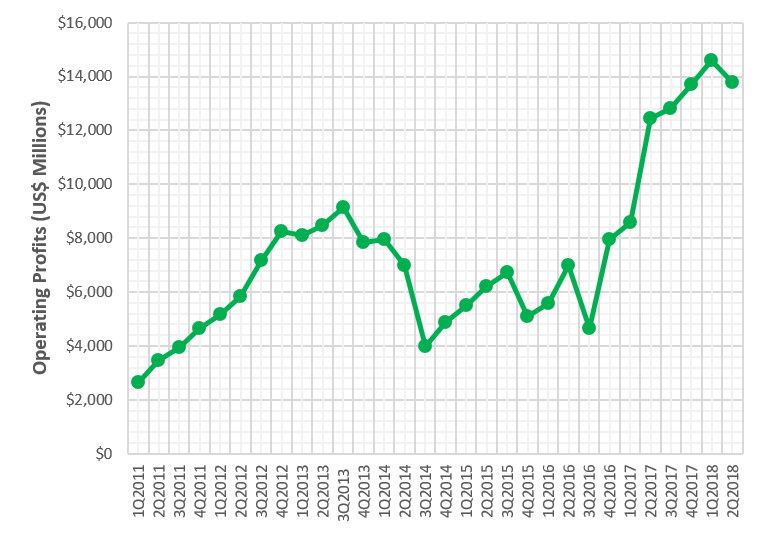

We mentioned in the previous post (here) how Samsung is transforming into semiconductor and systems company. Now we have more evidence that the horizontal semiconductor business is becoming really core to overall Samsung Electronics showcasing the real strong DNA of the Korean technology giant. The latest results for Samsung’s corporate level Q2 2018 performance is out, here is our analysis.

- Samsung Electronics clocked a massive US$54 Billion revenues in Q2 2018

- However, the revenues were flat YoY and down -4% QoQ after peaking in Q4 2017 due to the holiday season.

- The holiday season in Q4 2017 fueled the downstream end market demand for its semiconductor and smartphone business.

- The Mobile & Display Panel business revenues declined -18% & -23% YoY respectively.

- This downturn was due to weaker demand for its newly launched flagship S9 series putting pressure on mobile business & slow demand for Flexible OLED due to a seasonally slow quarter for most of its key customers

- However, offsetting these two businesses weaker performances was its semiconductor business.

- The semiconductor business (memory (NAND + DRAM), LSI & foundry) saw revenues grow a massive +31% YoY

- Further, Samsung continued to clock more than US$20Billion+ Operating Profits with healthy 25% margins

- However, the tremendous growth in the bottom lines can also be attributed to strong performance by semiconductor division.

- Samsung enjoyed the rising demand for high density memory for servers riding on the cloud computing and AI wave.

- Demand for SSDs storage solutions for datacenters to store the enormous flow of data being generated by IoT devices, smartphones, applications usage and so forth.

- The adoption of advanced configurations in NAND Flash (128GB+) & DRAM (3GB+) in smartphones across key customers continued to rise

- This also fueled the growth of semiconductor business and contributed to the bottom lines

- The mismatch between demand and supply for high density memories is at all-time-high leading to significant uptick in ASPs

- This has led to healthy margins for Samsung which is the leading manufacturer and supplier of memory bits globally.

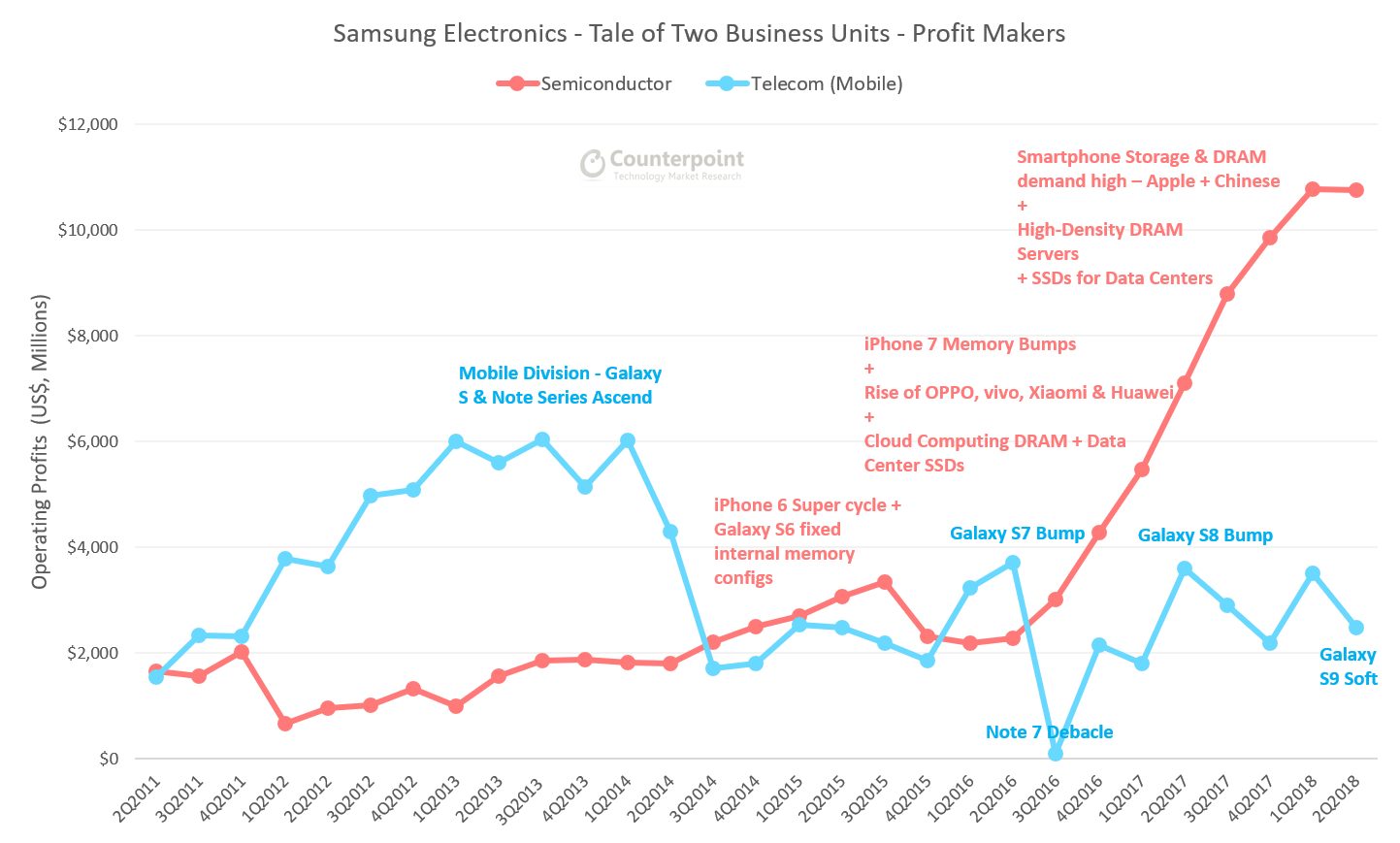

- However, the contribution from mobile division to the top line and bottom line reduced.

- This was mainly due to ASP and model mix shifted towards the refreshed J series portfolio towards the second half of the quarter with strong gains in emerging markets such as India.

- The Galaxy S9 series had softer than usual reception which also compounded negative growth annually for mobile division

- Globally Samsung’s smartphone division market share declined to 20% from 22% a year ago as smartphone shipments reached 71.6 million units down 10% YoY.

- The following chart narrates the tale of the two key divisions for Samsung : IM( Telecom) & Semiconductor and its impact on bottom lines and how they have grown over the years. Semiconductor division now contributes to 78% of the total Samsung Electronics’ operating profits.

- It is ironical that, the customers (Apple, Chinese brands, Qualcomm) driving part of the semiconductor business growth have actually impacted the mobile business.

- But this is how it is, when you are much better horizontal component vendor but also a vertical finished goods vendor with some inertia.

The complete analysis and charts on Samsung’s Q2 2018 corporate is available for Counterpoint clients at our research portal

The complete analysis and charts on Samsung’s Q2 2018 corporate is available for Counterpoint clients at our research portal