The global smartphone market generated $530 billion of revenues in hardware and apps & services. Hardware accounted for more than 85% of these revenues, apps & services the remainder. As smartphone hardware revenues plateau and replacement cycles get longer, OEMs are looking at new product categories (such as TWS, smartwatch, accessories, glasses) to drive top line growth. While hardware growth remains modest, services revenues are small but growing fast. iOS has done well in monetizing the services opportunity, but the Android ecosystem “by design” focuses on the ad revenues, and lags iOS in realizing the subscription-based services opportunity.

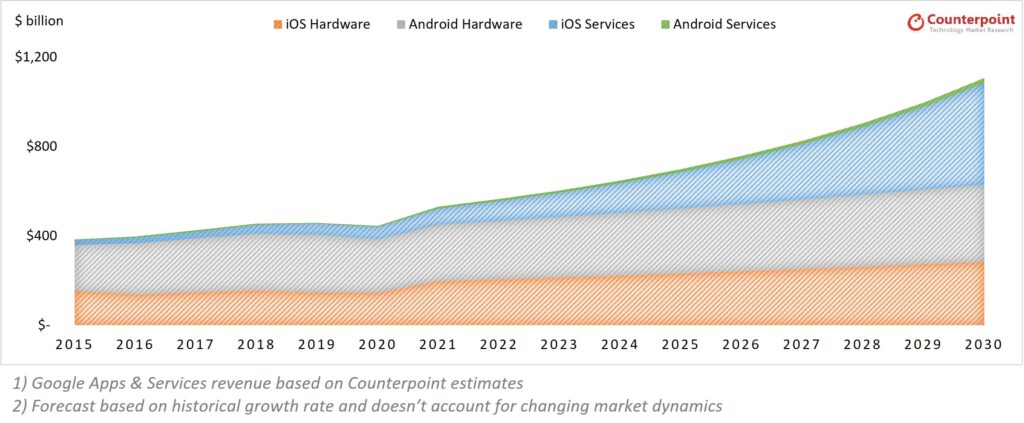

Smartphone service revenues are growing faster than hardware revenues

Smartphone hardware revenues have grown at 4% CAGR during 2015-2021, while service revenues have grown at 23% CAGR in the case of iOS and 12% in the case of Android. Services revenue is a big part of the iOS story, but Android falls behind by a huge margin. At current growth rates, Apple’s service revenues could overtake hardware revenues between 2028-30.

Exhibit 1: iOS vs Android Hardware & Services Revenues

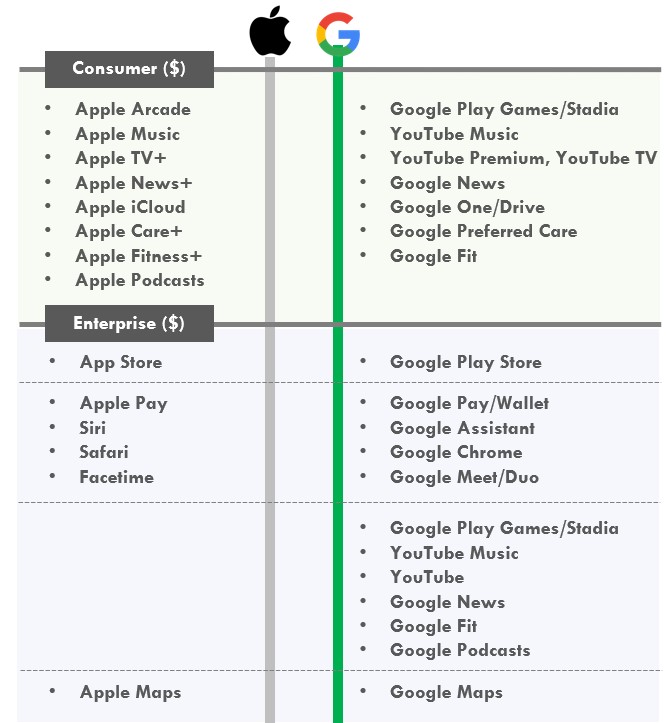

App stores account for a major chunk of the services revenue across both iOS and Android. But iOS is far ahead of Android in capturing the non-app store revenues i.e., subscription-based services driven by a bouquet of Apple services such as Apple Music, Arcade, TV+, News+, iCloud, Care+, Fitness+, etc. Together, these services can generate an annual revenue of $1200+ for an Apple power user. Android’s service ecosystem on the other hand is scattered and skewed towards ad-revenues – by design.

Android service ecosystem remains complex, while Apple declutters

Apple envisions hardware as a medium to target daily consumer needs such as health, gaming, utility, finance, entertainment, etc. Obviously, Apple makes its own hardware, but the motivation to do hardware is driven by fat margins and its walled garden approach to services. There is no denying that Apple caters to a premium user base which allows Apple to capture higher customer lifetime value through its range of subscription-based services. But consumer spending on services will continue to rise while the smartphone remains the centerpiece of daily consumer needs from shopping, food, finance, health and more.

In the case of Android, the service ecosystem is scattered, lacks scale and sense of community.

- The efforts to build a service ecosystem are scattered with each OEM trying to build its own. From LeEco to Xiaomi to Samsung, each OEMs made efforts to create an ecosystem of finance, entertainment, and health services. This is not sustainable as switching among Android OEMs remains high aside from very few OEMs.

- There is a low sense of community. Apple Originals TV Show, Ted Lasso, was extremely popular and created a global community of fans (primarily Apple users). This is hard to achieve among Android users unless there is a global force behind it. YouTube and Netflix are great contenders but they’re not Android exclusive.

- Lack of scale: A service initiative by an OEM remains restricted to its own user base and adoption among other Android OEMs remains low.

- Android services are confusing and poorly bundled. The utility of these services sometimes overlap, app discovery is scattered with OEM-driven app stores, and the experience is inconsistent and confusing for Android users. Apple on the other hand focuses on decluttering the experience and unifying subscriptions through Apple One. Minimal changes have been made in the past, which sends a strong message of continuity to its users.

Google is uniquely positioned to build a unified Android service ecosystem

Our research VP, Neil Shah, highlighted in his blog “Google’s Path to Vertical Integration with Tensor SoC – Become Apple or Stay Google?” why Google struggles with hardware. Google knows it’s not competing head-on with Apple, Samsung or other Android players, and likely doesn’t want to either. Its hardware game is more like Microsoft’s – showcasing what can be done.

Google makes most of its revenue from its core search driven advertising business, but it can do much better when it comes to services. There is a string of examples that indicate that Google often succeeds through experimentation. In fact, there is a website “Killed by Google” that lists more than 250+ Google products and services that have been discontinued or rebranded by Google.

In the case of Android, the hardware void is mostly filled by OEM partners, but that shouldn’t be seen as a drawback, rather an advantage because as hardware margins in Android market are razor thin. Therefore, Google must focus on building a unified service ecosystem that cuts across all Android users and brings the Android community together. It ticks all the boxes to stack up against Apple’s service, app, and search ecosystem.

Exhibit 2: iOS vs Android Apps & Services Ecosystem

There have been some initiatives by Google on this path already, but it still lacks a clear holistic approach that stiches together Android users and creates a strong sense of community. A service-driven model is the future of consumption. Smartphones, connected PCs, smart vehicles (connected, electric and autonomous), which largely drive their revenues through hardware right now will move towards a service-based model, powered by software cutting across endpoint devices, edge and cloud. Hardware will continue to evolve over the decades – laptop converging into tablets, smartphones into foldables, smart glasses or XR headsets may, ultimately, cannibalize smartphones – but a software hegemony will reign through decades.