- Quectel and Qualcomm led the global cellular IoT module and chipset markets respectively in Q3 2021.

- NB-IoT contributed to more than one-third of the cellular IoT module market.

- Smart meter, POS, enterprise, industrial and router/CPE were the top five applications in this quarter.

San Diego, Buenos Aires, London, New Delhi, Hong Kong, Beijing, Seoul – December 9, 2021

Global cellular IoT module shipments grew 70% YoY in Q3 2021, according to the latest research from Counterpoint’s Global Cellular IoT Module, Chipset and Application Tracker. In terms of overall revenue, the market crossed the $1.5-billion mark during the quarter. China continued to dominate in terms of volume, followed by North America and Europe. 5G was the fastest growing technology (+700% YoY) due to a lower base.

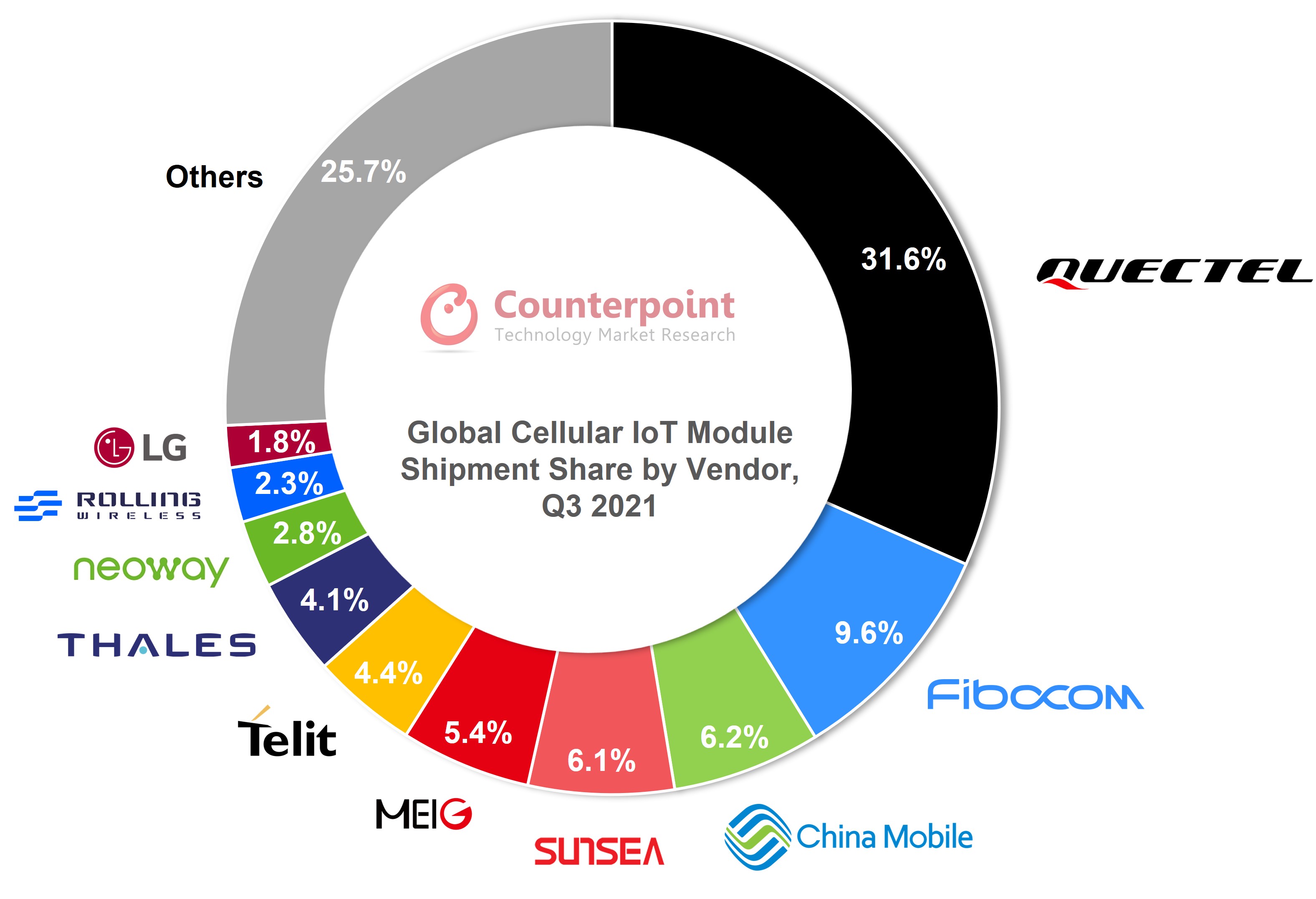

Commenting on the market dynamics, Research Analyst Soumen Mandal said, “Chinese module players performed well during this quarter while some international players struggled. Quectel, Fibocom and China Mobile were the top three cellular IoT module players in China in terms of shipments. For the rest of the world, Quectel, Telit and Thales were the top three cellular IoT module players.

Quectel’s cellular IoT module shipments grew nearly 80% YoY in Q3 2021. NB-IoT and 4G Cat 1 modules were major drivers for this immense growth. In this quarter, Quectel won some bids for 5G, including for 5G C-V2X with Great Wall Motor, high-speed rail applications with China Mobile, industrial applications with China’s industry and information technology ministry, 5G module with China Mobile and a customized project with China Unicom. We expect 5G module shipments to gain traction from early next year.

Fibocom maintained its second position in the global cellular IoT module market. The strong demand for NB-IoT modules helped Fibocom’s module shipments grow 84% YoY. Fibocom is also focussing more on 4G Cat 1 and Cat 1 bis modules. We expect to witness more competition in Cat 1 bis space next year.

China Mobile entered the top three module player rankings during this quarter. Its total shipments tripled annually in Q3 2021. The Chinese market is witnessing a lot of traction for NB-IoT and 4G Cat 1 modules as 2G or 3G modules are being replaced in most cases.

All the top five module players in Q3 2021 were from China. MeiG Smart is another Chinese player witnessing continuous growth. Automotive-grade NAD IoT module players Rolling Wireless and LG raced into the top 10 module players rankings as demand for connected cars continued to rise.”

Global Cellular IoT Module Shipment Share by Module Vendor, Q3 2021

Smart meter, POS and retail were the top three fastest-growing applications. The ongoing chip shortage had a negative impact on the automotive segment. Chipset dynamics are also changing depending on applications and technologies.

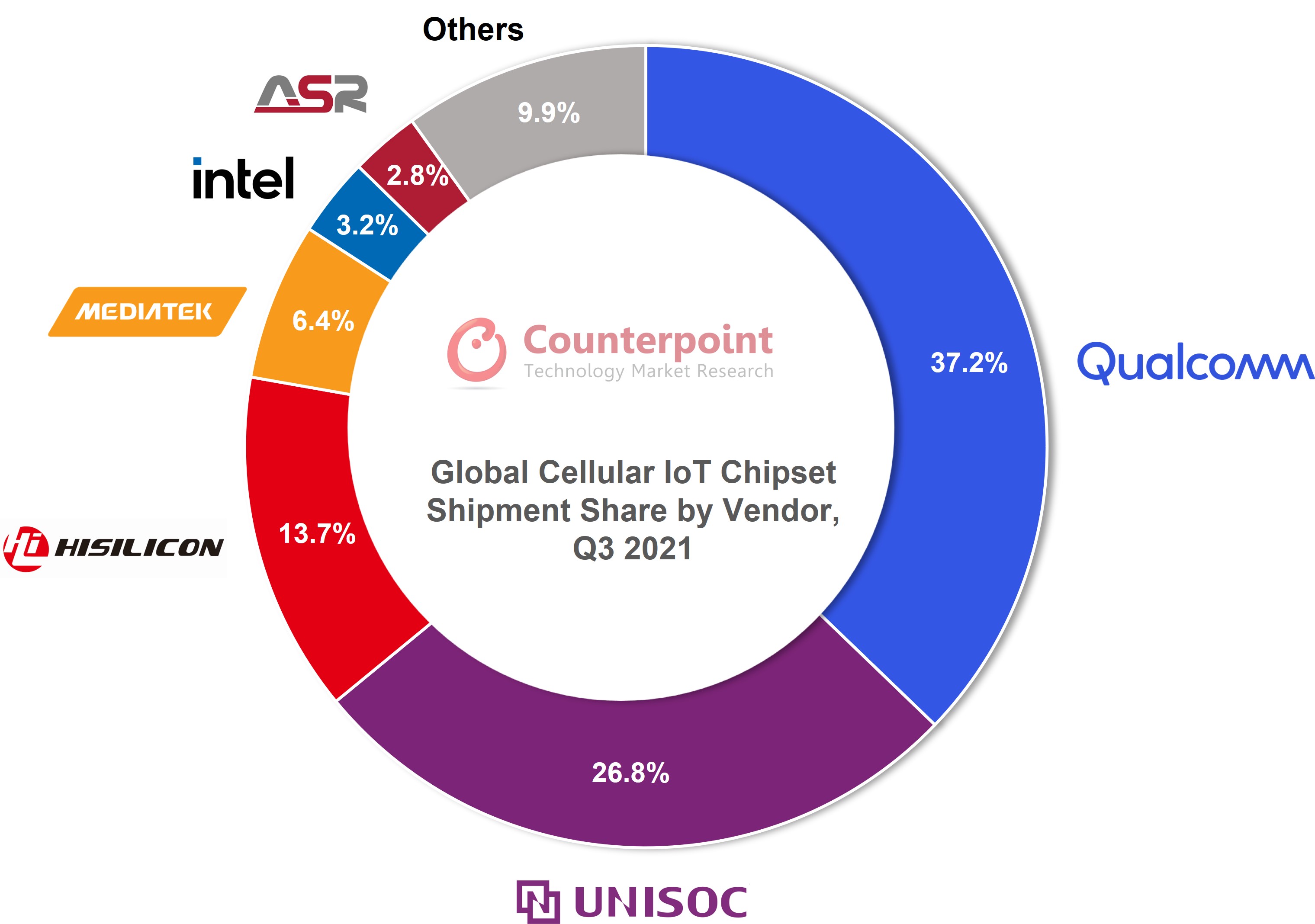

Global Cellular IoT Chipset Shipment Share by Chipset Vendor, Q3 2021

Commenting on the cellular IoT chipset supplier landscape, Vice-president Research Neil Shah said, “Qualcomm is leading in the global cellular IoT chipset market with more than one-third share. However, the company lost nearly 4% market share compared to the previous quarter. Still, Qualcomm is the leading chipset provider across 4G Cat 4, 4G Cat Others, 5G, LPWA Dual Mode, LTE-M and 3G technologies.

UNISOC, the second-largest cellular IoT chipset player, surpassed Qualcomm to lead in the 4G Cat 1 market. Cat 1 bis has been gaining traction, boosting UNISOC’s market share. UNISOC was leading across the 4G Cat 1, NB-IoT and 2G technologies in Q3 2021, thanks to volume growth in China and declining share of Huawei HiSilicon, which though still remained the third-largest chipset supplier.”

The overall cellular IoT module ASP decreased by 3% sequentially thanks to the shift towards the cheaper NB-IoT and 4G Cat-1 modules during this quarter. However, 4G Cat 4+ and 5G IoT modules’ ASP rose due to tight supplies. This had minimal impact on total shipments, but if the supply situation doesn’t improve, it could slow down 5G adoption.

For detailed research, refer to the following reports available for subscribing clients and also for individual subscription:

- Global Cellular IoT Module, Chipset and Application Tracker, Q1 2018 – Q3 2021

- Global Cellular IoT Module Vendor, Shipments, ASP, Revenues Forecast by Tech by Application, 2018-2025

- Global Cellular IoT Chipset Shipments Forecast by Brand by Tech by Application 2018-2025

Counterpoint tracks and forecasts on a quarterly basis 80+ IoT module vendors’ shipments, revenues and ASP performance across 12+ chipset players, 18+ IoT applications and 10 major geographies.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Soumen Mandal

Neil Shah

Counterpoint Research

press(at)counterpointresearch.com

Related Reports:

- IoT Intelligence Tracker – November 2021 Edition

- Quectel: Driving Towards Becoming a True IoT Company

- Global Point of Sale (POS) Market, 2018-2025

- Xiaomi IoT Vendor Profile

- FWA: The First 5G Killer App

- Global FWA + CPE Forecast 2019-2030 – 1H 2021

- Global XR (VR & AR) Market Forecast, 2016-2025

- Wi-Fi 6 Market Key Drivers, Challenges, Applications, Market Size, Outlook

- Global Smartwatch Shipments by Model Quarterly Tracker, Q1 2018-Q3 2021

- Global Tablet Market Forecast 2021-2023