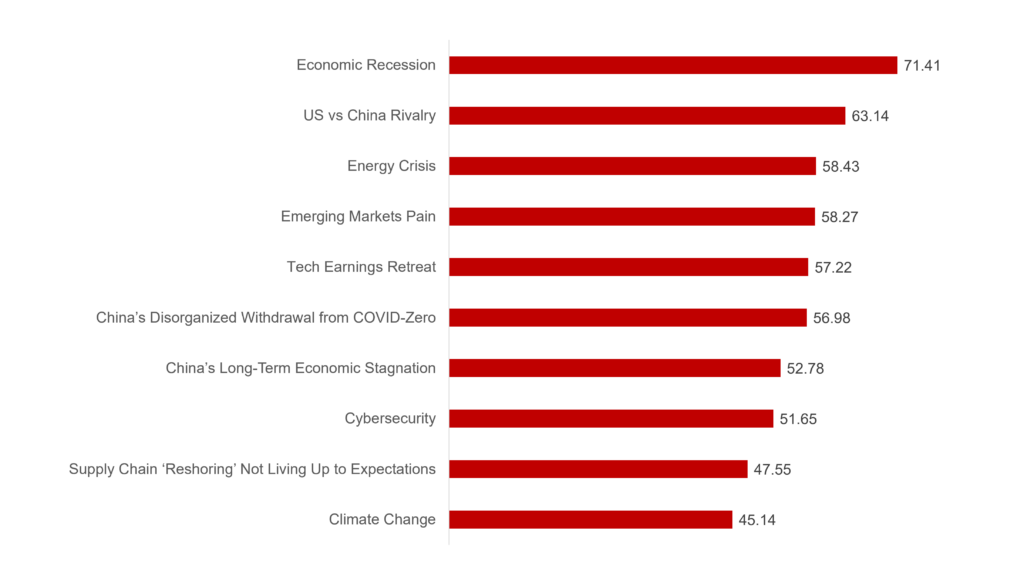

- Counterpoint analysts say economic recession will be the biggest macro risk affecting the tech world in 2023.

- Economic recession is followed by the ‘US vs China rivalry’ and ‘energy crisis’ risks.

- There is a sense that the tech industry is at the whim of factors it cannot control, as most of the issues do not relate to tech itself.

- China-related issues feature prominently on the ranking, appearing three times.

London, Boston, Toronto, New Delhi, Hong Kong, Beijing, Taipei, Seoul – January 24, 2023

Counterpoint Research has released its latest list and analyses of the top 10 macro risks that are most likely to impact the tech industry in 2023. In the list, which is a result of a survey conducted among Counterpoint analysts, the potential of economic recession ranks as the highest, by a large margin, followed by ongoing US and China tensions, and the energy crisis, which mainly stemmed from the Russia-Ukraine war.

Average Score of Top 10 Risks Rated by Counterpoint Analysts

The risk of economic recession continues to impact almost all industries, and tech has not been spared, despite the post-pandemic boom. The concerns about recession driving other macro risks resonate throughout our analysts’ primary concerns, such as in expected emerging markets’ pain, tech earnings retreat, and China’s recovery path. As we wrap up the report, there is a sense that the worst of the economic headwinds in the developed world may have passed, but there are still question marks over how much of the damage has already been inflicted, or how fast the economic rebound will be in the coming year.

In 2022, we also saw an escalation of tensions in the United States vs China rivalry. Most prominently, sanctions by US authorities against China’s fledging semiconductor industry are likely to hold back growth in this strategically important sector, with deep and long-lasting ramifications in China and beyond. Elsewhere, the two countries still hold many grudges, the most significant being the status of Taiwan, stance over the war in Ukraine, and trade tensions. Any of these have the potential to plunge the countries into deeper conflicts, but from our point of view, the fragmentation of the global system into potentially ‘two standards’ is the most serious threat for the tech industry, as innovation will slow while costs go up.

Inflation reached the highest levels in decades in the West in 2022. One of the key drivers of this inflation was, and remains, the energy crisis. The cost of energy spiked in 2022 as a consequence of Russia’s invasion of Ukraine, especially for European nations, as well as those in emerging markets. As we foresee no conclusive end to the war, energy will continue to be an unstable platform for the global economy in 2023, particularly as a large increase in energy demand is expected due to China’s reopening. There are positive signals on the renewable energy front, such as the EU and US passing landmark clean energy packages that are expected to increase investments and reduce emissions much more quickly than initially anticipated. But still, the world is many years and perhaps decades away from stopping its reliance on hydrocarbons as the main source of energy.

BONUS PODCAST: Key Macro Risks For Tech Industry in 2023

Here is a snapshot of the rest of the top 10 risks:

- Emerging markets pain: The post-pandemic boom is absent in emerging markets, resulting in a notable drop in living standards. A strong US dollar, lack of inward investments, deteriorating fiscal and monetary positions, and continued volatility in energy and food supplies will hamper emerging markets’ growth potential.

- Tech earnings retreat: Big Tech hired too many workers and took on too many poorly thought-out projects. Now, the withdrawal of ‘easy’ money is harshly exposing the less robust companies. Sectors exposed to geopolitical tensions, regulatory scrutiny, and business models accused of brewing social ills will be most under pressure.

- China’s disorganized withdrawal from COVID-Zero: A sudden withdrawal from COVID-Zero has taken most of the population by surprise, leading to a massive infection wave and excessive deaths. An economic rebound is expected in 2023 with the release of pent-up demand, but the healthcare damage could linger on in the economy and society.

- China’s long-term economic stagnation: China saw three ‘lost’ years during the pandemic when economic growth was put on the back burner. It will be a test to see if the country can rediscover its economic growth mojo, while tackling a range of structural issues including population decline, high debt levels and a fracturing real estate sector.

- Cybersecurity: The pandemic and the war in Ukraine ushered in a period of persistent and high-profile cyberattacks, which will continue to pose grave risks to businesses and institutions in the coming years. There is a sense that defenders struggle to catch up with the attackers, who are richly resourced and operate nimbly, with some backed by malevolent state actors.

- Supply chain ‘reshoring’ not living up to expectations: Talk of building a domestic and ‘resilient’ supply chain continues to gain traction, but the global recessionary environment, the nature of economic principles, and logistical realities pose daunting challenges for those looking to move established supply chains home.

- Climate change: 2022 was the warmest year on record. Extreme weather caused significant human life and economic losses. Some progress has been made by the world’s most important actors, but it falls short of key climate goals. Companies are starting to modify their business practices to take a more responsible stance toward the environment, but sometimes this appears to be more of a marketing spin than real action.

Despite our gloomy tone, we would emphasize that the reason why negative shocks hit the tech industry hard in 2022 was that many were unprepared for the extent and concentration of the risks. In 2023, many of the risks we identified will become well known, and the nimblest companies will institute mitigating mechanisms to navigate the uncertain near-term future. Nevertheless, it is critical for all industry participants to be wary of potential risks and plan for potential opportunities, instead of being overwhelmed by short-term adversity.

Counterpoint subscribers can access the full report here.

We welcome questions, feedback and discussion with clients over the risks we set out here as well as the ones that didn’t make the cut.

Counterpoint Research’s market-leading Market Monitor, Market Pulse and Model Sales services for mobile handsets are available for subscribing clients.

Feel free to contact us at press@counterpointresearch.com for questions regarding our in-depth research and insights.

You can also visit our Data Section (updated quarterly) to view the smartphone market share for World, USA, China and India.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Yang Wang