Samsung Electronics had a terrific earnings report for the quarter ended September 2020. The South Korean tech giant is in a formidable and unique position where it is making money not only through its own vertically integrated offerings but also by selling technology solutions to its competitors.

We have been extensively covering Samsung, one of the world’s leading consumer brands. While its consumer business is vertically integrated, its B2B tech solutions business is horizontal and drives bottoms lines. We have written about where it all started. Here are the key takeaways from Samsung Electronics’ Q3 2020 numbers:

▸Revenue: $56.3 billion (+8% YoY, +30% QoQ)

▸Profit: $10.3 billion (+59% YoY, +55% QoQ)

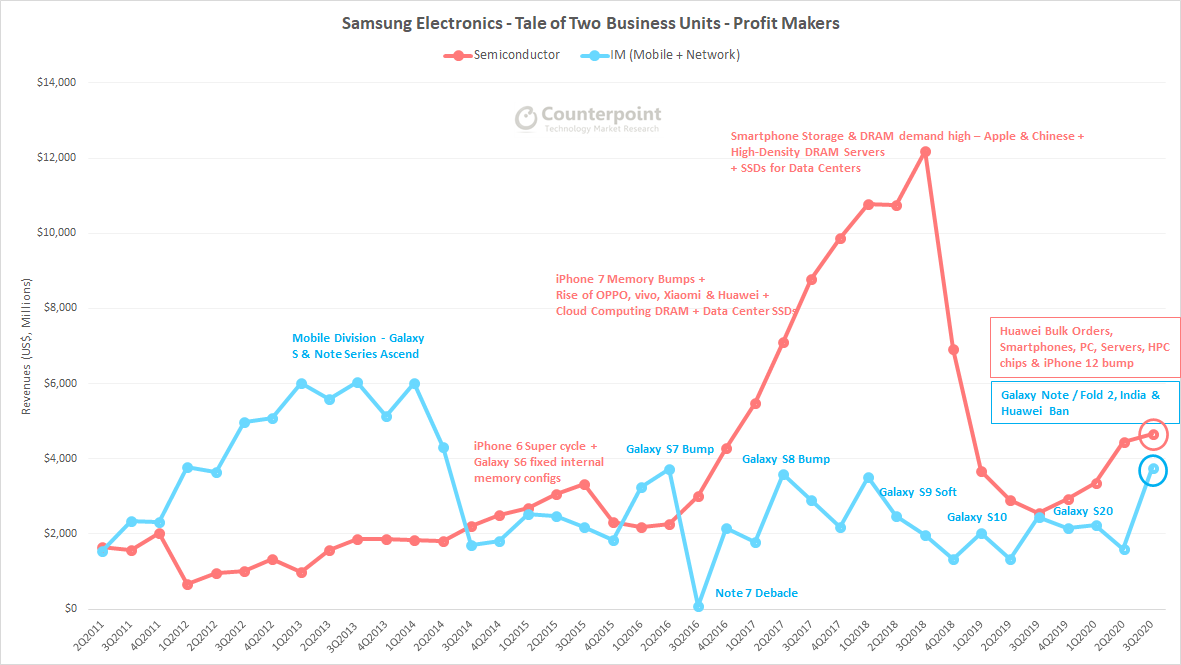

▸The earnings were driven by strong performances across Semiconductors (Memory) and Telecom (Mobile+Networks) businesses. Consumer Electronics divisions saw a bump as well.

▸Semiconductors and Telecom businesses together contributed to almost three-fourths of Samsung’s total revenue and 81% of the total profit in Q3 2020.

▸Semiconductors division’s revenue was up 7.3% YoY and profit up 82% YoY, while the Telecom division’s revenue was up 4.7% YoY and profit up 53% YoY.

Source: Counterpoint Q3 2020 Market Monitor, OEM Analysis

▸Memory division was the star, thanks to the growing need for Flash storage and DRAM across mobile phones, PCs and data centers.

▸The rise of AI, IoT and 5G will accelerate this need further across newer applications such as autonomous systems and Edge Cloud deployments.

▸Within Semiconductors, the LSI (chipsets, sensors, etc) and foundry business has been gaining steam for mobile and HPC applications.

▸Samsung’s Mobile division’s key competitors are also some of the key customers for its semiconductors business, an intriguing relationship.

▸Talking about its Telecom division, Samsung Mobile is benefitting a lot from the US stranglehold on Huawei and anti-China sentiments in India, the world’s second-largest mobile phone market. This is well supported by its world’s largest channels reach for any mobile phone vendor and a broader portfolio of mobile devices, ranging from a Samsung Guru Music 2 feature phone to the sub-$80 Galaxy Core M01, the flagship Samsung Galaxy S20 and Note 20 series and the Galaxy Fold series, the innovative line of foldable phones.

▸In addition to the mobile phone segment, Samsung has seen a growing demand for its offerings in the 5G network infrastructure market, with great operator wins across North America, South Korea, Europe and other regions, building upon its key wins in India (Jio) and South Korea in the 4G era.

▸Its display business will continue to expand and the Consumer Electronics business will see a bump as the COVID-19 situation has driven demand for electronics and appliances. A cohesive intelligent connected home story can further boost Samsung’s prospects.

Moving forward, Apple is likely to see its super-cycle with the new iPhone 12 series, even as Samsung’s semiconductor and display business benefits handsomely. Huawei’s struggles will help Samsung’s position in other key markets such as Europe, MEA and Latin America, not only for the devices business but also for the network infrastructure business. The growing demand for memory across various applications and strong demand from some of its LSI customers (like Qualcomm) should provide further scale and boost both the top and bottom lines.

Overall, Samsung is strongly positioned for all of its business segments in the short- to mid-term.