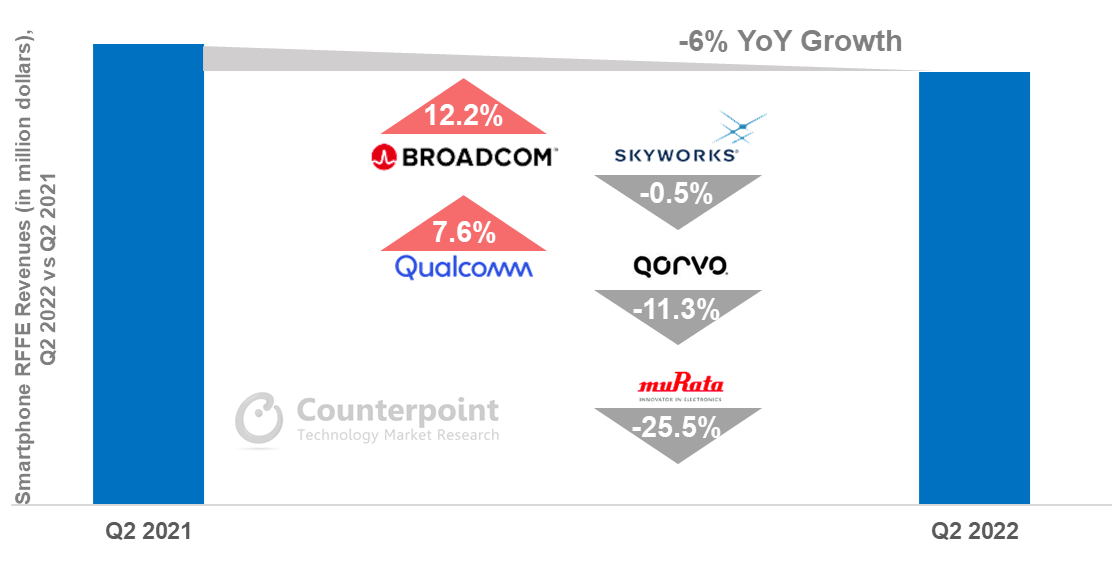

- In Q2 2022, the overall smartphone RF front-end market revenues were down 14% QoQ and 6% YoY.

- Against the market decline, Qualcomm and Broadcom delivered positive YoY revenue growth at around 7.6% and 12.2%, respectively.

- We have revised the 2022 revenue growth projection for the smartphone RF front-end component market to a low single digit amid an unfavorable macro environment.

In Q2 2022, the overall market revenue for diverse smartphone-related RF front-end (RFFE) components, mainly including RF PA (power amplifier) integrated modules, receiving modules and discrete components such as filters, switches, LNAs (low-noise amplifiers) and power trackers, was down 14% QoQ and 6% YoY, according to Counterpoint’s Smartphone RF Front-end Tracker.

Global smartphone shipments were down 9% YoY in Q2 2022, and the growth rate is expected to fall further in Q3 2022. Against the backdrop of such rising uncertainties, OEMs, particularly in the Android camp, became more conservative in managing inventory and their destocking efforts led to significant order reductions for general RF components, interrupting the secular growth trend of the smartphone RFFE sector. In this context, major vendors showed a mixed sales performance.

Smartphone RFFE Market Revenue Decreased 6% YoY in Q2 2022

Source: Counterpoint RF Front-end Tracker, Q2 2022

Qualcomm managed to deliver a 7.6% YoY revenue increase for RFFE components, building on its leadership in providing high-performance mobile platforms for premium smartphones. In Q2 2022, the shipments of flagship models powered by the Snapdragon 8/8+ Gen 1 exceeded 10 million with a much stronger presence (share climbed up to around 79%) in the Samsung Galaxy S22 family. This momentum will continue, resulting in robust demand for the paired 4G/5G PA-integrated and mmWave modules. Besides, we saw the spreading adoption of Qualcomm’s diversity receive modules across platforms at the cost of muRata.

Skyworks’ RFFE revenues were almost flat YoY, with more contribution from Apple and Samsung (the top two clients were estimated to account for approximately 90% of Skyworks’ Mobile revenue of $764 million in Q2 2022) but less exposure to China-based OEMs (<10% of Skyworks’ Mobile revenue), as its product portfolio is positioned towards the mid-to-high tier where there is a high level of customization requirements.

Qorvo’s smartphone RFFE revenues decreased 11.3% YoY in Q2 2022 due to reduced smartphone production across its Android clients (collectively contributing to around 60% of Qorvo’s MP revenue of $733 million in Q2 2022), although the company secured new design wins, such as the first shipments of low-band PAMiD (LB PAD) modules to Samsung, and ramped up production of mid/high-band PAMiD (MHB PAD) modules for the upcoming Google 7 series.

Broadcom, which has been providing MHB PAD modules for Apple’s iPhones and Samsung’s premium models, saw its RFFE revenues rise 12.2% YoY in Q2 2022, primarily driven by the ramp-up of production of the iPhone SE 2022.

muRata’s RFFE revenues from smartphone applications experienced a sharp fall of 25.5% YoY in dollar terms. The decline was largely due to the significant yen depreciation as well as the plunge in shipments to its Android clients in China.

China RFFE vendors are facing greater challenges as the low-end smartphone segment is more vulnerable to the impact of the worldwide economic downturn and rising inflation. For instance, Maxscend, the leading RF solution provider in mainland China, reported a more than 25% YoY revenue drop for Q2 2022 in dollar terms.

Smartphone RFFE revenue growth forecast for 2022 revised down

Globally, high inflation and economic slowdown are prompting consumers to cut unnecessary spending, leading to a prolonged smartphone replacement cycle. Major Android OEMs have lowered their production targets for the second half of 2022 and the resulting inventory correction is expected to persist through early 2023.

On the other hand, the annual 5G smartphone shipment volume is expected to increase by 20%, while the high-end segment is indicating a higher level of resilience against the ongoing market contraction. For instance, Apple is estimated to ship 25 million more 5G iPhones than it did in 2021, with equivalent production volume for the iPhone 14 series in H2 2022 compared to its predecessor.

Therefore, Counterpoint has revised down its 2022 growth forecast for the smartphone RFFE market to the low single-digit range (1%~3%) to reflect the greater-than-expected impact on demand for RFFE components. But in the longer term, the RFFE market is riding on the back of the worldwide spread of 5G and mmWave and has great potential for secular growth.