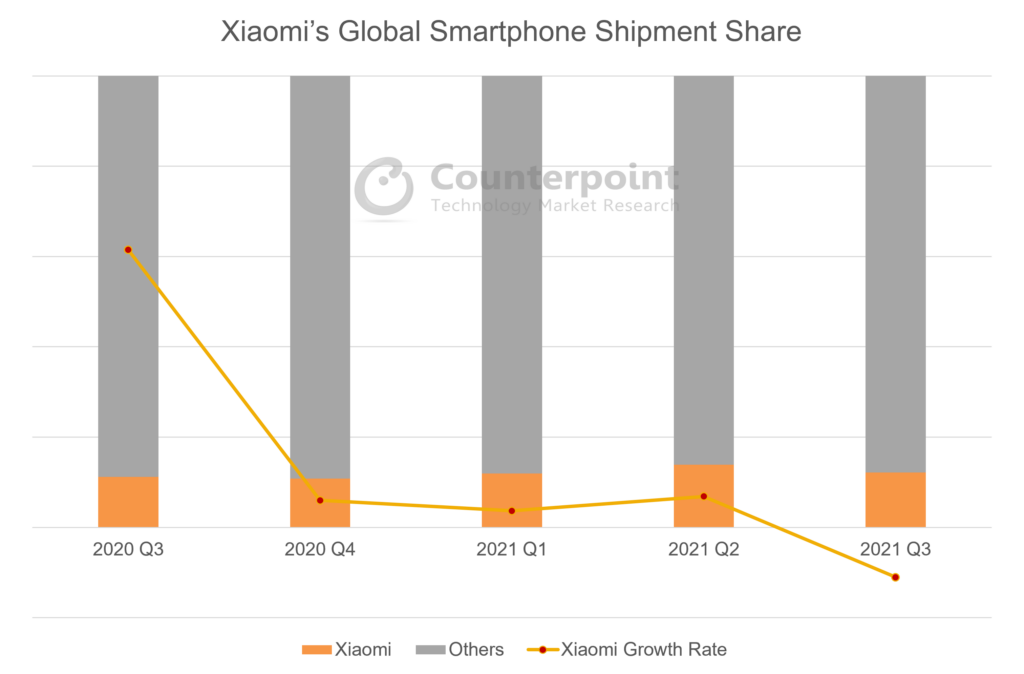

Xiaomi’s numbers for the third quarter show the impact of the ongoing global component shortages on its balance sheet. Revenues grew just 0.5% YoY and plunged 19% QoQ, while quarterly sales growth was slowest in more than a year. All this has prompted many to question Xiaomi’s business strategies. But Xiaomi is already at work, picking areas for improvement and finding ways to tackle external factors.

Xiaomi was the first OEM to bet big on combining internet characteristics with consumer electronics, especially e-commerce. The way the company built the connection between the brand and the consumer conveyed that it wanted to cut hardware and channel margins as much as possible. This was indeed a disruptive strategy for the market 10 years ago. Other OEMs in China were forced to adopt the same strategy. If we look at this 10-year period, this is how leading smartphone OEMs have survived:

- Adopted the internet brand strategy, where online-centric brands were launched. Examples: Xiaomi, realme, OnePlus.

- Adopted the internet brand strategy while leveraging the offline networks at the same time. Example: HONOR.

- Continued the offline strategy while targeting a decent pie of internet sales at the same time. Examples: OPPO, vivo.

Xiaomi, with its strong value-for-money and predominantly below-$300 product portfolio, has grabbed a huge market share globally, especially in the past three years. This is due to two main reasons. First, Xiaomi has managed to take a big share from the local brands, which were mainly getting their supplies from Chinese ODMs and, therefore, lacking in pricing advantage and core competency in software. Second, the local OEMs are not in a position to match Xiaomi’s marketing muscle. Therefore, with the right kind of penetration strategy, it can be a very potent mass market alternative. But today, other players too are playing the same “internet brand” game as Xiaomi and are close behind.

What has caused Xiaomi’s undulating performance in the past few quarters? Globally, Xiaomi experienced the ongoing SoC shortage, as was mentioned in its latest quarterly earnings call. Xiaomi’s main shipment contributors are 4G-enabled smartphones, especially those below $300. 4G SoCs also happen to be the ones facing the biggest shortage gap in smartphones.

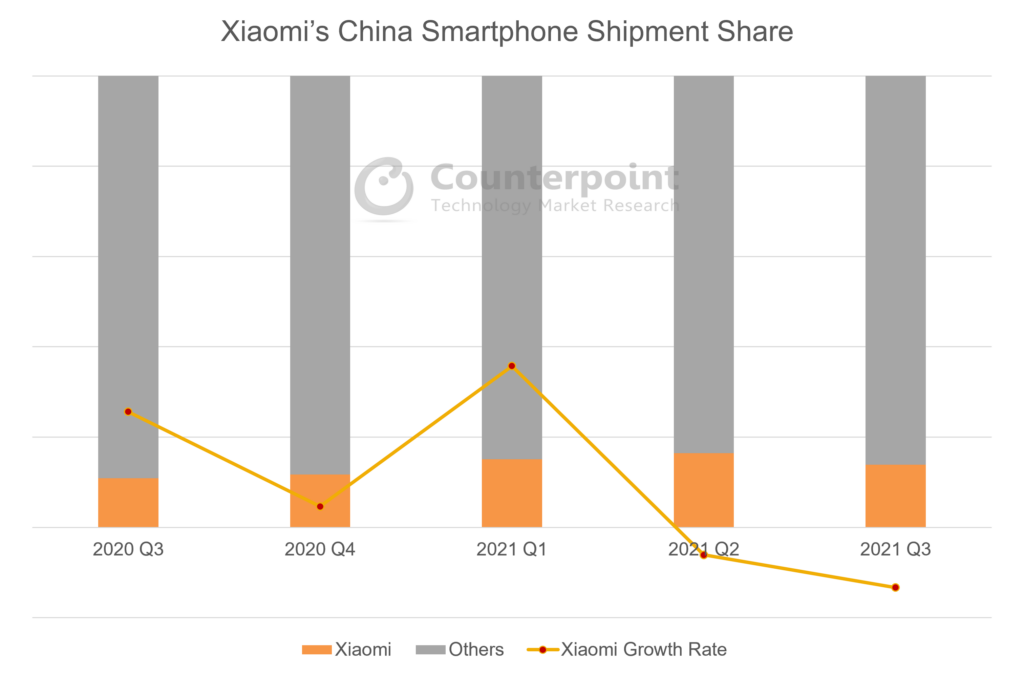

In Xiaomi’s home country, China, it continued to struggle in the offline market. OPPO and vivo held more than 65% share in the offline market, while HONOR’s strong return meant a huge impact on Xiaomi. In Q2 2021, with the big e-commerce festival of “618”, Xiaomi beat expectations. But in Q3 2021, there was no such festival, which led to Xiaomi’s underperformance. Xiaomi has been working to overcome downsides:

- It is working to ease component shortages, especially in SoCs.

- It is trying to raise its ASP by targeting the mid-to-high segment.

- It is doing offline channel mapping to better target the segment, though this segment takes time to produce results.

Xiaomi will perform much better in online sales in Q4 2021 when two big e-commerce festive sales of Singles’ Day (11.11) and Double 12 take place.