Consumption upgrade has been a key driver of China’s economy and smartphone markets reflect this as Chinese OEMs target more profitable premium segments resulting in rising average selling prices (ASPs).

However, making premium smartphone models successful is not an easy task. In 2021, the market share of Android smartphones in the >$600 price band in China shrunk to 36.5% from 44.6% in 2020, highlighting the difficulties domestic vendors have had capturing the premium space vacated by Huawei.

iOS and Android Market Share in >$600 Wholesale Price Band in China, 2020 vs 2021

In fact, OEMs have doubled down, continuing to target the premium segment with fresh strategies like “dual premium”. Instead of having one premium product line, many Android OEMs have two or more now, resulting in the >$600 price band becoming more crowded than ever.

For example, Xiaomi has the Mi12 and Mi12 Pro series and will separately launch the Mi12 Ultra soon. HONOR has launched the Magic V and Magic 4 series, while OPPO has brought the OPPO Find N and OPPO Find X5.

Even though it can be expected that Android smartphones will recover some market share from iOS this year, such an achievement would not be a low-hanging fruit. Taking the Mi series as an example, its sales fell about 60% in January 2022 from the previous year.

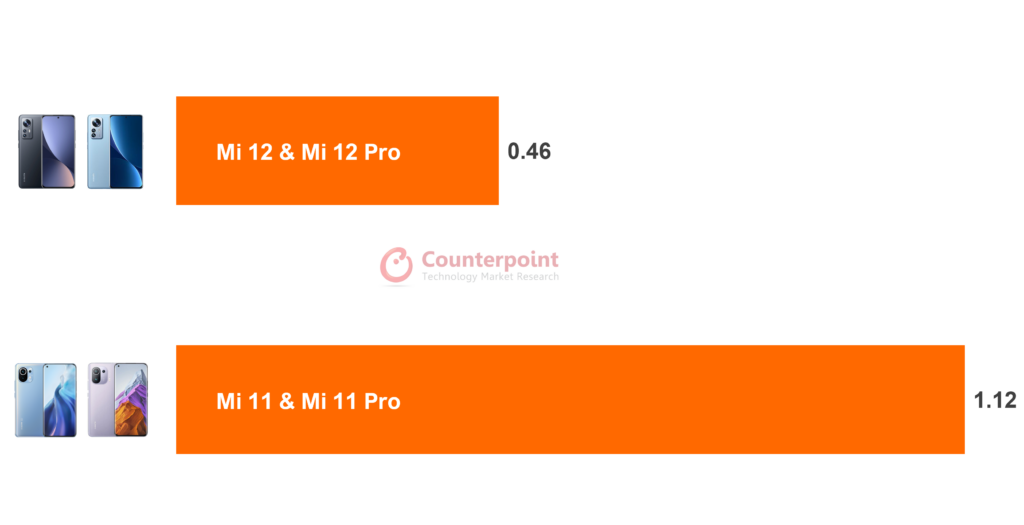

Unit Sales of Mi11 and Mi12 Series in First Month After Launch (in millions)

Beyond getting the supply chain right, OEMs will need to focus on fundamentals, especially in the case of premium.

We see three key areas where high-end devices must do well.

First and foremost is the display. A premium smartphone’s screen needs to support a high refresh rate, high resolution and cutting-edge color accuracy. We are seeing more premium smartphones supporting the DCI-P3 color gamut. Meanwhile, the LTPO screen is becoming a must-have in premium smartphones these days to support variable refresh rates.

The second is photography. In the era of computational photography, OEMs are improving the auxiliary camera specifications. For example, smartphones now have an ultra-wide camera with ultra-high resolution or periscope telephoto lens. Moreover, premium smartphones are boasting the cooperation among multiple cameras to capture more information for AI algorithm to process. This trend can be exemplified by the newly launched realme GT2 Pro which has two premium 50MP rear cameras.

The third is the gaming experience. Mobile games now consume more computing resources than before to meet the gamers’ demand for a better image and smooth playing experience. Cooling is another important factor as no one wants to have the smartphone burnt while gaming.

Other important aspects include a reliable connection, with some smartphones having a 4X4MIMO (multiple input and multiple output) solution to boost capacities. As well, more balanced stereo audio functions are important to provide optimum speaker and sound experience when used without earphones. And increasingly is battery life, and specifically, fast charging or battery sustainability, hence the ubiquity of battery packs amongst Chinese consumers.

In order to grab a good share in premium market, OEMs still have long way to go. Apple’s iPhones not only have good specifications but also have the iOS system with a rich ecosystem. For example, Apple Watch users can access online fitness lessons by subscribing to Apple’s service. Apple also applies standard design philosophy to all devices and apps in its ecosystem. Huawei also did well in the premium market with its excellent photography experience which makes the OEM stands out among its peers.