US Tariff Expansions Will Affect the US Smartphone Market

San Diego, Buenos Aires, London, New Delhi, Hong Kong, Beijing, Seoul

March 23, 2018

On Thursday March 22nd President Trump announced plans to impose $50-$60 billion of annual tariffs on products imported from China ranging from consumer goods to electronics. The President has instructed US Trade Representative Robert Lighthizer to publish a list of products that will be affected by the tariffs in the next 15 days. China has responded with $3b in targeted tariffs.

This announcement and the implications of a potential trade war has sent many people in the tech industry reeling. The Trump administration is seeking to protect the domestic tech industry, but tariffs as high as 25% will certainly affect sales of smartphones being imported into the US from Chinese manufacturing sites.

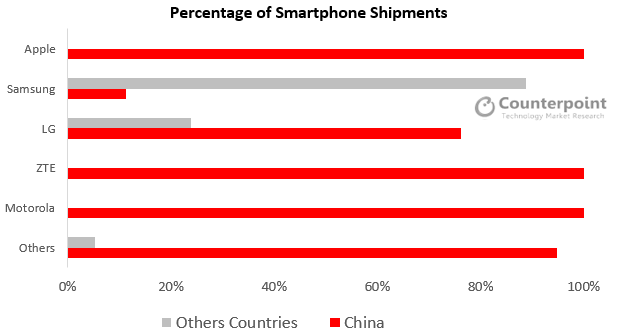

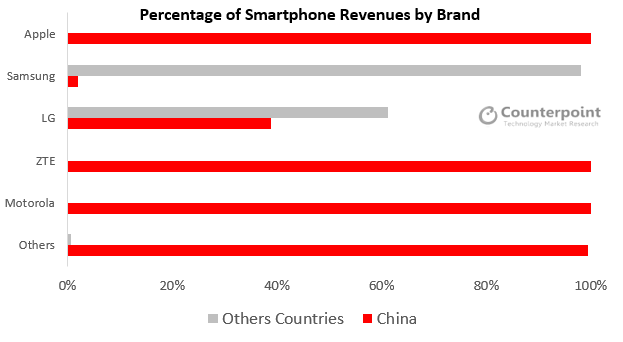

According to Counterpoint’s latest research from its Market Pulse program, 74% of total US smartphone shipments in 2017 came from China amounting to 130 million units. Revenues from Chinese imported smartphones also make up 86% of total smartphone revenues in the US. The top 5 brands which are exported from China are Apple, LG, ZTE, Motorola, and Samsung.

Commenting on the recent developments, Research Director Jeff Fieldhack stated, “The implications that this potential tariff could have does not bode well for the US smartphone market. The move is seen as negative and we immediately saw a decline in telecom stocks. Since 75% of US smartphones are imported from China, a 15% or 25% tariff would be substantial and likely drive prices higher. For example, when import duties were recently raised in India, iPhone prices rose and so did prices for iPhone accessories, parts, and the Apple Watch.”

Fieldhack added, “Although Apple will need to revisit their US strategy and pricing, 23% of their total iPhone sales are in China. This will help buffer any potential tariffs. Other OEMs with China-based manufacturing will have the difficult decision between attempting to push the additional costs onto consumers or absorbing the tariff. Most brands are more price sensitive than Apple and it will be more difficult for them to pass the cost onto consumers. Samsung and LG are in a better position as most of their manufacturing is outside of China. Their revenues would not be impacted as much by these tariffs. The two companies also have the option to shift more manufacturing outside of China, if needed.”

Commenting on the larger component ecosystem, Research Analyst Maurice Klaehne stated, “Looking beyond smartphone imports, the tariff will also have a trickle-down effect on components and the markets that they are used in. For example, the currently growing refurbished market may take a hit, as major operators (e.g. Verizon, Vodafone etc.), OEMs (e.g. Apple) and major distributors (e.g. Brightstar) have added full life-cycle services. Parts may become pricier which would impact the cost of repair and refurbishment services.”

Lastly, Research Director, Peter Richardson added, “There remains uncertainty of what new tariffs will mean for the telecom sector or if the Trump administration is using them just as a negotiating tactic. The recent steel and aluminum tariffs were watered down. It is also not known if the Trump administration will attempt to protect certain sectors or companies with exceptions similar to the exclusions made for six countries on steel and aluminum import duties.”

Background:

Counterpoint Technology Market Research is a global research firm specializing in detailed industry analysis of the TMT sectors. It services major technology firms and financial firms with a mix of monthly reports, customized projects and detailed analysis of the mobile and technology markets. Its key analysts are experts in the industry with an average tenure of over 15 years in high tech industries.

Analyst Contacts:

Jeff Fieldhack

+1 858 603 2703

jeff@counterpointresearch.com

Peter Richardson

+ 44 20 3239 6411

peter@counterpointresearch.com

Maurice Klaehne

+1 917 679 4038

maurice@counterpointresearch.com