Beijing, Hong Kong, New Delhi, Seoul, London, San Jose, Buenos Aires – May 16, 2022

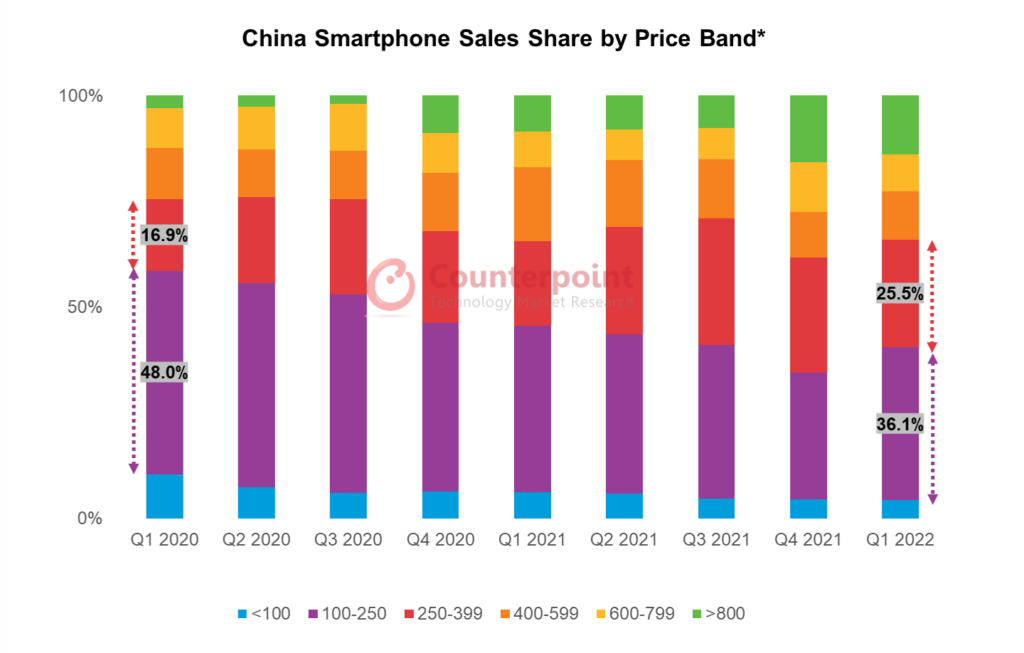

China’s smartphone market saw its $250-$399 (wholesale price) mid-to-high segment growing nearly 10% YoY in Q1 2022 to account for 25.5% of overall sales, a marked expansion from the segment’s 16.9% share just two years ago, according to Counterpoint Research’s China Handset Model Sales Tracker.

Leading smartphone brands have taken note of this by increasing the number of models to address the rising demand for features within the segment, which has been especially popular among consumers aged 24 and below.

Senior Analyst Ivan Lam said, “China’s Gen Z buyers are extremely savvy when shopping for smartphones and demand exceptional value. Leveraging online reviews and resources, this generation is making its renminbi punch above its weight, often comparing mid-to-high-end device features with more premium models. They are looking for solid CPU performance for activities like gaming, very good camera experience and great design.”

Source: Counterpoint Research China Handset Model Sales Tracker, Q1 2022

The market shift is being driven by the following factors:

- Continued growth of 5G: Our China Smartphone Market Pulse report shows 5G smartphone sales accounting for 75% of the overall sales last year, compared to 42% in 2020.

- Upgrade cycles: Many consumers are replacing older 4G phones with 5G devices as they move up into the $250-$399 segment.

- Post-COVID rules and regulations: Utility of smartphones has increased, especially with regard to vaccine certificates, testing procedures and quarantine rules.

- Push from leading OEMs: To minimize the impact of shrinking margins at the low end, caused by shortages, especially of 4G SoCs and other mature node components, leading OEMs are nudging average selling prices (ASPs) higher.

Source: Counterpoint Research China Handset Model Sales Tracker, Q1 2022

Research Analyst Archie Zhang said, “In the past, the big domestic players were marketing-driven, but what we are now seeing is a focus on advanced technologies and features. Marketing is obviously still an important piece, but vendors are now really looking to differentiate further at the hardware level too.”

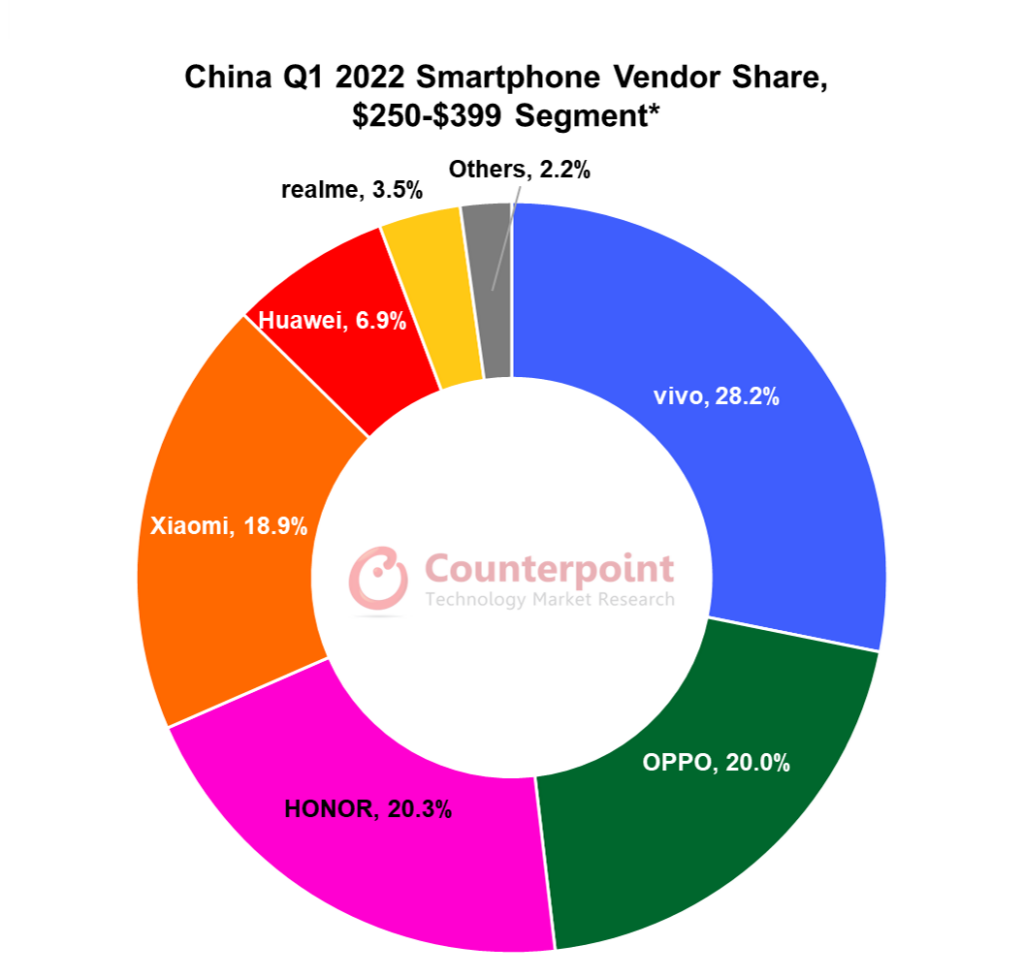

Within the segment, vivo led the pack in the first quarter with a 28.2% share, according to Counterpoint’s China Handset Model Sales Tracker. Of the 145 models in the segment, vivo’s S12 came out on top, accounting for nearly 9% of total unit sales. Following closely behind were the Redmi K40, HONOR 60, OPPO A93s and Huawei’s Nova 9.

Competition is clearly intensifying at the upper end of the market with the balance of sales shifting from the under-$250 price band in Q1 2020 to the over-$250 band starting with Q4 2020.

Research Analyst Mengmeng Zhang said, “A good example of this market transition to higher-end devices is what is happening at vivo. The company has successfully shifted its X-series devices from the mid-high segment to position them as high-end flagships. This can be seen in the recent launches of the X80 series, X Note and, in particular, the X Fold. The S series has done very well as a replacement in the mid-to-high segment. And of course, we expect vivo to continue addressing the important sub-$250 segment with its popular Y-series devices.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Ivan Lam

Mengmeng Zhang

Archie Zhang

Follow Counterpoint Research

press(at)counterpointresearch.com