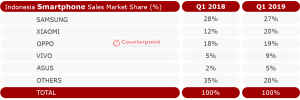

The Indonesian smartphone market is increasingly concentrated at the top with the market share of the top five smartphone OEMs reaching the highest-ever level of 80% in Q1 2019, according to the latest research from Counterpoint’s Market Monitor service. Samsung, Xiaomi, OPPO, Vivo, and Asus, the top five smartphone OEMs by market share, are more than four years old in the market and have a strong offline reach now, as compared to previous years. This enabled them to reach users even in the least populated provinces in the eastern region of Indonesia.

Meanwhile, overall smartphone shipments in the country fell 4% year-on-year (YoY) during the quarter. This is due to a dip in demand post strong fourth quarter. Some of the key brands were sitting on inventory post-Q4 2018.

Commenting on the results, Research Analyst, Parv Sharma, said, “Indonesia is one of the key South East Asian markets which OEMs are keeping a close eye on. Almost two-fifths of the population lives in rural areas, which is much higher than more developed countries in the Asia Pacific (APAC) region. Further, 4G penetration, as well as coverage, is growing rapidly. This offers a big opportunity for smartphone OEMs to target feature phone and entry-level smartphone users looking to upgrade to 4G devices. This trend of upgrading will drive Indonesia’s smartphone market to grow by 7% YoY in 2019 as per our estimates.”

Entry-level devices in the sub-US$200 price bands dominate Indonesia’s smartphone market, occupying close to 75% of the shares by volume. However, going forward, we estimate the mid-tier segment to gain more traction as more Chinese brands to expand their product portfolio in the mid to high tier segment.

Commenting on the distribution landscape, Associate Director, Tarun Pathak said, “Offline still remains the dominant channel strategy for OEMs. Leading retailers like Erajaya have been successful in forging partnerships with key OEMs, and this is one of the reasons why we have seen that share of the top five brands expanding in the country. Additionally, the government will introduce a new rule in August, which aims to curb the distribution of illegal handsets. We believe this is a step in the right direction and will positively impact the leading retailers in the country.”

Exhibit 1: Indonesia Smartphone Sales Market Share – Q1 2019

Source: Counterpoint Research Market Pulse Q1 2019

Market Summary:

- Samsung led the smartphone market with a 27% share. It has managed to hold on to its market share amid intense competition from Chinese brands.

- For Samsung, the J series (J2 prime and J4 plus) was driving the volumes but is likely to be replaced by A series, which is doing well in other countries. Samsung still has a robust distribution structure and reach.

- Xiaomi’s share has hit the highest-ever level in Indonesia, driven by strong sales of Redmi 6A. Xiaomi has a strong retail strategy in Indonesia, in partnership with Erajaya. It is also expanding its Mi Stores to 40 by the end of Q1 2019. It has also partnered with Lazada, Blibli, Shopee, JD, and Akulaku apart from selling through its own online store.

- A3S was the best-selling model for OPPO followed by F series. OPPO’s portfolio still remains leaner in Indonesia, and the brand is estimated to launch new products faster in the country.

- Local players are now playing only in the sub-US$100 segment with their share reaching the lowest-ever level of 9% during the quarter due to the onslaught by Chinese players.

- LTE capable smartphones contributed to 97% of total smartphone shipments.

- Qualcomm led the SoC segment a reaching its highest-ever market share of 44%, followed by MediaTek, and Samsung, with 38% and 14% share respectively.

- Other brands which did well during the quarter were Realme, Nokia HMD, and HONOR. Realme recently entered the market and managed to get good traction for its new devices like the Realme 3.

- With the ongoing trade war between China and the US, Indonesia is one of the countries which is looking to position itself as an attractive destination for some component players to reduce dependency on China.

The comprehensive and in-depth Q1 2019 Market Pulse is available for subscribing clients. Please feel free to contact us at press(at)counterpointresearch.com for further questions regarding our latest research or insights. The Counterpoint Market Pulse is based on sell-through estimates based on retail surveys, vendor polling triangulated supply chain checks and secondary research.

Analyst Contacts:

Follow Counterpoint Research

press(at)counterpointresearch.com