- Carriers managed yet another strong quarter of postpaid subscriber growth in Q3 2022

- While part of this growth is coming from prepaid to postpaid migration, other factors are helping the total handset subscriber base in the US to grow

- Subscriber growth could slow going into 2023 due to macroeconomic headwinds

The hot streak of postpaid subscriber growth continued throughout the industry in the US in Q3 2022, with T-Mobile adding over 800,000 postpaid phone subscribers and AT&T adding over 700,000. Meanwhile, Spectrum and Xfinity both posted their best quarters of mobile subscriber growth since they entered the wireless market back in 2018. Xfinity managed to net 333,000 mobile subscribers while Spectrum netted 396,000. Verizon was the biggest loser in terms of mobile subscriber growth, with its consumer business managing just 28,000 net postpaid additions. But due to its expansive subscriber base and healthy upgrade rate, the company maintained its position as the largest channel for smartphone sales in the US according to Counterpoint’s US Monthly Sell-Through Tracker.

However, this subscriber growth begs a question – Where are all these new subscribers coming from? After an initial dip during the onset of the COVID-19 pandemic, there have been major subscriber gains during the recovery. While an initial boost to subscriber growth due to the transition to work from home, large government stimulus enabling customers to migrate from prepaid to postpaid plans, and the usual trickle of young people getting their first phone was expected, this growth has been sustained for longer than most anticipated.

*Company reports and Counterpoint estimates

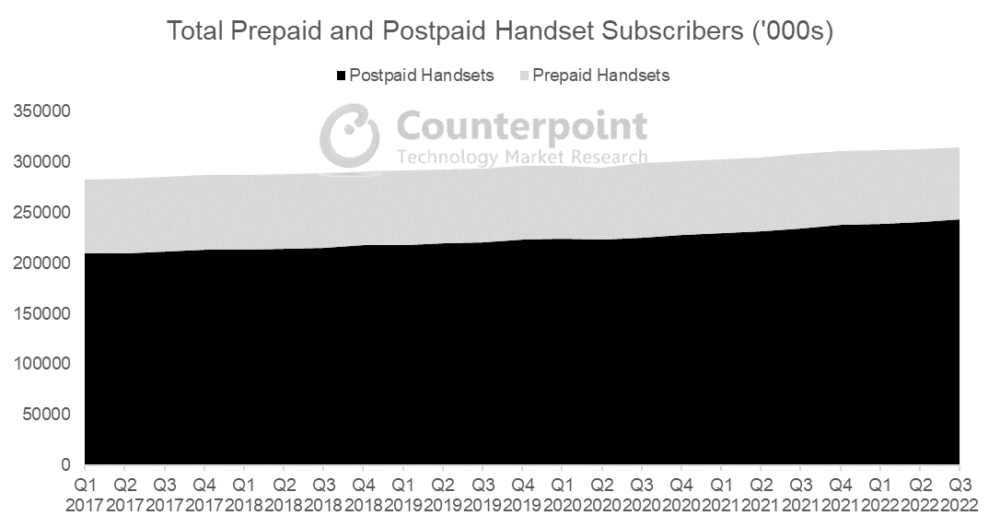

One common explanation has been that subscriber growth has been in part the result of prepaid-to-postpaid migration. This helps to explain sustained postpaid subscriber growth but fails to address the bigger picture. With this explanation, one would expect total mobile subscriber growth (including both prepaid and postpaid subscribers) to remain on trend with before the pandemic and simply for postpaid to increase its share of the total mobile subscriber pie. But as the chart here demonstrates, even as postpaid subscriber growth has increased, prepaid subscriptions have remained stable. So, while prepaid-to-postpaid migration is a contributing factor to explaining postpaid subscriber growth, it is inadequate in answering why the total number of mobile subscribers in the US is increasing and why most of that new growth is coming in the form of postpaid subscriptions.

There are a few factors that are contributing to growth in the overall mobile market. First, a wider range of age groups is purchasing handsets. A higher share of older adults has phones than in past years and a higher share of children are adopting phones at even younger ages. As a result, the total addressable market continues to expand. This trend also favors the postpaid market where family plan pricing offers a better value than prepaid service plans. While prepaid family plans are cheaper than postpaid plans, postpaid plans offer better total value to customers through add-ons like streaming services and other subscriptions. We expect the service aggregation and bundling to continue into the next year. Second, there has been significant growth in business lines. Separating personal and business communications is increasingly vital to companies for security reasons, so they are more likely to opt to purchase business lines for employees. Additionally, the rise in work from home during the pandemic helped encourage the adoption of business lines for employees as mobile lines served as a replacement for landlines in the office. Competition in the business segment has heated up over the last year, with the carriers recognizing the potential for growth in this segment and due to the hot labor market. Verizon’s business postpaid phone net additions have outpaced consumer postpaid phone net additions in recent quarters as they target this vertical, while T-Mobile is aggressively seeking to gain business subscribers from its weak starting position. This helps to explain the overall growth in mobile lines, as many customers now have two lines, one for business and one for personal use, as well as why that growth is in the postpaid market, as prepaid carriers do not offer services for the business segment.

What can these trends tell us about 2023?

Understanding these trends can help us get an idea of how a potential downturn in 2023 could impact the mobile industry in terms of subscriber growth. Since postpaid subscriber growth appears to be driven by prepaid-to-postpaid migration, an expanding market due to demographic trends, and growing business lines, we can assess in turn how each of these growth factors might be impacted by a downturn.

First, prepaid-to-postpaid migration will likely slow and potentially even reverse as unemployment is likely to increase and wages are likely to stagnate amid a recession. As customers look to reduce their spending, some of them who switched from prepaid to postpaid plans may find themselves needing to move back towards prepaid plans to save money. As a result, this would impact the churn levels and subscriber growth seen at the postpaid carriers.

Second, parents may be more willing to hold off on buying their child their first phone to save money during an economic contraction. While smartphones are increasingly becoming necessary across a range of age groups, the trend of adoption among ever younger age groups may slow, with parents seeing limited utility in adoption apart from entertainment. This could impact not just postpaid growth but growth for the mobile industry as a whole.

Third, business line growth is likely to slow as fewer new employees are brought on board and hiring slows. Depending on the size of the contraction, layoffs may result in business line net losses. This would impact the growth of the overall mobile industry and specifically the postpaid market, as prepaid carriers do not offer business services.

As a result, it seems likely that overall mobile subscriber growth will slow heading into 2023, and potentially turn negative in H1 2023, especially in postpaid. Meanwhile, prepaid carriers may gain slightly in the share of the overall mobile subscriber pie as prepaid-to-postpaid migration is likely to turn towards postpaid-to-prepaid migration in a contraction.