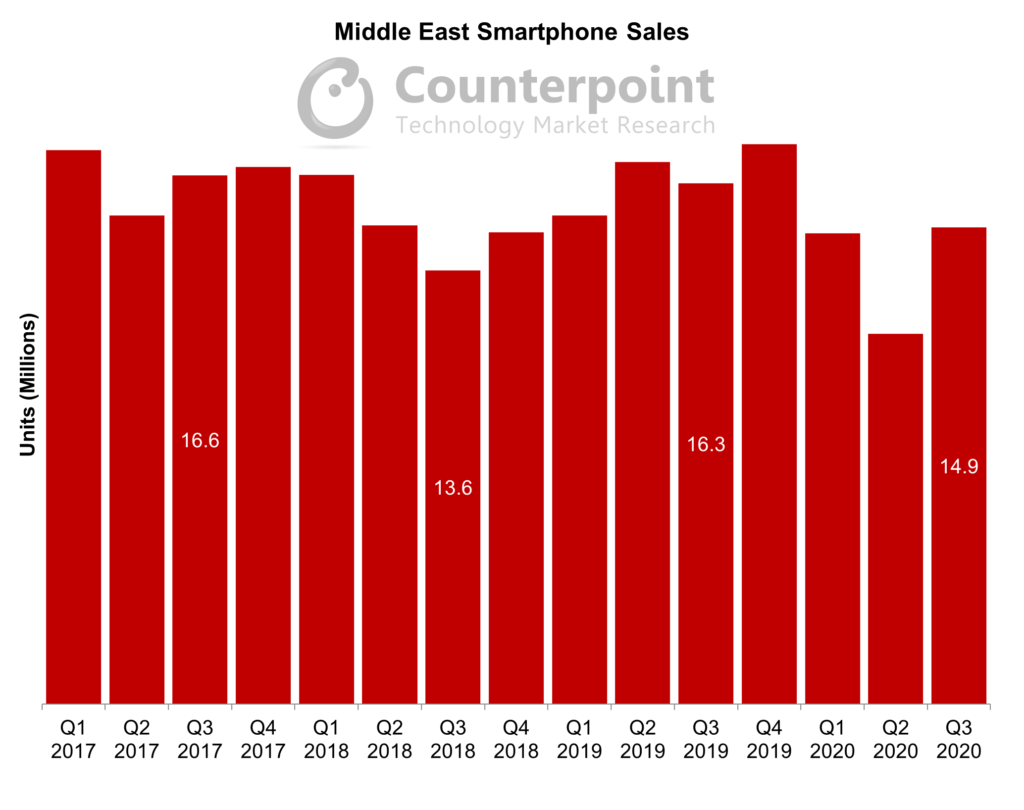

The Middle East smartphone market contracted in 2020 after experiencing big declines during the height of the COVID-19 pandemic in the second quarter. Major markets in the region saw demand return in the second half of the year, when lockdowns were gradually lifted. Heading into the new year, Counterpoint expects market momentum to cautiously tick upward as oil prices stabilize and economic activity returns to normal.

Smartphone sales had plateaued for several years in the Middle East before 2020. At the start of the year, most Middle East economies had been under pressure due to years of depressed oil prices, weak services sector growth and rising sovereign fiscal deficit. Several countries enacted diversification plans to cut dependency on energy revenues even as reduced subsidies, higher taxation and structural reforms repressed consumer sentiment.

The largest smartphone markets in the region also faced idiosyncratic difficulties. Turkey, the region’s largest market, had seen five successive hikes in its imported smartphone registration charge in 2019, with the latest rate at Turkish Lira 1,838 ($310). Demand was further depressed due to the Turkish Lira depreciating 45% between the start of 2020 and end of October. Saudi Arabia, the region’s second largest market, effected a VAT hike from 5% to 15% in July to offset the impact of lower oil revenue on state finances, which depressed smartphone sales through the second half of 2020.

Supply chain disruptions caused by COVID-19 were already leading to weak smartphone sales in Q1 2020. By Q2, sales plummeted due to physical store closures mandated by lockdown measures across the region. In addition, consumer sentiment was severely dented by a two-month oil price war between Saudi Arabia and Russia that saw Brent oil prices fall from around $65 per barrel at the start of the year to $18 by the end of April. In Q3, however, the smartphone market recovered strongly with the lifting of lockdown measures. Counterpoint expects Q4 smartphone sales to continue to trend higher in a typically strong quarter and grow by mid-single digits QoQ. The market will be aided by most countries having dodged the second wave of COVID-19, the launch of the iPhone 12 series, and aggressive channel strategies by Chinese vendors.

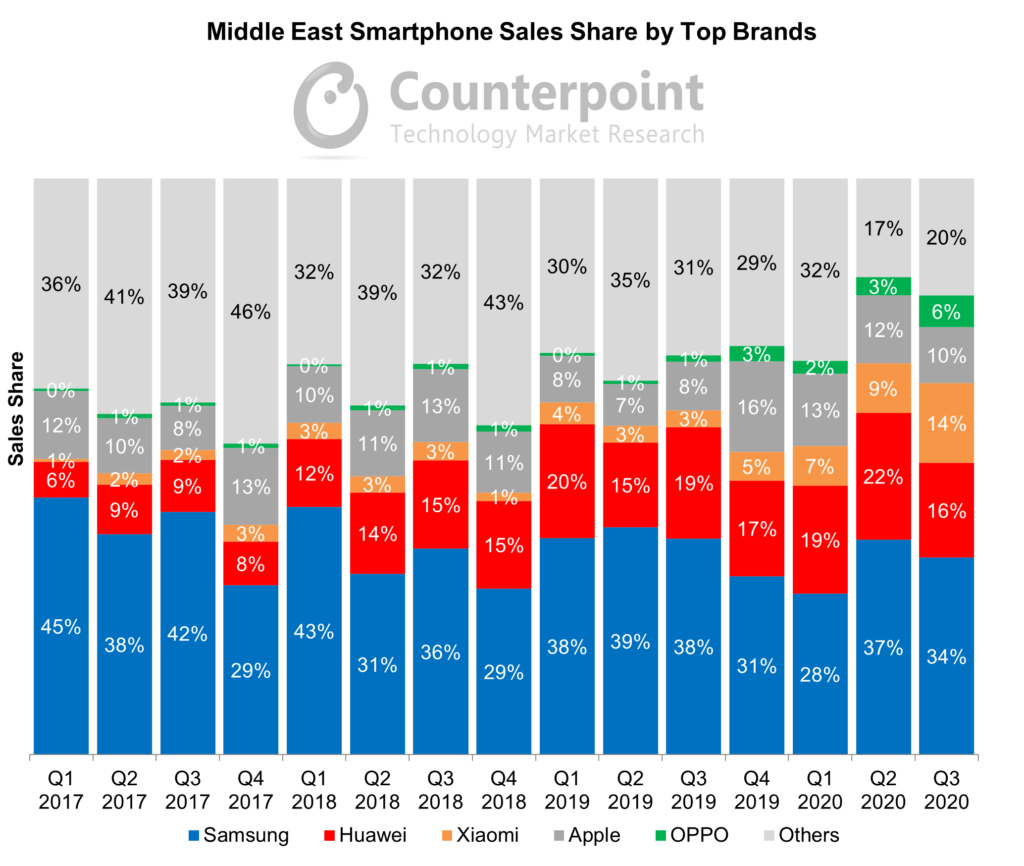

The Middle East smartphone market has been through significant consolidation in recent years. As of Q3 2020, the top five brands accounted for 80% of the market, compared to 64% at the beginning of 2017. Samsung is by far the biggest smartphone vendor in the region, covering a wide range of products across all price levels. The sales decline of flagship models in the earlier part of the year was cushioned by the successful budget range Galaxy A series. Huawei, the region’s second biggest brand, saw sales decline throughout the year due to a mixture of supply chain challenges and component unavailability because of the US sanctions. The biggest beneficiaries of Huawei’s loss were Xiaomi and OPPO, which both saw significant market share growth on the back of aggressive market entry initiatives, especially in Turkey, Saudi Arabia, UAE and Israel. Apple also saw market share loss throughout the year, mainly due to squeezed consumer sentiment and the delayed launch of the iPhone 12 series. However, Apple is expected to bounce back strongly in Q4 following the long-awaited launch.

The average selling price (ASP) of smartphones by Q3 2020 was only 70% of the level at the beginning of 2017. While premium models struggled, budget-friendly models like the iPhone SE 2020, Samsung Galaxy A series, Xiaomi’s Redmi series and OPPO’s A series all outperformed. At the lower end, the market for entry-level smartphones priced below $150 was supported further by operator plans across the region, notably in Bahrain, Saudi Arabia and the UAE, which took concrete steps to shut down their 2G networks. Smartphone shipment gains came at feature phones’ expense, whose drop gathered pace in 2020 at a YoY rate of around 35%.

2020 also saw the launch of the first 5G capable smartphone models in the region, albeit mostly in the above $600 range. Currently, seven countries – Bahrain, Israel, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE – have commercially available 5G networks. With the hype created by the iPhone 12 series launch, and cheaper 5G models from other brands, we can expect 5G subscription and device adoption to gather pace in 2021.

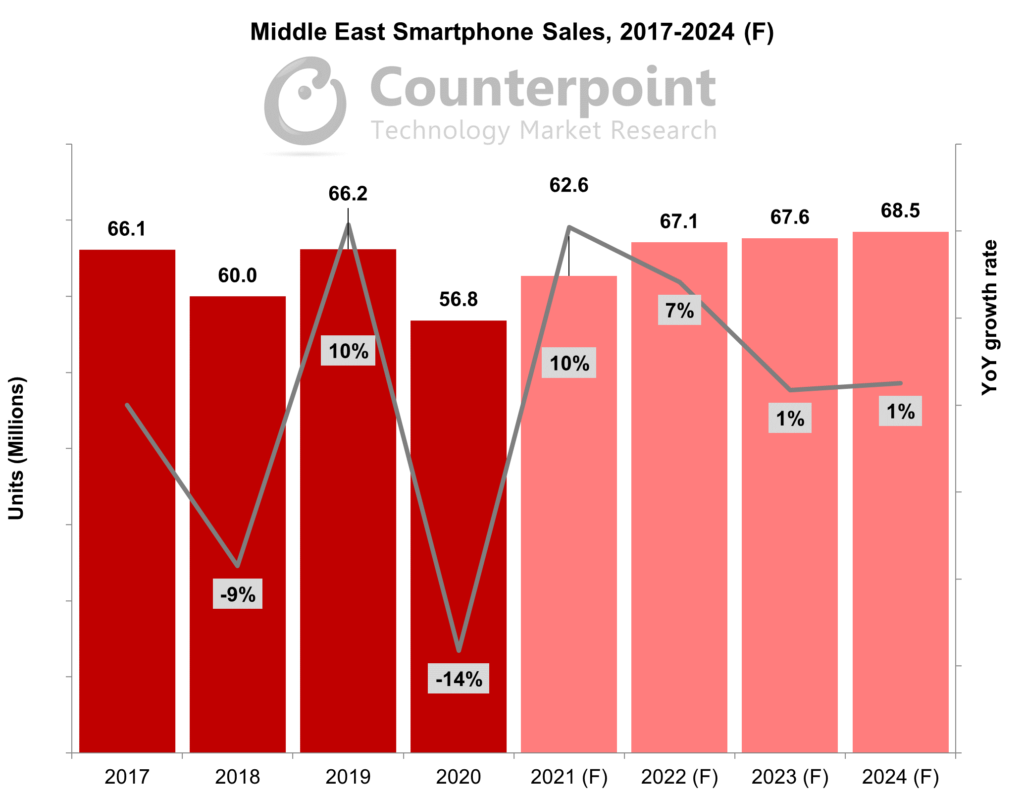

Counterpoint expects the Middle East smartphone market to rebound by 10% YoY in 2021 and reach pre-pandemic sales levels in 2022. In the new year, we expect some of the favorable developments that emerged in late 2020 to gain traction. The successful rollout of the COVID-19 vaccination drive across the world can resume travel, which will cushion oil prices and support the services sector recovery in the region. Premium smartphone brands like Apple and Samsung will benefit from new product launches while the Chinese vendors will continue market penetration drives, leading to increased sales across the region.

We expect more countries in the region to offer 5G services in 2021, with Iran, Turkey and Lebanon the likely candidates. Further, we expect the 5G subscriber base to increase from around 1.5 million by the end of 2020 to 10 million by the end of 2022, and 5G capable smartphone sales to increase from around 5 million in 2020 to 13 million in 2021.

*This blog classifies the Middle East region as the following countries: Bahrain, Iran, Iraq, Israel, Jordan, Kuwait, Lebanon, Oman, Palestine, Qatar, Saudi Arabia, Syria, Turkey, United Arab Emirates and Yemen.