- Google has been making news in the automotive industry this year. First, with the announcement of HD Maps to support assisted driving and then with a partnership with Mercedes Benz to develop Mercedes-branded navigation.

- Google’s deal with Mercedes is interesting. Google will be licensing services including YouTube and map data to Mercedes but without the automotive OS, and it will not control the data.

- Apple sees the growth potential in the auto industry and likely wants a piece of the pie. This is hinted by Apple’s move to introduce next-generation CarPlay, which will deeply integrate with the vehicle to take over interior screens and instrument cluster.

Since the beginning of 2023, Google has been making news in the automotive industry. First, with the announcement of HD Maps to support assisted driving and then with a partnership with Mercedes Benz to develop Mercedes-branded navigation. The nature of this partnership is unfamiliar to Google; the company usually wants to be in control of the data. So, the question is why Google chose to form this uncommon partnership. To answer this, we have to look at Google’s automotive journey.

Google’s entry into automotive industry

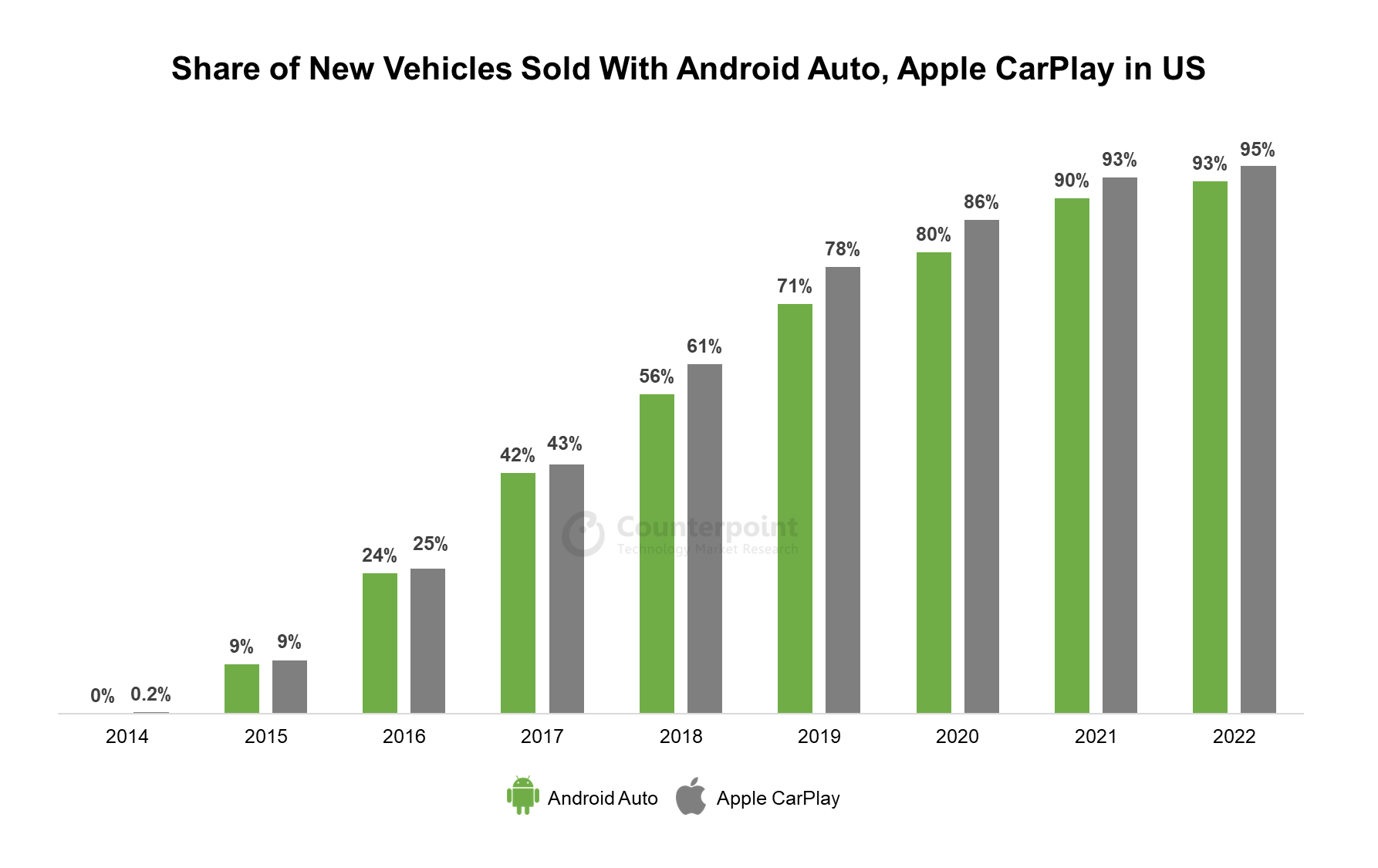

Google is ubiquitous in smartphones thanks to the strong Android user base. The company wanted to bring the same Google services experience to the car through in-vehicle infotainment (IVI). Android Auto bridged the gap between smartphones and cars and allowed its customers to use Google-based apps for navigation, entertainment and communication, as well as Google Assistant. Over time, Android Auto started gaining popularity as users liked being able to have a similar experience across their phones and vehicles, and additionally use free services like Google Maps. According to Counterpoint Research estimates, around 90% of car models sold in the US in 2022 support Android Auto.

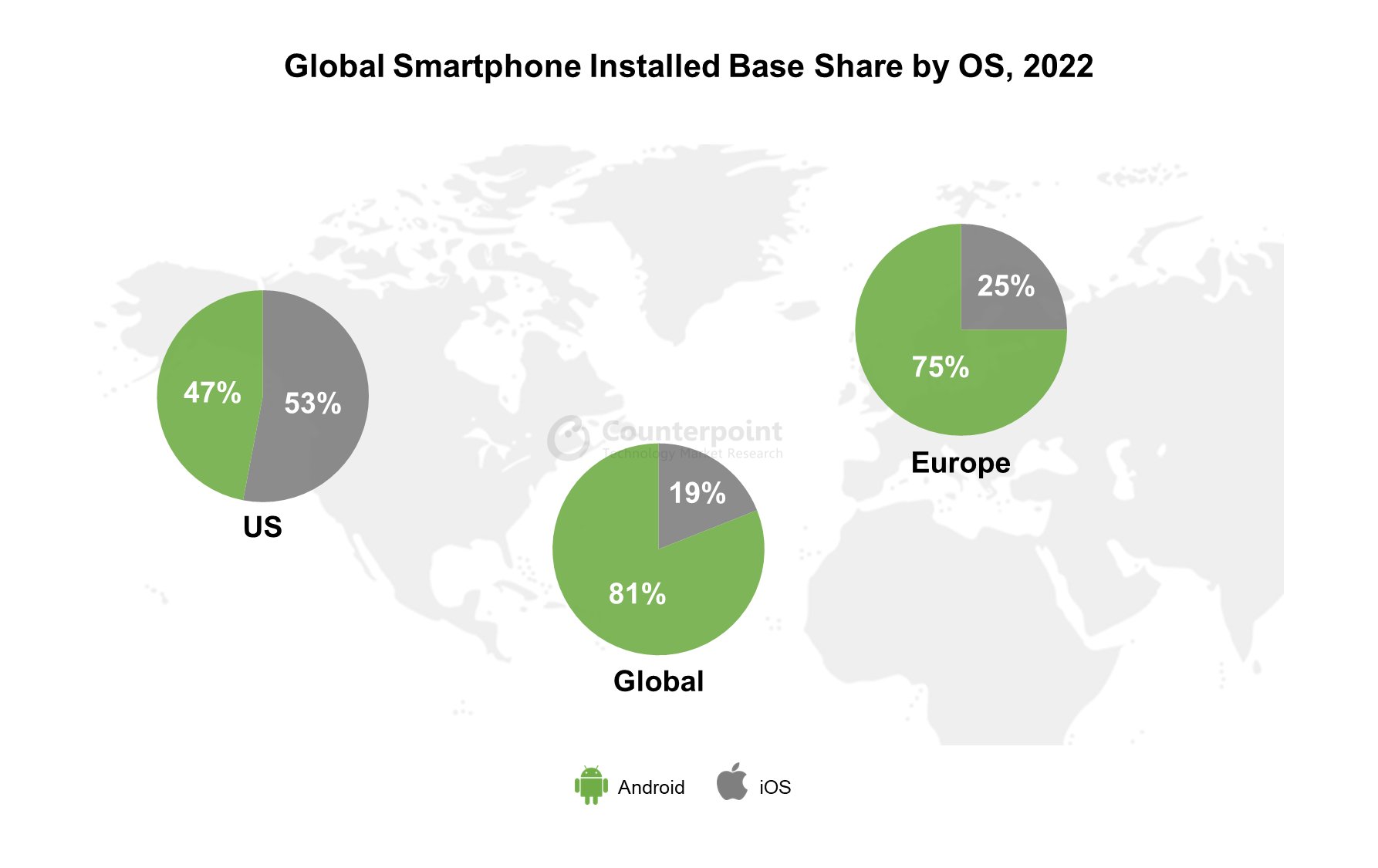

This is a strong performance, but it was not an easy road for Google/Android Auto to get accepted by auto OEMs as data privacy concerns always loom around Google. Companies like Hyundai, Kia, Volkswagen, GM and Honda were early adopters of Android Auto, while others, including BMW, Toyota, Lexus, Jaguar Land Rover and Infiniti, didn’t introduce Android Auto compatibility until 2018-2020 after getting repeated requests from owners. In the US, the Android installed base is slightly close to 50%, whereas in Europe it is over 70% and close to 80% for the global market. Therefore, it is not surprising that most drivers from these brands own phones running on Android.

Google’s ambitious plan to capture automotive market

Google set its sights beyond IVI to take on the challenge of autonomous vehicles (AV) and software-defined vehicles (SDV) with the 2016 formation of Waymo, which started as a self-driving research project, and the announcement of Android Automotive OS, an expansion of its Android Auto initiative. Android Automotive OS (AAOS) is an open-source OS, somewhat replicating Google’s smartphone OS strategy. Running directly on in-vehicle hardware (i.e. head unit), it is a highly modular and full-stack open platform and supports apps built for Android as well as those built for Android Auto.

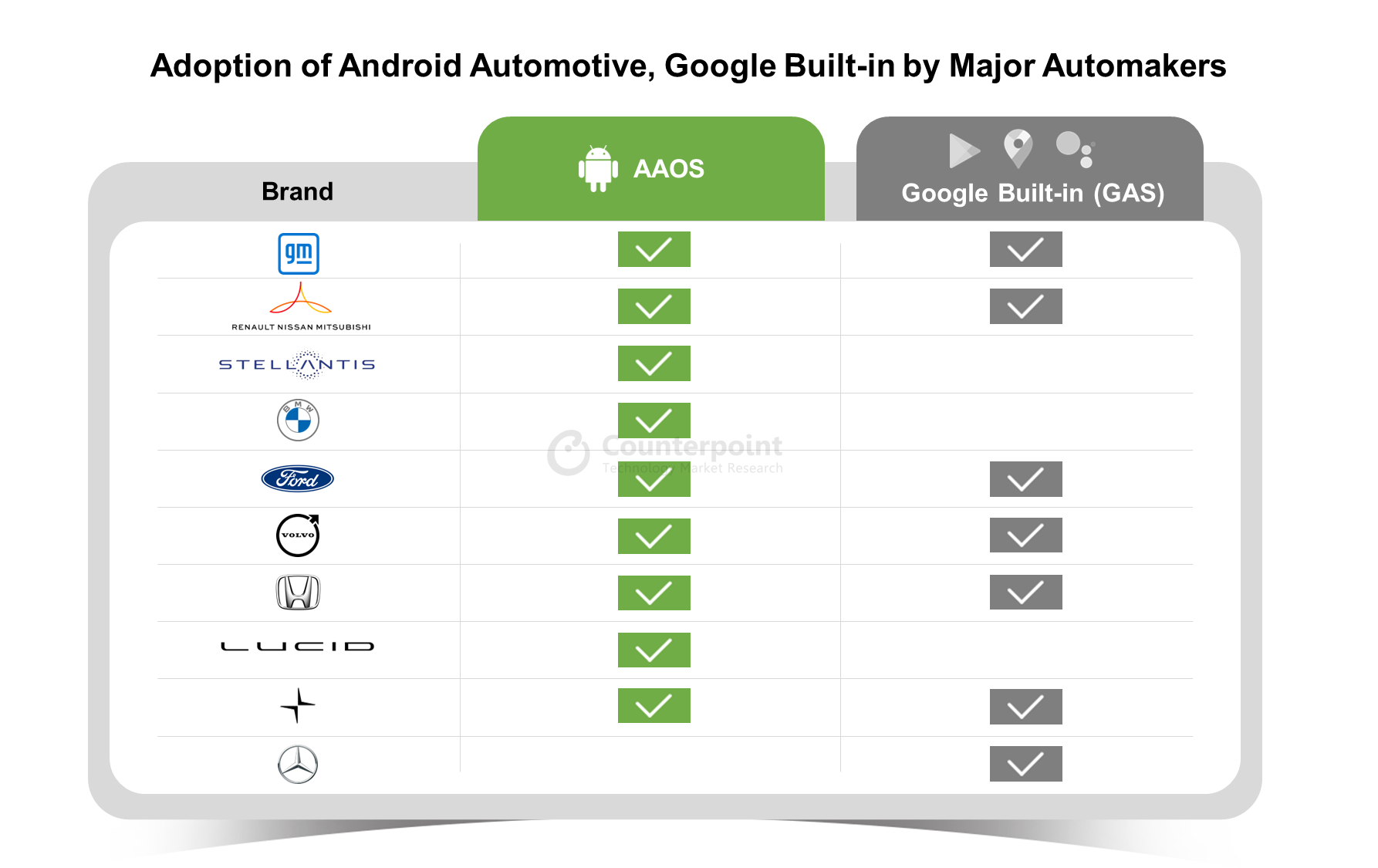

One standout feature is that AAOS has a suite of applications and services called Google Automotive Services (GAS), which is often marketed as Google Built-in by automakers. The GAS suite offers options to carmakers to integrate different services from Google, like Maps, Play Store and Assistant, directly into the vehicle without the need for an Android smartphone. Automakers can obtain GAS through a licensing fee on top of Android Automotive.

Currently, there are around 20 models available with Android Auto. The latest addition to the list is the 2023 Honda Accord. Several other automakers have announced plans to move to AAOS, but not every automaker is interested in GAS. We list below some major automakers and their plans to use Android Auto and Google services.

Volvo and Polestar: Volvo brand Polestar, with its Polestar 2, was the first automaker to adopt Android Automotive with GAS integration. Volvo’s first all-electric XC40 Recharge was also the first car to run on Android Automotive. In 2022, Volvo announced from 2023 onwards would be equipped with Google infotainment.

Renault-Nissan-Mitsubishi: In 2018, the alliance announced a partnership with Google to run its infotainment systems on Android Automotive. Renault’s Megane E-Tech was the first car to run on Android OS with GAS. In 2022, the Renault Austral was launched based on Android Automotive. Nissan and Mitsubishi have not announced any plans to launch models based on Google.

General Motors: In 2019, GM announced that its in-vehicle infotainment system would be powered by Android Automotive and feature Google apps and services for vehicles starting 2021. The GMC Hummer EV became the first GM car to be run on Android Automotive with GAS integration. Later, in 2022, mainstream models like the Chevrolet Tahoe, Chevrolet Suburban, Chevrolet Silverado, GMC Sierra and GMC Yukon were launched with Google Built-in.

Stellantis: Before the merger between PSA and FCA, PSA Group announced that Android Automotive would be powering its in-car infotainment system starting from 2023 models. In a different approach, FCA launched the Uconnect 5 based on Android Automotive but without GAS. But after the merger of both brands into Stellantis, the whole group is integrating AAOS for the IVI system.

Ford: Joining its US rival GM, Ford announced a partnership with Google in 2021 to run its SYNC infotainment system, which currently runs on Blackberry QNX OS. Ford plans to integrate GAS into its vehicles from late 2023 onwards.

Honda: The Japanese company was one of the early adopters of Android Automotive OS for the in-car infotainment system with its Honda Connect, based on NVIDIA’s Tegra processor. In 2021, Honda announced the integration of GAS into its vehicles from H2 2022. The 2023 Accord is the first Honda car with Google Built-in services.

BMW: The German brand took a different approach, announcing in 2022 that its new BMW OS 9 would be built on Android Automotive OS. But due to data privacy concerns, it is reluctant to integrate GAS. BMW is also an investor in navigation services provider HERE Technologies.

Lucid: The American company adopted Android Automotive OS for infotainment but did not integrate GAS.

Porsche: The Volkswagen brand was one of the few carmakers that only offered Apple CarPlay but not Android Auto for many years. Porsche released its first car with Android Auto only in 2022. The VW group is facing a lot of criticism due to software issues that are delaying the launch of electric models from its brands Porsche, Audi and Bentley. Hence, Porsche is looking at a strategy shift by taking into account Android Automotive OS and integrating GAS, which will include Google Maps, Google Assistant and Google Play Store, into its IVI.

Google’s road ahead

Google’s deal with Mercedes is interesting. Google will be licensing services including YouTube and map data to Mercedes but without the automotive OS, and it will not control the data. This shift in Google’s approach shows that it is willing to change its strategy to build trust with automakers, especially the Germans who are known to be apprehensive about data privacy.

With the major trends of electrification and ADAS/Autonomous Driving (AD), and some of the EV models already equipped with Google Maps, Google has been adding EV-related features such as EV routing and searching for charging stations in in-vehicle Google Maps. Besides, Google has announced HD Map support for Level-2 hands-free driving and Level-3 driving systems. HD Map will roll out first in the Volvo EX90 and Polestar 3.

Google Maps is challenging the territory of established players like HERE and TomTom. We expect Google will further develop its in-vehicle navigation to make EV use easier and support higher levels of automated driving.

Lastly, the next-generation vehicles will be software-defined vehicles. This will allow companies to generate various recurring software revenue streams. As a result, the car software market will grow. Apple sees this growth potential in the auto industry and likely wants a piece of the pie. This is hinted by Apple’s move to introduce next-generation CarPlay, which will deeply integrate with the vehicle to take over interior screens and instrument cluster, and allow users to control climate and radio. So far, 14 automakers have confirmed to integrate new CarPlay, which is set to launch in late 2023. Therefore, in the future, we may see Apple developing complete software that runs on the vehicle without a partner iPhone, similar to Android Automotive. There are reports that indicate Apple is working on its ‘Apple Car’ as several patents related to cars have been filed by the company. This will allow Apple to replicate its strategy of using its software and services to monetize its hardware.

Therefore, in the era of software-defined vehicles, we may see the next round of battle between tech giants Google and Apple, this time for supremacy in the automotive OS, which will be the heart and soul of the car.