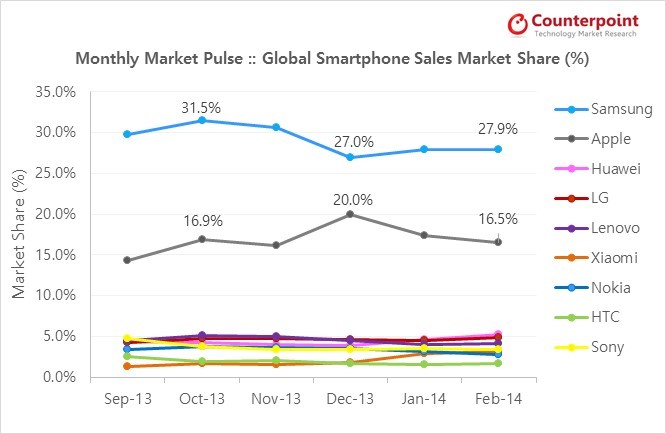

According to the latest research from Counterpoint, global smartphone demand slowed down slightly sequentially but was up a healthy 51% annually in February. While the demand across mature markets such as Japan, Korea and US slowed down further to pre-holiday season levels, in emerging markets such as China, Nigeria and India demand remained robust. Samsung, LG, Huawei and Xiaomi were the biggest gainers while Apple, Lenovo and ZTE lost some steam in the global smartphone market.

Samsung is making a strong comeback after a dip in December when iPhone holiday season mania took hold. The Korean vendor has registered an uptick in global smartphone market share during February 2014. Samsung reached a record high in monthly smartphone sales in China — jumping back to 17% share from 14% smartphone sales market share in December 2013. The Galaxy Note 3 remains one of the main growth drivers taking the onus from the Galaxy S4. The Galaxy Note 3’s success also benefits Samsung’s long-tail of entry- to mid- price Galaxy-branded smartphones.

However, we should caution that the growth for Samsung is accompanied with a drop in overall wholesale ASP (average selling price) highlighting strong price-battles which the Korean vendor is winning right now. The upcoming Galaxy S5 will need to perform well to arrest the declining ASP and hence boost the top-line and bottom-line for Samsung in coming quarters.

Apple is up year on year globally thanks mainly to channel expansion at NTT DoCoMo and China Mobile, but the momentum has slowed down from the peak in December. In terms of regional performance, it has been a mixed bag during the month. In China, Apple has tied with Lenovo to capture the second spot in the smartphone sales ranking reaching its highest ever smartphone market share during February, thanks to China Mobile’s addition. However, in contrast, in USA, Apple share fell back to 37% from an all-time-high of 46% in January 2014 as the momentum built by heavy marketing to clear excess iPhone 5c inventory, which paid off in January, stalled in February.

Huawei is slightly ahead of LG and maintaining its third spot in the global smartphone market, mainly benefitting from the steady demand and rising brand equity in domestic as well as international markets. There is a close competition for the third spot between LG, Huawei and Lenovo. Meanwhile, the fast-growing Chinese brand Xiaomi surpassed Huawei, Coolpad and ZTE to become the fourth largest smartphone brand in China during February for the first time. This is the best ever performance from Xiaomi, tripling its sales volumes in a year’s time during the February month. The cheaper Hongmi Red Rice smartphone was Xiaomi’s best-seller while the higher priced Xiaomi Mi-3 maintained the halo effect, attracting young and urban consumers during the February month. Xiaomi benefitted from its smarter marketing, innovative go-to-market & channel strategy selling multiple SKUs for both its hit models that are compatible with all the three Chinese network operators. With global expansion on the cards, Xiaomi is a player everybody will have to keep an eye on this year.

Demand for Nokia’s Lumia series remained flat sequentially as all eyes are on how Nokia’s upcoming Android based Nokia X series performs which started rolling out globally in March 2014. Nokia X series will boost the Finnish vendor’s marketshare closer to that of Sony in coming months and also help potentially climb towards the top-5 spots. On the other hand, HTC saw its smartphone sales shrink by 17% annually in February as its marketshare dipped with the Taiwanese vendor being squeezed between the aggressive Korean and Chinese OEMs. It remains to be seen how the new HTC OneM8 is able to drive HTC’s mindshare and marketshare in coming months.