- Q2 2023 Global EV unit sales grew 50% YoY driven by strength in Western Europe, nascent markets, and NAM

- China’s domestic market continued to dominate globally but growth failed to keep pace with other major markets

- Global OEMs extended share of higher-tier mid & full-sized categories, while Chinese groups dominated lower-tier sub-compact and compact segments

Beijing, New Delhi, Boston, Seoul, London – August 31, 2023

According to Counterpoint Research’s latest Global Passenger Electric Vehicle Tracker, Q2 2023 battery electric vehicle (BEV) unit sales grew by 50% YoY, driven by Western Europe, North America and nascent markets across Asia.

China’s frail economy failed to fully rebound the domestic market from a disappointing first quarter, resulting in 37% YoY growth which was well below the global average.

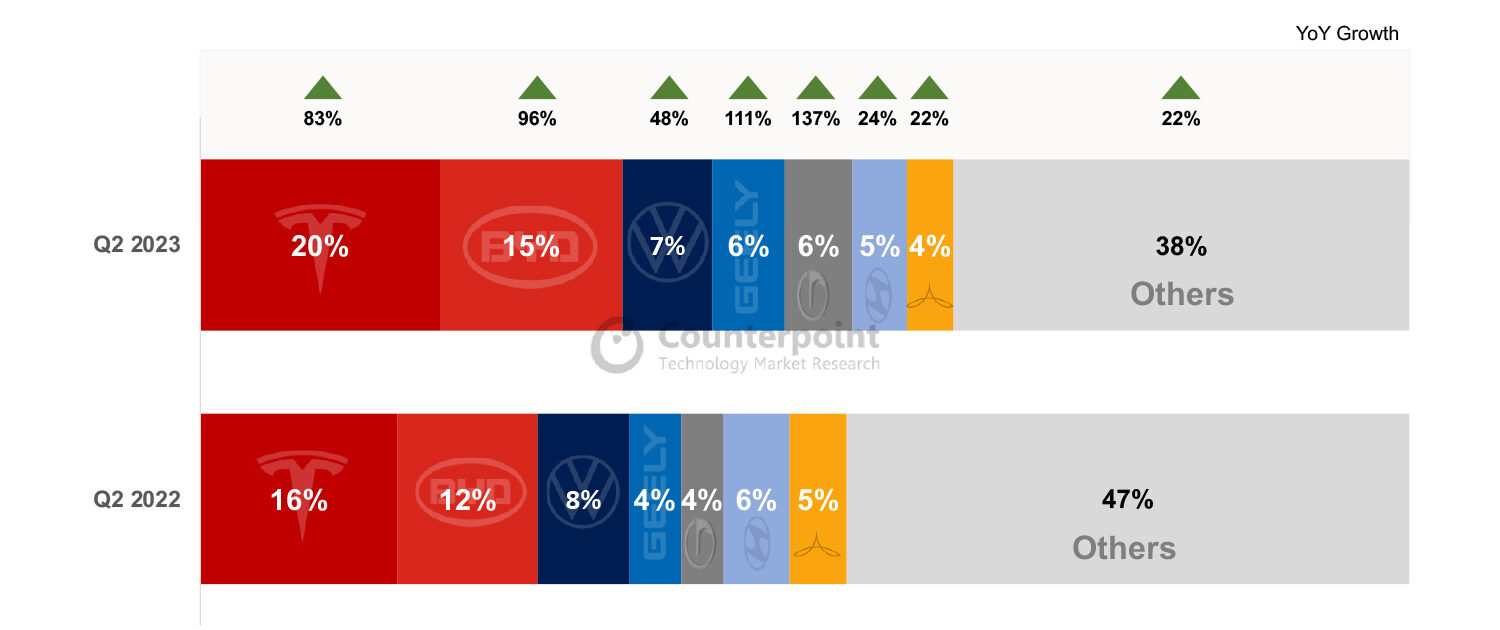

Global Passenger EV* Unit Sales Share by Auto Group

*Battery electric vehicles (BEV) only.

However, Chinese OEMs continued to dominate as they enjoyed scale advantages at home, allowing them to account for 56% of global unit sales – albeit the lowest Q2 in three years. “BYD Auto, GAC Group and Geely Holdings were three of the world’s top five passenger EV makers last quarter, yet none are household names in the west. They sell most of their cars at home,” notes Archie Zhang, Research Analyst, China. “Chinese OEMs play mainly in the compact or sub-compact space with performance and features reflecting this positioning. They might look sleek but they’re not a Tesla – at least not yet.”

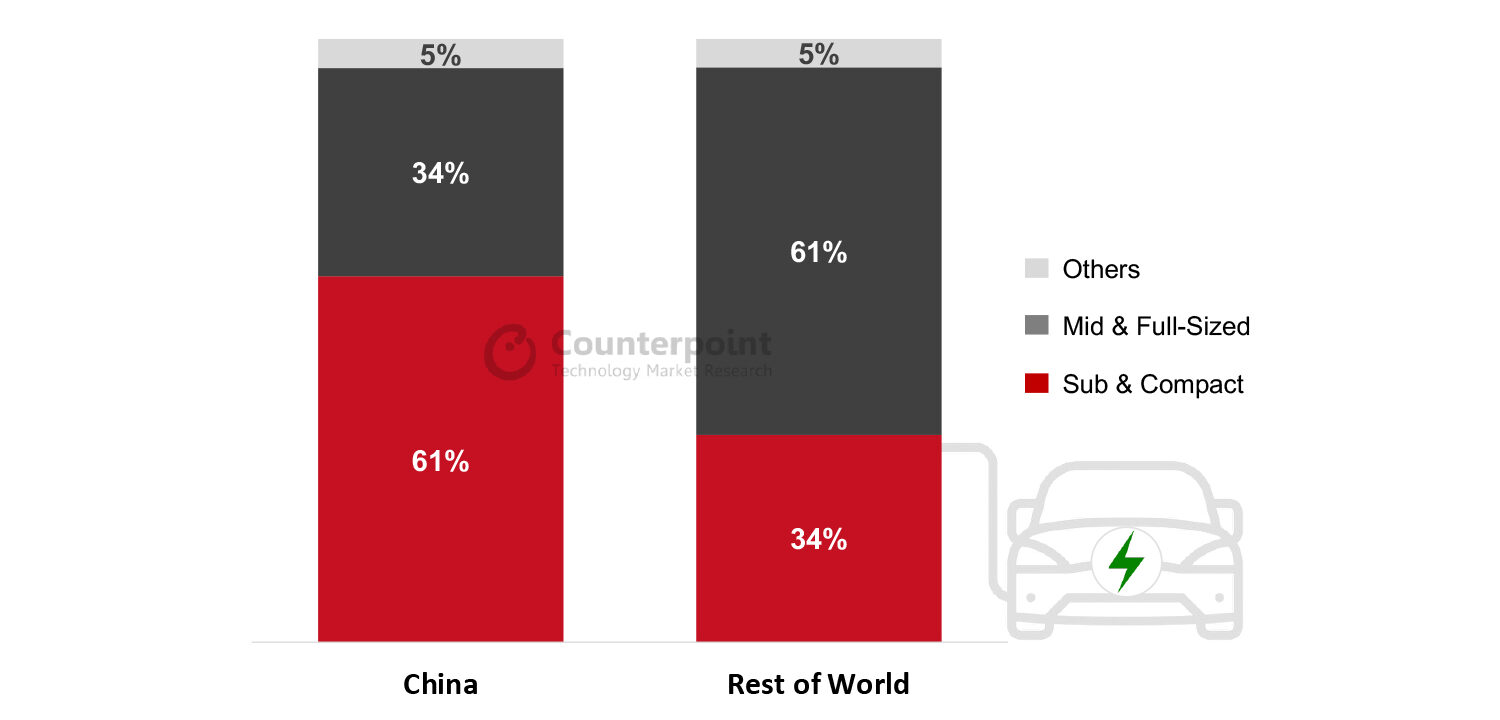

Chinese and Non-Chinese OEM Global Passenger EV Sales Share by Segment

*Compact represents ABC segment cars usually priced below $40,000 retail for base models;

Executive are D and E segment vehicles usually above $40,000.

Source: Counterpoint Research Global Passenger EV Tracker. *Compact represents ABC segment cars usually priced below $40,000 retail for base models; Executive are D and E segment vehicles usually above $40,000.

The trend outside of China has been biased towards the more premium executive segments, with the majority of passenger EVs sold being bigger, pricier, and often more luxurious. Senior Analyst for Automotive, Soumen Mandal, observes, “Tesla is obviously a big influence, but increasingly Hyundai Kia, Volkswagen, BMW, and Mercedes are moving the needle in premium.”

It has been slow going because electrification is forcing carmakers to rethink manufacturing. Premium EVs now need to resemble smartphones more than traditional cars to offer a similar experience to Tesla – the gold standard in EVs with its vertically integrated platform.

“Tesla’s brought a new dimension to the automotive industry by tightly integrating advanced hardware with software and electrification. While the traditional OEMs are competing with this level of modernization and sophistication, Tesla is racing to scale down this software-centric approach from luxury to premium and mainstream levels. For most OEMs, they had to start from scratch and play catch up” says Brady Wang, Associate Director, Semiconductors and Components. “It’s a learning curve on employing cutting edge chips, components, and software and achieving a level of user experience set by Tesla.”

With modern EVs demanding up to 3-4X more advanced chips and other hardware components like cameras, sensors, power-controllers, batteries and the like, sourcing and securing supply for these components is equally critical to manufacturing EVs to unlock advanced experiences. Chip shortages came to the fore last year as automakers across all segments struggled with procurement.

As EVs continue to grab a bigger piece of the pie, the automotive sector is seeing a new demand cycle driven by rapidly expanding needs for computing power, sensors and software capabilities.

Wang explains, “Tesla’s been showing everyone how to make a rolling computer for years and the industry is just now following suit. As computing requirements grow exponentially, so too will chip intensity per vehicle. This could have big implications on semis demand as EVs ramp over the next few years.”

For US and European automakers this might mean focusing on better procurement processes. But for Chinese OEMs, it could bring the added element of geo-political risk as they expand further into premium and try to move up the computing value chain.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research