- Total wireless service revenue grew to $18.8 billion, a 10.0% YoY increase primarily driven by administrative fee increases

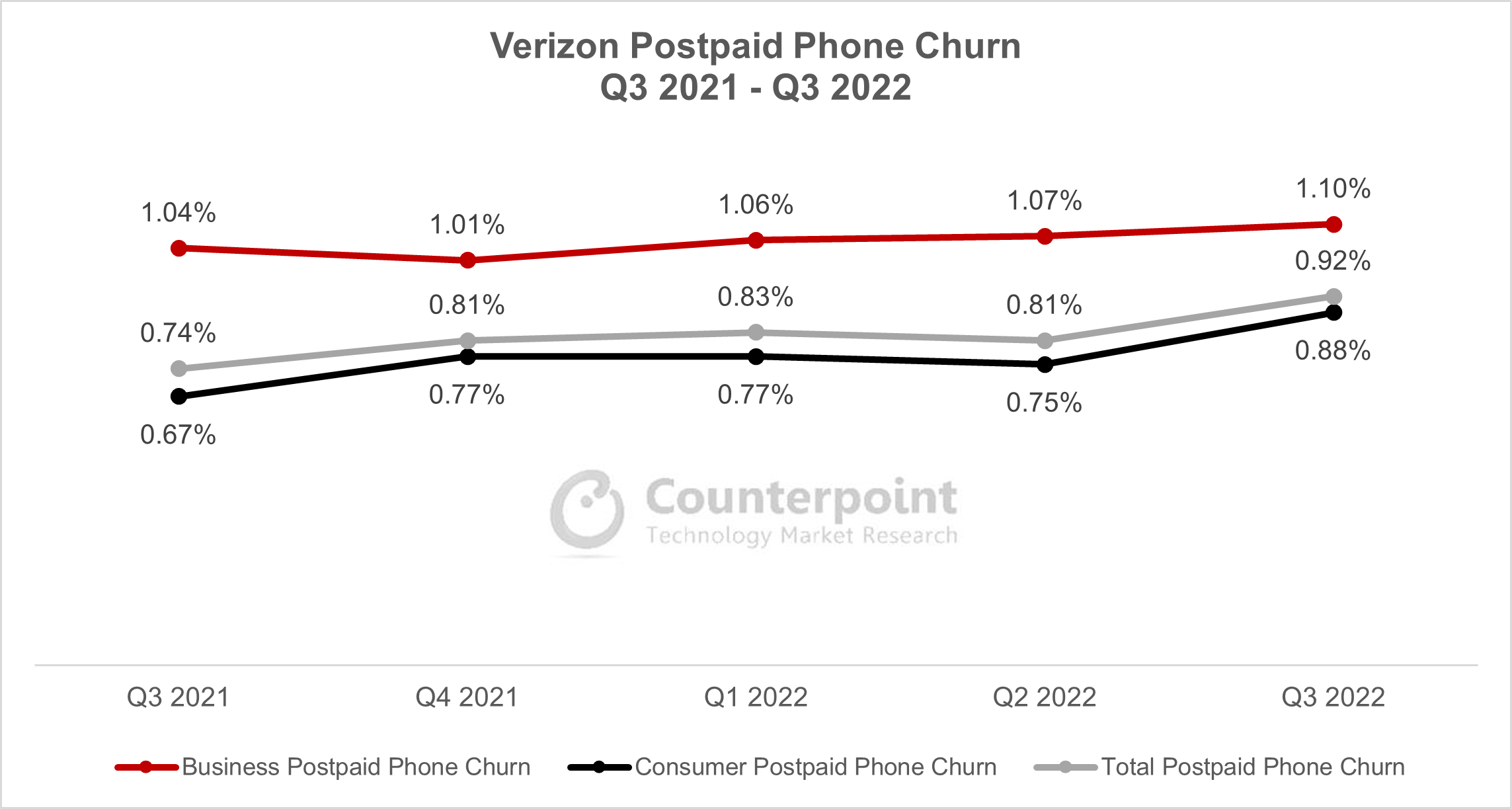

- Wireless retail postpaid phone churn climbs to .92% from 0.74% in Q3 2022

- Strong business net adds and FWA growth bright spots for Verizon going into Q4 2022

Verizon had a strong quarter in terms of revenue growth

- Total wireless service revenue grew to $18.8 billion, a 10.0% YoY increase primarily driven by administrative fee increases that took effect in June 2022. Wireless postpaid consumer customers saw an administrative charge increase of $1.35 per voice line to $3.30. For businesses the amount of the charge is $2.20 per month per line for each smartphone and data device, and $0.98 per month per line for each feature phone and tablet device. This was called an “Economic Adjustment Charge”.

- Business wireless service revenue grew 5.7% YoY. Verizon continues to lead in business subscribers, owning over 45% of mobile B2B subs. Revenue growth was attributed to a strong uptake in business subscribers, up 5.5% YoY, now at 17.8 million wireless retail postpaid phone subs.

- Equipment revenues also grew to $6.6 billion, up 22.9% YoY driven by a stronger upgrade rate of 4.7%, up 0.4 basis points YoY. Promotions for Samsung’s new foldables and the latest iPhone 14 helped achieve this higher upgrade rate. According to preliminary estimates for Q3 2022 from Counterpoint’s US Channel Share Tracker, Verizon’s share of sales of $800 and above smartphones was more than 60%, compared to below 40% in Q3 2021.

Wireless retail postpaid phone churn climbs to .92% from 0.74% in Q3 2022

- As expected, due to the Economic Adjustment Charge, Verizon posted a consumer postpaid phone churn of 0.88% and business postpaid phone churn of 1.10%. Both went up YoY but the consumer segment saw stronger increases.

- Higher churn saw net adds also drop to just 8,000 postpaid phone subscriber additions in Q3 as the consumer segment saw a loss of 189,000 postpaid phone subs while the business segment saw 197,000 postpaid phone subscriber additions.

Source: Verizon Earnings Statements

Business growth a bright spot for Verizon

- Business revenues and subscriber growth has helped Verizon weather the current headwinds well. Unlike the consumer segment, businesses tend to have fewer choices of providers, making switching more difficult. This has benefitted Verizon on the business side. The increase in administrative fees had a greater (negative) effect on the consumer side.

- Verizon sees continued positive momentum for its business segments in government, enterprise, and SMBs due to the need for increased mobility among the workforce. Work from home trends have helped Verizon during COVID-19 times, but it remains to be seen how much this trend will continue in the long-term.

Fixed wireless access momentum continues with 342,000 net adds in Q3 2022

- Consumer FWA net additions were 234,000 while business FWA contributed 108,000 net adds.

- There are now more than 40 million households covered by Verizon’s fixed wireless in Q3 2022, including over 30 million households covered by mmWave 5G, dubbed 5G Ultra Wideband.

- Verizon also launched FWA in prepaid through Straight Talk in Q3. Straight Talk Home Internet is a new service which uses Verizon’s LTE and 5G networks for $45 per month with download speeds promised between 20-100Mbps. A Home Internet Router has a one-time fee of $99.99 and is available at Walmart.

Prepaid segment saw the first positive Tracfone net additions since Q1 2021

- Prepaid had a gain of 39,000 net additions in the quarter, 34,000 of them from Tracfone brands. There are now 23.1m prepaid connections.

- In addition to launching an FWA program in prepaid, Verizon also launched a new prepaid brand called Total by Verizon. This will sit in-between the low-end Tracfone value offer and the higher-end postpaid services to give consumers a high-end value option.

C-band 5G build out is faster and better than expected

- Verizon is well on track to hit 175m POPs by the end of the year, having eclipsed 160 million in Q3. It also expects to hit 200 million in the first quarter of 2023.

- In Q3 2022 nearly 53% of its postpaid wireless phone customers having 5G-capable devices. According to the US Channel Share Tracker, over 90% of sales made in Q3 were 5G-capable phones compared to 70% in Q3 2021.

- In terms of guidance on deployment expenditures for the company’s C-Band 5G network, Verizon continues to expect to spend $5 billion to $6 billion in 2022.

Outlook for Q4 2022 and full year 2022

- Verizon’s overall 2022 guidance has remained the same with a projected wireless service revenue growth of 8.5% to 9.5%.

- In Q4, it will need to manage the increased churn, especially in the consumer segment. New iPhone 14 sales and promotions will help with this, as well as improved network infrastructure through its C-Band deployments.

- FWA and business momentum will likely continue, especially with the expansion of FWA to more segments and the current work from home climate.

- Verizon announced an organization restructuring with goals of cutting $3 billion in costs. AT&T has also started cost cutting which included almost 3,000 jobs.