Counterpoint Research team of Analysts have completed preliminary sizing of the global handset and smartphone market as few OEMs have already released their Q3 2015 (July-Sep) performances. Following are our preliminary market share and rankings according to our quarterly Market Monitor service.

The key highlights of the quarterly performances so far include:

Market:

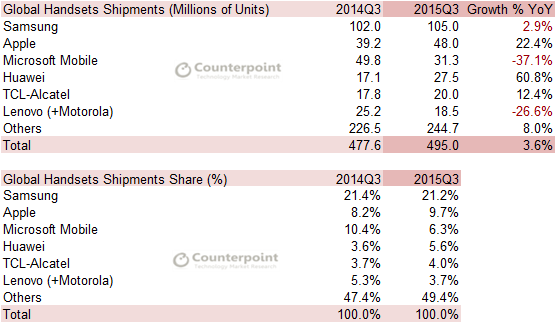

- Global mobile phone shipments reached a September quarter record of 495 million units up 3.6% YoY and 7% QoQ as Chinese brands continued to grow their share beyond China

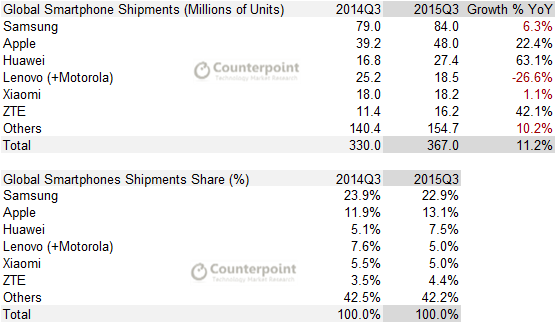

- Global smartphone shipments also climbed to 367 million units for the September ending quarter growing a very healthy 11% YoY

- Almost 3 out of 4 phones shipped globally were smartphones as feature phone demand continued to shrink fast globally

- Rising proliferation of LTE smartphones is driving smartphone demand in markets such as China, India, Russia, Indonesia and others

- Emerging markets such as India, Indonesia, Nigeria are hot destinations for OEM’s which are moving beyond domestic boundaries in quest for expansion.

- Chinese brands continued to rise with aggressive go-to-market strategies, with some brands strongly benefiting from e-commerce channels in emerging markets whereas some mature Chinese brands through carrier channel partnerships in markets such as USA, Europe and Latin America.

- Some of the Chinese brands like Oppo, Vivo, Huawei are investing a significant chunk of money on brand promotion and channel development building foundation in newer countries

- The Chinese & Indian brands have become highly competitive not only from time-to-market perspective but also in offering thinner, metallic and premium designed LTE phablets now at sub $120 retail price-points allowing these brands to penetrate much faster than the other tier-1 brands

- Chinese brands such as Huawei, ZTE, Meizu were the fastest growing brands during the quarter and moved up the rankings significantly while brands like Lenovo, Coolpad continue to face stiff competition.

- Huawei strengthens its No.3 position in smartphone market while Apple completed its strongest ever fiscal year on account of robust iPhone 6 series sales, thanks to larger screen sizes

- BBK backed Oppo & Vivo entered the top ten rankings during the quarter due to the strong performance in domestic China market as well as other South Asian markets.However the surprise of the quarter was growth of new entrant LeTV which managed to grab the attention through its affordable flagship offerings backed by strong content play in its first few months itself

- 9 out of the top 12 smartphone brands globally were Chinese which combined captured more than a third of the total smartphone market

- The top six global smartphone brands together captured almost 58% of the global smartphone market

Exhibit 1: Overall Mobile Handsets

Exhibit 2: Smartphones*

Samsung

- Samsung shipped 105 million mobile phones seeing a significant uptick sequentially and annually for its feature phones and mid-tier smartphones

- The overall handset demand was strong across Asia. Africa though flat across China, USA and parts of Europe

- Smartphone gained volume momentum rising to 84 million units though growing slower than the global growth hence losing some market share

- However, due to introduction of competitive affordable J series of smartphones while S6 series undergoing price correction across many markets helped Samsung see a healthy uptick sequentially

- In premium segment, Galaxy Note series will continue to be the savior during the upcoming holiday quarter with positive demand for its new Note 5 to offset some softness in demand for the Galaxy S6 flagship SKUs

- We continue to recommend Samsung to significantly cut down on hundreds of SKUs to a few hero models which will immensely help Samsung focus on its products design, experience and generate greater scale to improve profitability which is dipping quarter after quarter from 20% level when Samsung was at peak

Apple

- Apple posted its strongest ever fourth quarter for both revenue and sales for iPhone with shipments at 48 Mn during the quarter, a Y-o-Y increase of almost 22.4% and above the market growth.

- Apple iPhone revenues were at 63% of the total Apple revenues, depicting importance of iPhone’s performance for total corporate performance .

- Apple’s overall handset market climbed to 10% and the smartphone market share climbed to 13% during the quarter

- The popularity of higher capacity offering led to iPhone ASP of $670 driving healthy top and bottom lines

- With iPhone 6 and 6 Plus, Apple has successfully retained its user base and also recaptured most of the previous iOS users who had defected to Android because of larger screens

- China is now consistently the biggest iPhone market for Apple globally and now corresponds to almost 24% of the total corporate revenues

- In emerging markets China recorded a string growth YoY with shipments in India, Vietnam and Indonesia alone increasing by 96%.

- Apple is becoming a strong emerging markets player with highly aspirational brand value driving demand not only from rich urban consumers but also beginning to penetrate and capture a good share of middle class consumers’ wallet

- Apple fringe business segments like Services and other products are on track to become more than $30 Bn revenue in 2015 which is more than Xiaomi, Huawei and Lenovo combined.

Huawei

- Huawei continues to be among top three smartphone brands globally with a market share of 7.5% and YoY growth of 63%.

- Apart from this the strong growth in China amid the slowdown led Huawei to Top position in China Smartphone market in Q3 2015 surpassing Xiaomi.

- Honor brand is yielding results for Huawei with a presence in more than 74 countries around the globe and contributed to more than a third of the shipments.

- Honor brand has given successful entry in emerging countries like India where traditionally it was not strong whereas Ascend series continues to do well in Middle East Africa and Europe

- Huawei’s volumes increased by 4% in China as the vendor remained aggressive on pricing and distribution to capture market share at the same time strengthening its retail presence in recently entered markets in APAC and MEA region.

- North America remains a weak spot for Huawei and it needs to focus on the region if it has to narrow down the gap between top 2 smartphone brands.

- During the quarter Huawei gained share in mid to high end smartphone segment which is a positive sign for the company as it will push the overall ASP of its handset business and thereby improving profit margins.

- Moreover the recent launch of Nexus 6P will help it to scale up further thereby giving Huawei immediate presence in price segment where it has been struggling to get hold of in recent years.

- Going forward it will continue to leverage the momentum by launching more flagships in various geographies along with its online only business model in some of the regions

- At this pace Huawei looks well positioned to achieve its target of shipping 100 million smartphones in 2015

Xiaomi

- Xiaomi continues to be among top 5 in smartphone segment surpassing Lenovo ,ZTE & LG in Q3 2015 shipping 18.5 million smartphones with a market share of 5% during the quarter.

- With YoY growth of just 3%, Xiaomi is struggling to gain scale beyond China.

- Xiaomi saw healthy shipments for its newly launched Redmi Note 2 in China which led the Chinese brand to keep its momentum in China.

- Although much of sales are still coming from Online channel, Xiaomi is consistently trying new strategies outside home market to drive volumes.

- Some of these strategies includes tying up with Tier One National distributor, Redington, for offline distribution and partnership with Foxconn to manufacture locally in India which is its biggest market outside China currently.

- During the quarter it entered Brazil where we can expect it to go with a mix of offline and online distribution structure through operators and other offline channels.

- However going forward it will continue to invest in regional content platforms in countries like India and Indonesia and at the same time expanding in new regions like MEA.

Lenovo (+Motorola)

- Lenovo (+Motorola) smartphone shipments were down 26% annually as Lenovo continued to suffer an onslaught from Huawei & Xiaomi in its home market, China.

- However, Lenovo’s growth outside China in India, Middle East and South Asia has helped it maintain its position in top 5 smartphone brands globally

- Lenovo A series has been very popular in Asia e.g. it has been one of the top three selling models in India

- Motorola on the other hand had a softer quarter with focus on Latin America inventory correction and almost flatter growth in most of the other markets

- The new models from Motorola launched during the Q3 2015 are still rolling out across many countries and will see an uptick in Q4 2015. E.g. Moto G (3rd Gen) & Moto X Play are gaining in popularity

For press comments and enquiries please reach out to analyst (at) counterpointresearch.com