August was a busy month for Rakuten. The Japanese company announced its first major vendor contract with German Internet company 1&1 Drillisch, launched its new Symphony telco platform, acquired the remaining shareholding in open RAN software vendor Altiostar and published its latest financial results.

Rakuten Symphony

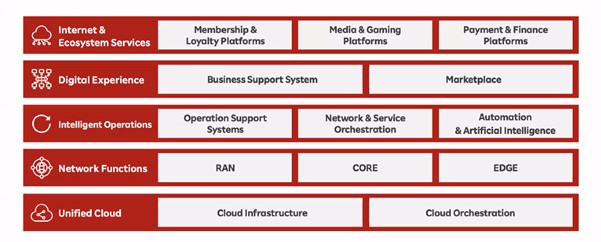

In October 2020, Rakuten launched the Rakuten Communications Platform (RCP), a cloud native communications platform consisting of a private cloud platform, RAN, core and edge VNFs plus various AI and OSS-based automations solutions. With the launch of Symphony, Rakuten adds a further two layers, a BSS layer and a layer comprising a range of digital services from parent Rakuten Group (Exhibit 1). By combining all of its telco products, services and solutions under a single global banner, Rakuten is now able to offer 4G and 5G solutions to customers worldwide.

A lot of the technologies offered by the Symphony platform is derived from Rakuten itself, either directly or via its recent acquisitions. For example, Rakuten provides the horizontal cloud infrastructure platform, the systems integration skills and R&D expertise while the vRAN and OSS solutions come from Altiostar and Innoye respectively. Other technology comes from key partners such as NEC (mMIMO radios, 5G converged core), Nokia, (IMS), Mavenir (RCS), Red Hat (cloud) and Intel (FlexRAN architecture) while smaller companies such as radio vendors Airspan and Sercomm round up the vendor line-up.

Exhibit 1 Rakuten’s Symphony Telco Store

© Rakuten Group

© Rakuten Group

One of the supposedly attractive features of Symphony is that an MNO can mix and match software and hardware components from any vendor in the Symphony portfolio. While Symphony is definitely multi-vendor, it does not seem to be very vendor neutral, although that may change with time. For example, MNOs crave a wide choice of radios. However, Symphony currently only offers one mid-band mMIMO radio vendor (NEC), one mmWave small cell vendor (Airspan) while Sercomm is the only indoor radio vendor. Nokia and KMW, the other radio vendors, only offer 4G radios.

Target Markets

As demonstrated by the recent contract award from 1&1 Drillisch, the most likely candidates for Rakuten’s Symphony telco store concept will be new entrants, particularly those companies that have little or no experience in the mobile telecoms industry such as ISPs, cable companies as well as enterprises who wish to build their own networks.

However, Counterpoint Research believes that the number of new entrants such as 1&1 Drillisch will be limited while the enterprise market will be extremely competitive with a plethora of new open RAN vendors, public cloud providers as well as incumbents such as Nokia and Ericsson battling for market share. Nevertheless, Rakuten may not need many major contracts to generate a lucrative new revenue stream.

Rakuten’s Future Role

Rakuten plans to be a major player in the global telecoms vendor market, and as mobile networks become virtualized, it has the potential to become a disruptor. With Symphony, Rakuten becomes a technology vendor, systems integrator, digital services provider as well as an MNO and mobile service provider. But where does its future lie?

Chairman Mickey Mikitani claims that revenues from the telco platform could ultimately surpass the company’s core e-commerce and financial services businesses. Clearly, the contract award with 1&1 Drillisch is a major financial and psychological boost for Rakuten at a time when the company is haemorrhaging cash and struggling to finish deploying its 4G network while its Japanese rivals are rolling out their 5G networks.

However, Counterpoint Research doubts that Rakuten will have the product range, economies of scale as well as mind share to seriously compete against the big RAN and cloud incumbents. Instead, it probably sees its role as a “facilitator” or platform provider (along the lines of its core e-commerce business), initially selling its own solutions plus knowledge and expertise alongside that of its core partners. The company may have a 1-2 year head start on rivals, but success will ultimately depend on what the company offers on Symphony, the cost and quality of its solutions and the business relationships it manages to strike with other vendors. Ideally, Symphony needs to offer a choice of “best-of-breed” solutions from multiple vendors. Inevitably, this will be its biggest challenge.

Although many Tier 1 MNOs will no doubt develop their own solutions, Symphony’s packaged offerings – and above all, Rakuten’s experience of running virtualized networks – may be attractive to some Tier 2/3 MNOs, ISPs, cable companies as well as some enterprises. However, Counterpoint Research expects that it will take a few years before the telco store business model establishes itself as a concept or not, and if it does, there will be no shortage of competing platforms. In the meantime, Rakuten must deliver in Germany as well as overcome the considerable commercial challenges facing its own mobile network business back home in Japan.

Related Reports

Fixed Networks Star Performer in Nokia’s 1H 2021 Turnaround

Infrastructure Insights: Massive MIMO and Cloud Dominate Quarter

Open RAN – Will 2021 Be A Breakthrough Year?