According to the latest research from Counterpoint’s Monthly Market Pulse, the demand for smartphones in China grew a healthy 17% annually in June. This was the best ever June month in terms of sell-through for smartphones, even though the overall market for the June-ending second quarter has seen modest growth over the first quarter of the year.

Commenting on the results, Research Director, James Yan, highlighted, “The competitive environment in the world’s leading smartphone market has taken an interesting turn as domestic brands have significantly ramped-up their positions in the smartphone market. Oppo became the number one brand in China for the first time ever in June surpassing Huawei, Apple and Xiaomi with a record 23% market share with sales volumes up a massive 337% annually for the month.

Sharing the same owners the BBK group, Vivo also displayed strong performance alongside Oppo with the launch of the Xplay 5 & demand for its X6 series. Taking both brands together they captured a third of the Chinese smartphone market up from a combined 6% and 13% in the same month in 2014 and 2015 respectively. Meanwhile, Apple’s market share slipped to 2014 levels as iPhone 6S and SE demand remained softer compared to the iPhone 6 series last year. Huawei, saw a dip in June due to strong performance from Oppo and Vivo, however, it led the smartphone market for the full quarter ending in June 2016.”

Exhibit 1: % Smartphone Sales By OEMs in June 2016

Commenting on Oppo’s skyrocket growth, Research Director Neil Shah, noted, “Oppo has adopted a simple but effective strategy, going after the offline market which still contributes more than 70% of total sales in China. Aggressive marketing, promotions and sponsorships, greater offline retail penetration beyond tier-2 and tier-3 cities, better retail margins, dealer support and above all head-turning, innovative smartphone designs has helped Oppo drive its sales in the last eighteen months.

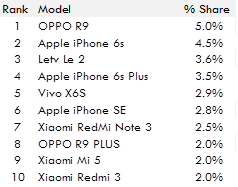

“Oppo’s immense focus on industrial design and key features such as camera, battery technology and materials has helped Oppo maintain an edge over its rivals and win consumer mindshare – especially in the under 25 years age group. Oppo R9 and R9 Plus have been the best-selling models for Oppo in June ending quarters with Oppo R9 alone the best-selling model in June.

Chinese brands now control more than 84% of the total Chinese smartphone market as they exert an iron grip on the sales channels, industrial design curve and leverage access to Chinese supply chain. Their dominance extends across the price bands even extending in to the premium segment with models such as Huawei P9, Oppo R9 Plus and Vivo X play 5.”

Exhibit 2: Top Ranking Smartphone Models Sold in China in June 2016

Highlighting on the competitive landscape, Research Director, Peter Richardson noted, “Oppo and Vivo growth story has been impressive and it is important to note that the brands which have entered the top three spots in Chinese smartphone market have tendency to hold on to the spots for atleast for some period of time. So expect Oppo and Vivo to provide tough competition to Huawei, Apple and Xiaomi in a close fight for the top three spots and consumer mindshare. The importance of brand pull, deeper sales channels penetration and time-to-market with head-turning design and innovative features will decide who owns the first three spots.

While Huawei has grown in confidence with innovative portfolio, rising brand power and Apple already has unparalleled brand equity and ecosystem advantage, Oppo and Vivo have product and sales channel momentum, the real work is cut out here for Xiaomi to not fall off the cliff considering its over-dependence on China market”