NIO is a leader in China’s smart electric vehicle (EV) market. After starting its business in 2014, NIO delivered its first model, the ES8, in December 2017. Since then, it has grown rapidly. The company has also entered the international market with the launch of operations in Norway in the latter half of 2021.

In China, NIO operates in the premium price segment where it competes with brands like Audi, BMW and Tesla. However, NIO plans to launch a subsidiary brand for the low-tier and mid-tier segments. While this sub-brand will compete against automakers like Wuling, Volkswagen and Toyota, NIO as a brand will continue its operation in the premium segment.

Apart from its EV business, NIO also provides battery and vehicle charging solutions through its subsidiary NIO Power. In December 2021, NIO Power had more than 700 swapping stations across China, which had already provided a total of 5.3 million swaps. NIO also has 3,020 power chargers and 3,319 destination chargers in various locations across China.

Q4 2021 Results

In late March, NIO released its unaudited financial results for Q4 2021 that showed nominal progression across most metrics.

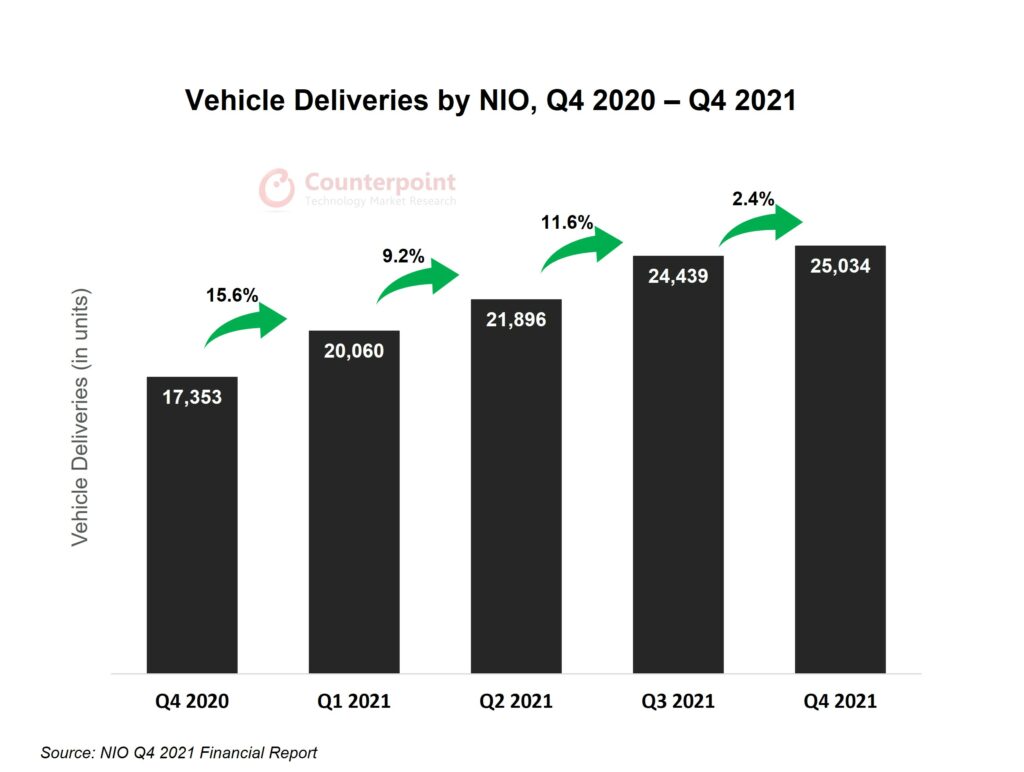

Vehicles Delivered

During Q4 2021, NIO delivered 25,034 units of cars, which is an increase of 2.4% QoQ and 44.3% YoY. NIO’s total vehicle sales grew 109% annually to reach 91,429 units in 2021. This growth was mainly driven by rising EV adoption in China and NIO’s business initiation in Norway.

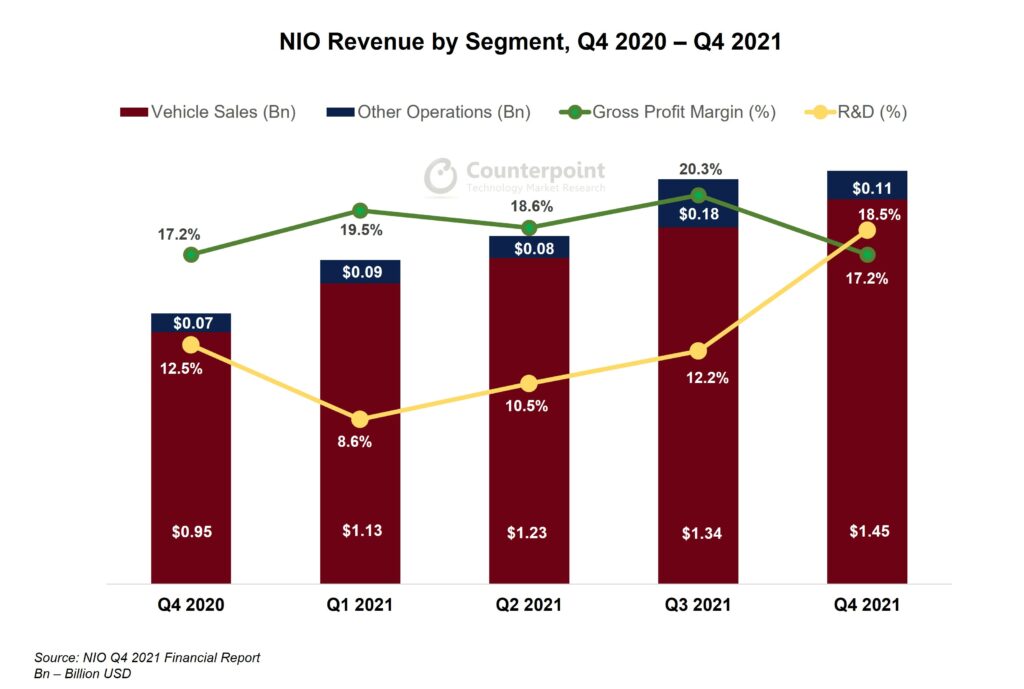

Revenue

Keeping parity with vehicle sales, NIO’s total revenue for Q4 2021 stood at $1.55 billion, a 1% sequential increase. Revenue from vehicle sales was $1.45 billion, a 6.7% increase from the third quarter. For the full year of 2021, revenue from vehicle sales reached $5.2 billion, a 118% increase compared to 2020.

While around 92% of NIO’s 2021 revenue was generated through vehicle sales, revenue from power and services also increased.

Gross Profit

Although NIO saw nominal sales and revenue growth sequentially in Q4 2021, gross profit declined 14.7% QoQ to $266.7 million, giving a gross margin of 17.2%, which also decreased by 3% points QoQ. Regulatory credits helped its gross margin during Q3 2021.

Research and Development

During Q4 2021, the R&D cost was $257.2 million, amounting to more than one-third of the total R&D cost for 2021. This jump suggests NIO is working on several new vehicle projects as well as developing new services. In January last year, NIO launched its autonomous driving platform ‘NIO Autonomous Driving’. Though the platform is restricted to ADAS, it is expected that L4/L5 autonomy will be developed on this platform. Nio started the deliveries of ET7 in March this year. So, a part of R&D cost might have been mobilized even towards software development to make it a best-in-class product.

Market Outlook

With EV sales accelerating compared to previous years, the company expects to achieve revenue growth of 20.6% to 25.1% during the first quarter of 2022. However, China’s EV market is currently going through a slack period for two main reasons: Firstly, rising COVID infections are causing widespread city and even regional lockdowns, and secondly, raw material prices for EV batteries are rising (nickel and lithium prices have increased sharply).

Due to the rising costs, EV manufacturers are either increasing prices or sacrificing profit. Entry-level and mid-level brands are likely to be most impacted, but even premium brands will be affected eventually.

While OEMs are reluctant to increase their vehicle prices, Xpeng, another leading Chinese EV manufacturer, has recently increased its vehicle prices by at least $1,500. Even Tesla and BYD, which are believed to have strong and stable supply chains, have been forced to increase prices. NIO has resisted the move so far and expects to benefit from strong demand in the short term.