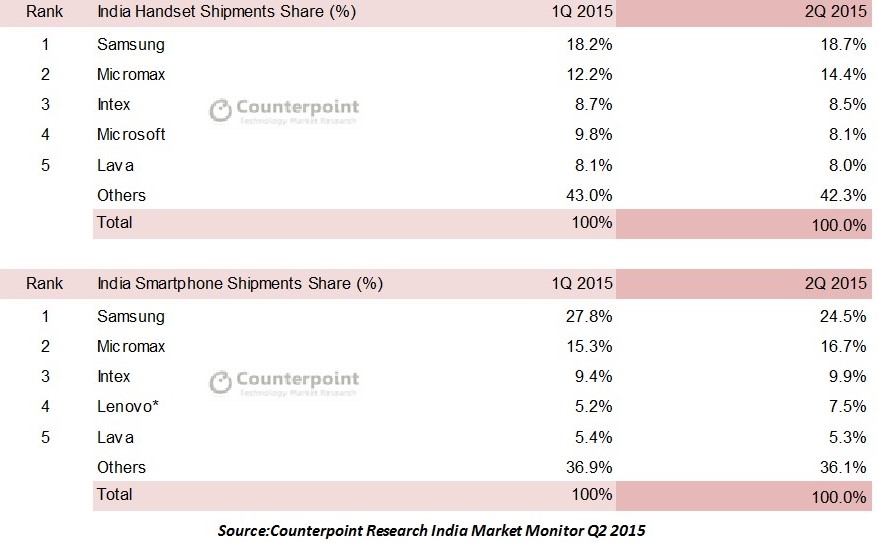

- Samsung led the overall mobile phone market and the smartphone segment during the quarter with market shares of 18.7% and 24.5% respectively

- Samsung remained aggressive in terms of promotion during the quarter with its Flagship models S6 and S6 edge launch. As a result, Samsung’s S6 series shipments sell-in remained healthy and out-shipped iPhone 6 series by 2:1

- Surprisingly, Samsung’s Tizen based Z1 was Samsung’s best-selling smartphone in India during the quarter, thanks to its cheaper price point, higher sales incentives and wider distribution

- Apart from this the Korean giant also looked to embrace e-commerce more seriously as it launched specific SKU’s and its own online brand store exclusively on leading e-commerce platform

- Micromax maintained the second position in both overall mobile phone market and the smartphone segment and regained market share during the quarter mostly due to increase in sales from Online sales channel and Bolt series.Micromax’s new brand Yu launched its second model Yuphoria during the quarter and started off well

- The vendor has also scaled up its domestic manufacturing operations in its local facility in Rudrapur, India with a production output of now 2 Million units per quarter

- Continuing its momentum from Q1 2015, Intex has captured third spot in both overall and smartphone segment for the first time ever, capturing slightly under 10% of the smartphone market during the quarter. Demand for Intex products in the sub-$100 smartphone price band still remains strong

- Lava excluding its sub-brand Xolo captured fifth spot in both overall and smartphone segment with a market share of 5.3% in the smartphone segment. The Lava IRIS series, especially the X1ATOM and X8 smartphone were among the bestselling models

- Lenovo including Motorola raced to fourth position, primarily due to strong sales of its A6000 plus and A7000 models which helped the Chinese player to cross 1 Million unit mark on its own for the first time ever

- Lenovo was also the second largest LTE smartphone vendor during the quarter.

- Xiaomi smartphone shipments increased sequentially during the quarter the vendor and became the third largest 4G smartphone vendor during the quarter, thanks to brisk sales of Redmi 2 4G and Mi Note 4G.The Chinese brand also debuted new flagship Mi4i with its first India specific launch

- Meanwhile, Apple’s iPhone shipments remained strong during the quarter as vendor expanded its distribution reach through both online and offline channel by adding more partners. The Cupertino-based vendor also crossed 1 million unit shipments in the seven months of its fiscal year since Oct 2014. An achievement that it took almost twelve months to manage in its last financial year

- Microsoft also found its place among top five overall mobile phone brands during the quarter but Lumia shipments declined sequentially

- Meanwhile, the other brands which grew significantly during the quarter were Infocus, Vivo, Huawei-Honor, Panasonic and Sony

Other important trends worth noting during the quarter were:

- Online Sales: Almost 30% of the total smartphones sold during the quarter were through the online channels and ‘exclusive’ online only smartphone sales contributed to more than 20% of the total smartphone sales

- 4G LTE Smartphone: One in Four smartphones sold during the quarter was LTE capable

- Make in India: One in Five phones shipped during the quarter were “Made in India”

Exhibit 1: India Mobile Phone and Smartphone Shipments

The comprehensive and in-depth Q2 2015 Market Monitor is available for subscribing clients. Please feel free to contact us at analyst@counterpointresearch.com for further questions regarding our in-depth latest research, insights or press enquiries.

The Market Monitor research is based on sell-in (shipments) estimates based on vendor’s IR results, vendor polling triangulated with sell-through (sales), supply chain checks and secondary research.