Xiaomi (363%) and Huawei (193%) were the fastest growing brands in Vietnam.

Xiaomi enters the top five brands for the first time

New Delhi, Hong Kong, Seoul, London, Beijing, San Diego, Buenos Aires –

August 7th, 2018

According to the latest research from Counterpoint’s Market Monitor service, the Vietnamese smartphone market recorded double digit growth at 11% YoY, the highest since 4Q 2016. Growth in the smartphone market was due to new launches and offers in entry to mid segment, mainly from Chinese brands. However, the overall handset market declined 6% YoY owing to a steep decline in the feature phone segment.

Commenting on the findings, Associate Director, Tarun Pathak said, “Even though the Vietnamese smartphone market is increasing at a healthy pace, the local players are facing stiff competition from Chinese and Global counterparts. Further, amid the US-China trade war, the RMB (renminbi) is weakening, resulting in cheaper Chinese products in Vietnam. This will favour the Chinese brands, which now hold around 39% of the market in Vietnam.”

Commenting on the players’ strategies, research analyst, Varun Mishra added, “The Vietnamese e-commerce market is also is poised to grow as Chinese tech giants like Alibaba, JD.com and Tencent are investing in Vietnamese online. This will further give a boost to the Chinese players who have leveraged both offline and online platforms to sustain growth in similar markets. While the Chinese players are actively targeting mid-tier segments, local players are being pushed toward the entry level segment.”

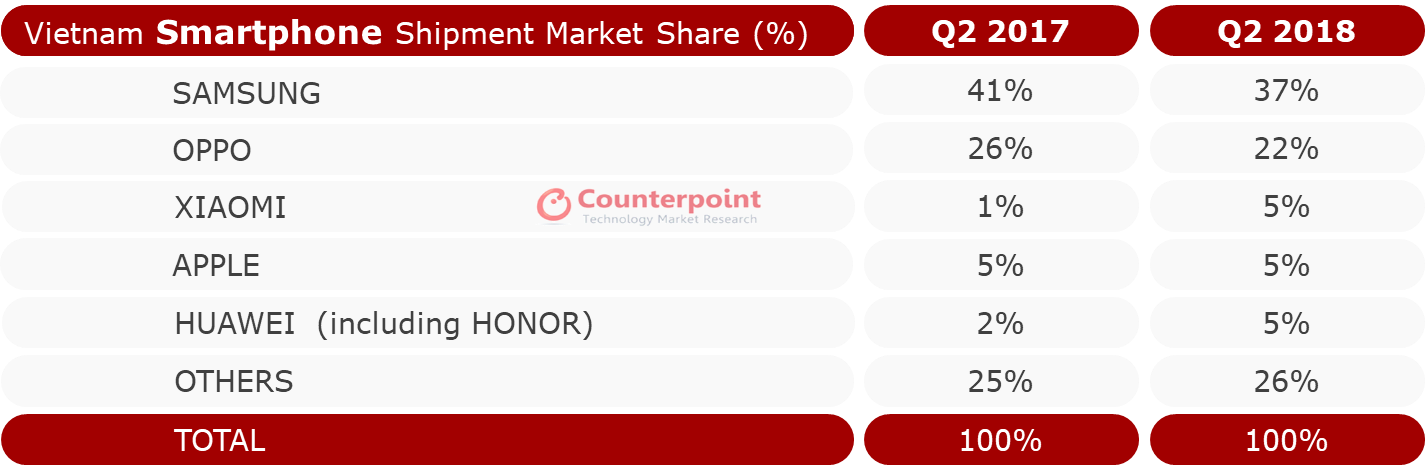

Exhibit 1: Vietnam Smartphone Shipments Share by Brands

Source: Counterpoint Research: Quarterly Market Monitor Q2 2018

Market Summary:

- The smartphone segment contributed to almost 52% of total handset shipments during Q2 2018. Although the feature phone segment declined 19% YoY, it remains a sizeable market in Vietnam.

- Samsung captured over one third of the total smartphone market. The Galaxy J series continues to do well, contributing to over 60% of Samsung’s total shipments for Vietnam.

- OPPO remains the second largest brand in Vietnam, driven by sales of its models like F7 and A71.

- Xiaomi entered among top five in Vietnam for the first time owing to the strong performance of Redmi 5A and Note 5.

- Huawei with its Y series and Honor brand, which debuted in the market in March, captured 5% of the total market. It aims to aggressively expand in the market in future. Vietnam has one of the fastest growing gaming industries in the world and Huawei has tied up with one of Vietnam’s top gaming firms, VNG, to boost growth.

- Chinese brands in the mid-tier segment are now launching multiple variants of the same smartphone with different storage capacities, tempting customers to spend more.

- Vietnam’s relatively low smartphone penetration indicates the market holds potential for growth. New players like Symphony MGT, HIYA and Vfone have entered the smartphone market, further crowding the smartphone segment.

- Furthermore, additional companies such as Vingroup and Asanzo are planning to enter the smartphone market by launching models at lower price points, to capture the bottom of the pyramid of the price-sensitive Vietnamese market

The comprehensive and in-depth Q2 2018 Market Monitor is available for subscribing clients. Please feel free to contact us at press(at)counterpointresearch.com for further questions regarding our latest research, insights or press enquiries.

The Market Monitor research is based on sell-in (shipments) estimates based on vendor’s IR results, vendor polling triangulated with sell-through (sales), supply chain checks and secondary research.

Analyst Contacts:

Tarun Pathak

+91 997-121-3665

tarun@counterpointresearch.com

Shobhit Srivastava

+91 900-083-1117

shobhit@counterpointresearch.com

Varun Mishra

+91 991-502-0142

varun@counterpointresearch.com

Follow Counterpoint Research

press@counterpointresearch.com