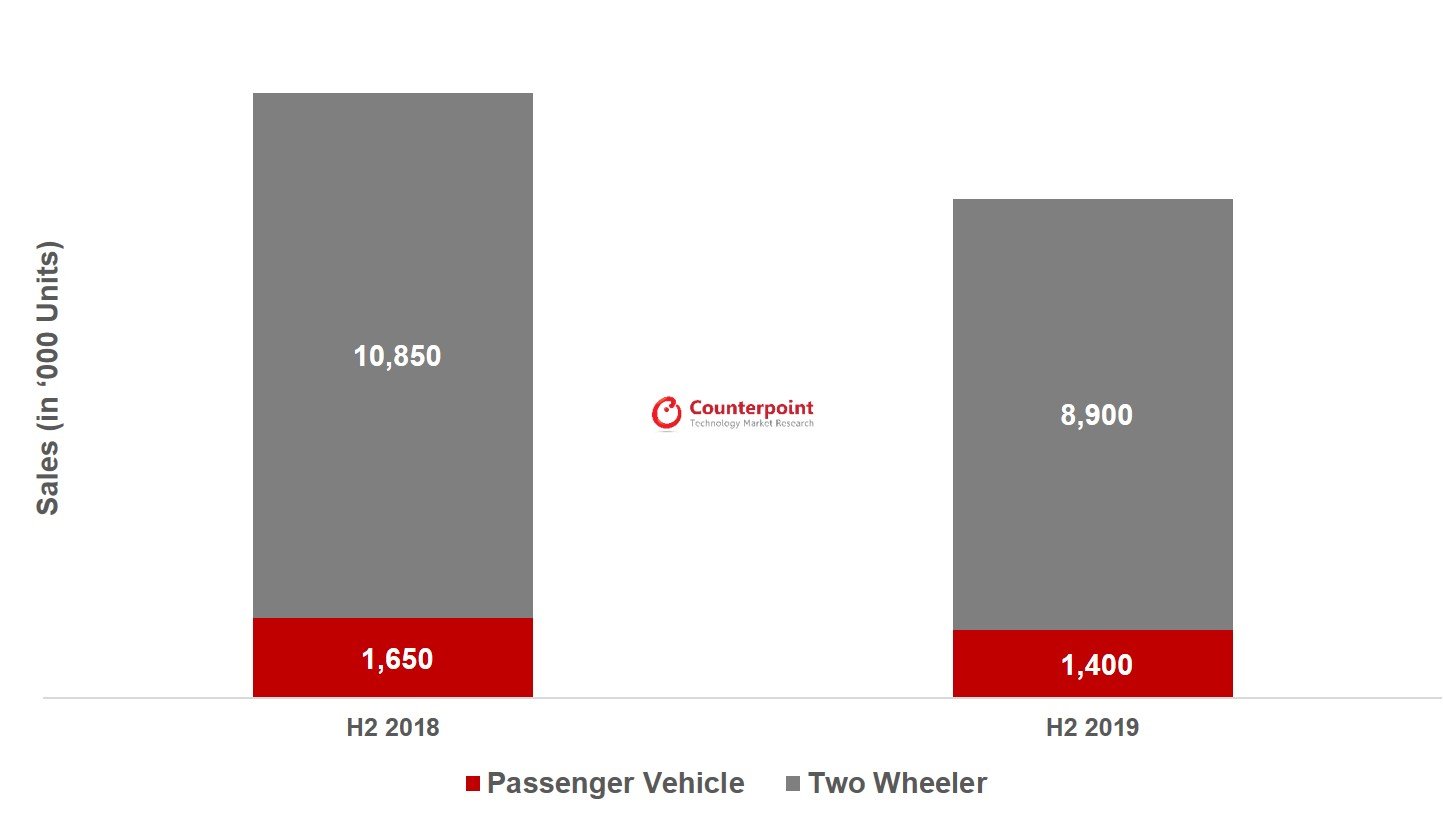

Demand for new cars declined sharply in 2019, forcing automakers to cut production across the year. Sales were expected to revive during the annual festive season from October 2019 but failed to do so. In fact, there was an encouraging spike in sales in Q3 – stimulated by promotional offers, aggressive discounts, new model launches, and the increasing availability of models offering Bharat Stage-VI (BS-VI) emission standard. However, volumes dipped soon after the season was over. Counterpoint Research expects the negative month-on-month sales trend will continue in Q1 2020. Despite continued difficulties, we expect the overall YoY decline to moderate over the rest of the year, with anticipation of economic interventions and industry stability.

Exhibit 1: Vehicle Sales in India (‘000 Units), H2 2018 vs H2 2019

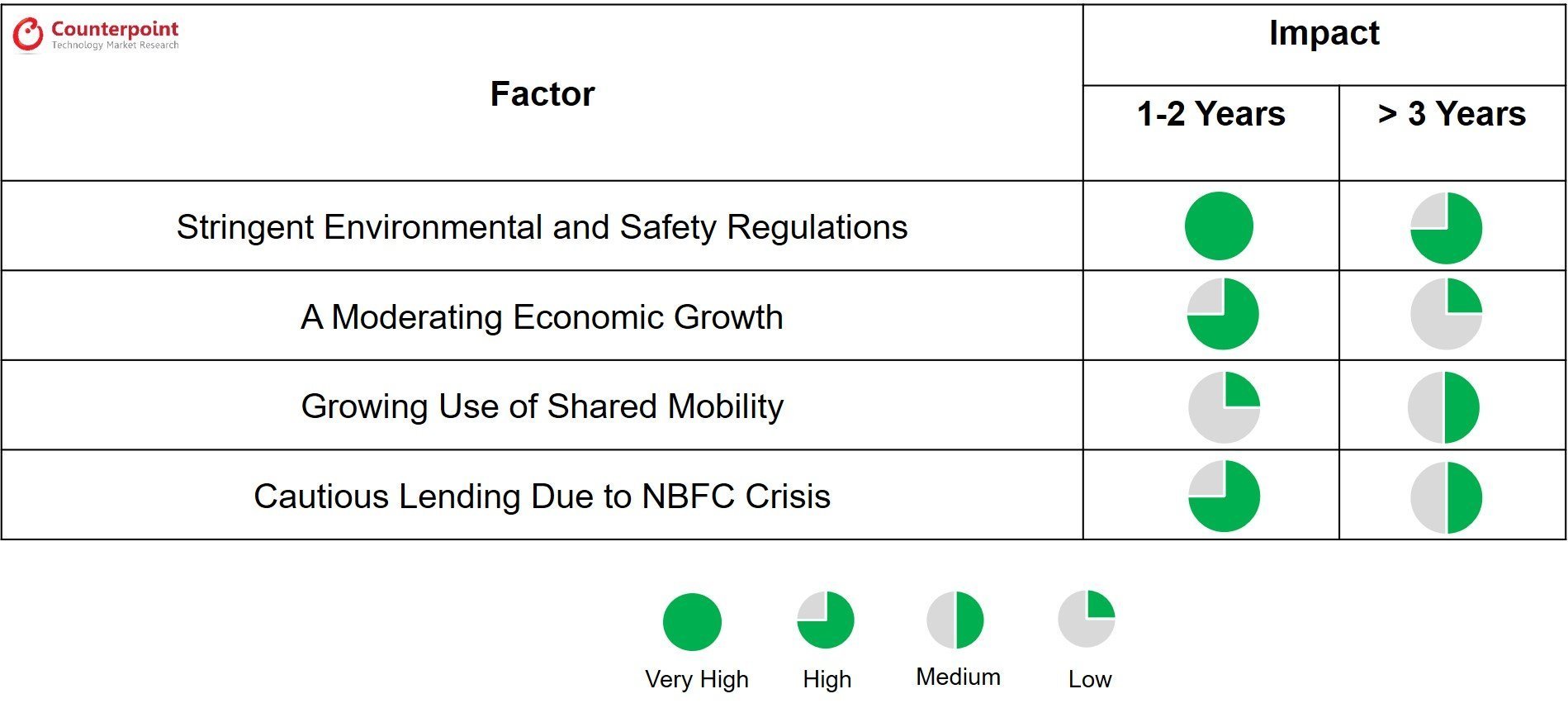

Political, economic and consumer-led factors will carryover from 2019 to impact sales in 2020. These include stringent environmental and safety regulations, a moderating economy, the increasing popularity of shared mobility, political uncertainty, increasing insurance norms and cautious lending.

Elaborating on these factors:

Stringent Environmental and Safety Regulations:

- Over 2019, automotive OEMs scrambled to comply with additional mandated safety equipment requirements including anti-lock/combined braking systems, driver side airbag, speed warning alarm, rear parking sensors, front seatbelt reminders, and crash test standards. All adding to investment costs and increased pricing to customers across all models.

- The impact of mandates introduced in 2018, e.g. five-year third-party insurance premium for two-wheelers to be collected in advance, had its full-year effect in 2019 on overall vehicle sales, and on two-wheeler sales in particular. These continue to bite.

- By April 2020, all vehicle types, two- and three-wheelers, cars and commercial vehicles – are mandated to conform to BS-VI emission standards, with cost increases estimated to be between 5-10%. Having increased prices already at the beginning of January 2020 by 2-3% to offset economic cost increases, OEMs are faced with the dilemma of potentially absorbing some of the extra costs or lost volumes.

Moderating Economic Growth:

- The global economic slowdown has impacted the Indian automotive sector (and Europe and China). India’s GDP growth in Q3 2019 fell to 4.5% from 5% in Q2, and from 7.1% a year ago, resulting from lowered consumer spending and reduced private investment. A depressed rural economy with the lower annual rainfall continues to have a significant impact on two-wheeler demand.

- Growing unemployment and a moderating economy led people to postpone vehicle buying decisions. According to the Centre for Monitoring Indian Economy (CMIE), the unemployment rate was at 8.5% in October 2019, the highest since August 2016. Inflation rose to 3.99% in September 2019 from 3.18% in June.

- The International Monetary Fund has cut its growth forecast for the Indian economy from 7% to 6.1% in 2020.

Growing Popularity of Shared Mobility:

Shared mobility providers continue to dent the demand for passenger vehicles in urban areas, with people increasingly preferring shared-mobility services for their commute. Based on primary research conducted in the country in 2019, Counterpoint Research estimates two out of three frequent users of shared mobility services consider ride-hailing more economical than owning a car. Leading players Ola and Uber have plans to expand services further into tier-2 and tier-3 cities in the next few years.

Cautious Lending by NBFCs:

Non-banking financial companies (NBFCs) finance most vehicle purchases, particularly in rural India. Dealers depend on NBFCs to fund their wholesale purchasing of vehicles from OEMs. The recent solvency issues surrounding India’s NBFCs led to cautious lending that has adversely affected automotive sales in 2019 and shows no signs of abating. OEMs and dealers have approached India’s Finance Industry Development Council, seeking government intervention to improve the financial health of leading NBFCs.

Exhibit 2: Indian Automotive Industry – Impact of Key Factors

Growing Competition:

In spite of the apparent slowdown, MG Motors (part of SAIC Group), BYD and other leading Chinese OEMs including Changan Automobile and Great Wall Motors have serious investment plans for India and are showcasing their proposed models at this year’s Delhi Auto show. Bucking the trend MG Motors and Korean automaker Kia Motors have had strong launches of their recent SUV models, receiving significant orders months in advance. With the increased competition in passenger cars in 2020, Counterpoint estimates these new automakers will nibble away at Maruti Suzuki’s and Tata Motors’ market shares.

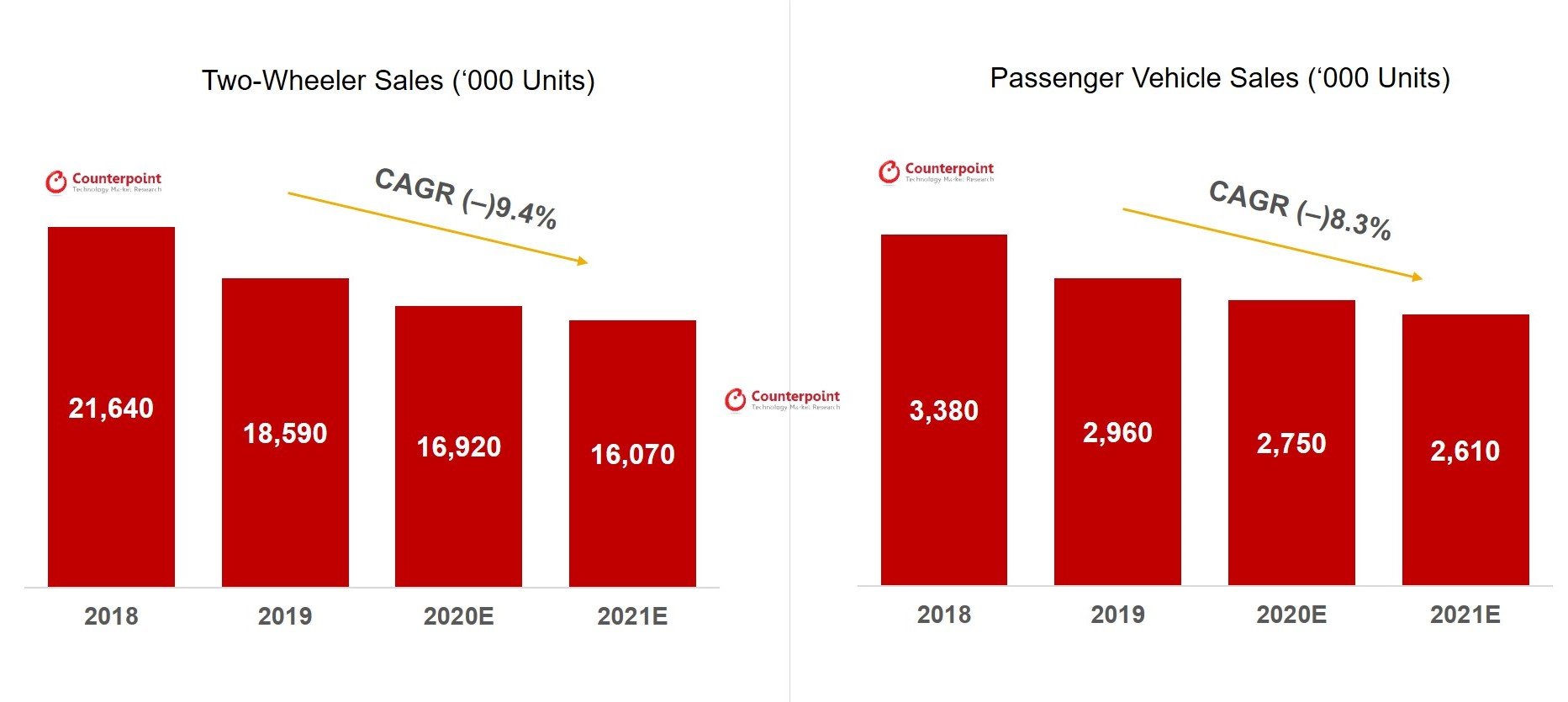

Exhibit 3 – Two-Wheelers and Passenger Vehicles Sales, India, 2018-2021

Conclusion:

Overall for 2020, Counterpoint Research’s automotive sales forecast for India remains cautious, with several factors – particularly tight credit conditions, the moderating economy and the transition to BS-VI emissions standards – creating uncertainty, obstacles and delays.