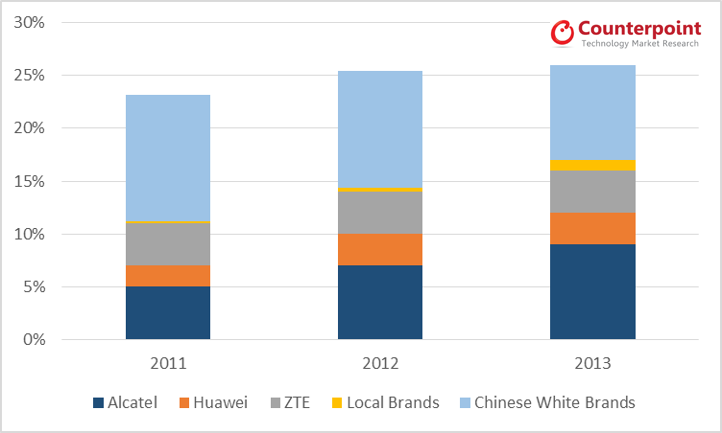

During 2013, Chinese brands all together captured approximately 25% of the LA (LATAM or Latin America) mobile device market, an increase of just 1% since 2011 (Figure 1). The performance varied broadly among each of the countries, categories and brands. But since rapid growth after 2007, Chinese brands have stabilized at current market share levels. The question is whether they can inject a further shot of growth through the next phase of the market’s development?

Chinese Players In LATAM– What’s the same, What’s different?

In LATAM, Chinese brands fall into three categories:

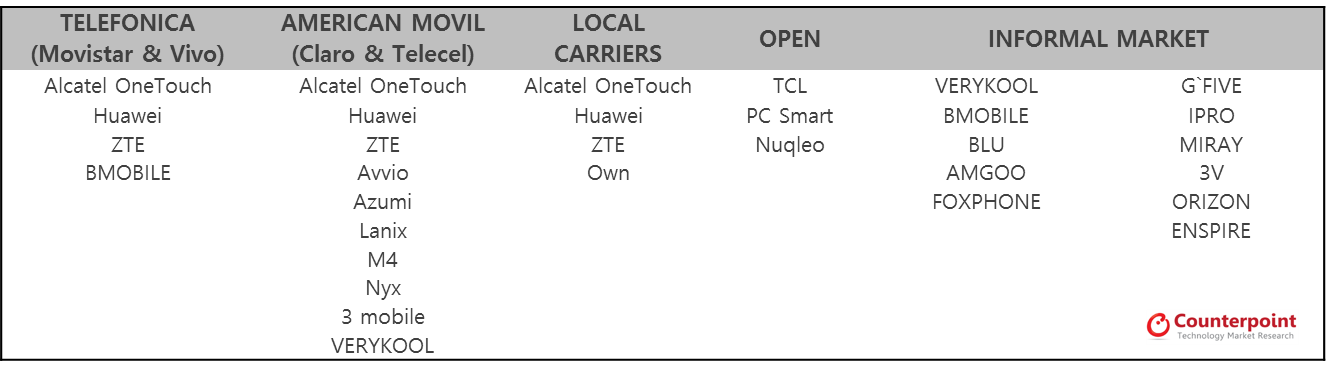

1. Brands with strong local organizational structures. These include Alcatel One Touch, Huawei and ZTE. Most of these brands also have assembly facilities in LATAM or, as in the case of ZTE, plan to set it up in 2014. These brands tend to have close contact with the carriers and as a result, almost all their sales, are done through carriers’ channels. Of the three, only Alcatel OneTouch invests to any significant degree in marketing and promotion. Perhaps as a result, carriers tend to consider them as 2nd tier brands, but brand awareness is steadily growing thanks to their long tenure in the region.

Exhibit 1: Chinese Brands Share of Mobile Phone Market in LATAM

2. Chinese ODM products to local brands (White Label brands)

These brands are mostly imported directly from China by local distributors, examples with reasonable market share include: Mobile Phone, ZTC, Blu, Ipro and Verykool. This category also includes some illegitimate devices that attempt to pass-off the look and feel of major brand devices. Products from this category reach the consumer through informal or online channels. None of these brands have any access to the carriers. The stores that sell these devices, are usually concentrated in confined areas and indoor markets in most of the big cities in LATAM. Examples of these markets include: Galeria Pagé, in Sao Paulo, Brazil; Cyberplaza in Lima, Peru; Plaza Meabe o Tepito in Mexico City, Mexico; San Adrecito in Bogota, Colombia.

3. Chinese companies using local brands such as Avvio and Lanix.

There are 4 or 5 brands that have managed to win a regional contract with American Movil (AMX). Each of AMX’s country markets can decide which brands to add to its portfolio with each usually taking one or two brands.

In 2013 this category collectively achieved about 1% market share (Figure 1), which is in distinct contrast to what local brands have achieved in many Asian and African markets. These devices are not sold in the open market, in those country in which AMX has operations. Telefónica on the other hand, has focused its portfolio to include principally only global brands (Exhibit 2).

Exhibit 2: Chinese Brands Distribution Channel in LATAM

Profiling Chinese Players in LATAM

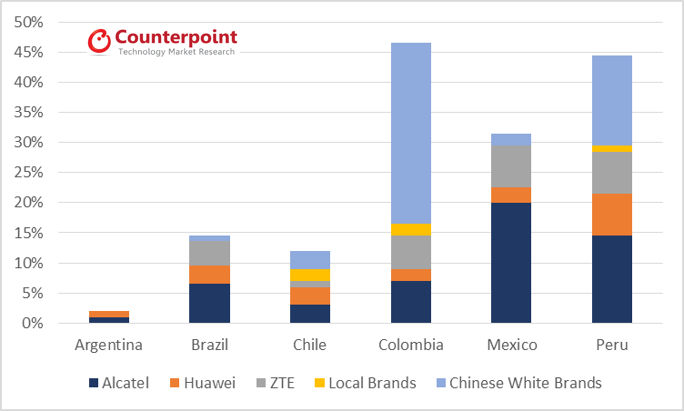

Alcatel OneTouch, which is part of TCL China, has the highest volume market share among Chinese brands in LATAM, trailing only Samsung and Nokia and reached 11% share in 2013 (figure 1). It is constantly competing, with LG, for 3rd position across the region – and winning most battles. It has strong double digit share in both Mexico and Peru. In all the other countries it has single digit share, but with different pace of growth. In Brazil Alcatel One Touch is showing steady growth. While in both Chile and Colombia, for the last three years, its market share has been stable but not growing.

In Brazil Alcatel One Touch had 4% share in 2012, but grew to reach 6.6% volume market share in 2013 (Figure 3). The growth in market share could partly be attributed to the setting up of a partnership with a local assembly facility, located in Manaus. This effort has helped Alcatel OneTouch to lower its prices significantly; as locally assembled products don’t pay as much tax as imported products. This assembly facility plans to begin production in three smartphones and one 7″ tablet in 2014 with a target of over two million units.

In Mexico, Alcatel OneTouch, is the second most important brand in volume share behind only Samsung. In 2010 the brand had around 9% share but more than doubled its share over the ensuing three years to reach 20% in 2013 (Exhibit 3). The brand has the biggest portfolio of devices, among Chinese brands available in Telcel (AMX) – the biggest carrier in Mexico. The portfolio includes four feature phones and six smartphones. Alcatel OneTouch is slowly starting to invest in marketing and promotion in Mexico. It ran a promotional campaign in early 2014 with One Direction, the British teen band.

Exhibit 3: Chinese Brands Share of Mobile Phone Market across LATAM countries in 2013

- Alcatel OneTouch is also very solid in Peru with around 15% share in 2013 It has also experienced substantial growth from the 6% the brand had in 2011.

- Compared to the above mentioned countries, Alcatel OneTouch is not doing so well in Colombia (6% volume share) and in Chile (3% volume share). The share has been quite stagnant, in both countries but for different reasons:

-

Chile has one of the highest ASP in LATAM, which leaves less room for value-oriented Chinese brands to gain ground. Even Alcatel OneTouch, which is not perceived as Chinese brand, does not have much opportunity in Chile.

-

Argentina is the only country that Alcatel OneTouch has been losing share in the last 3 years. It had 7% volume share in 2011, but it only reached 1% share in 2013 (Figure 3). The loss of share in Argentina, is partly due to the ban of imports of mobile devices, while its local assembly partner, Radio Victoria, had production issues. Without local production, the brand would not have any opportunity to grow. Alcatel currently markets locally two brands, Alcatel OneTouch for carriers and TCL for the open market.

Alcatel One Touch & Mozilla Firefox OS

Alcatel, Mozilla and Telefonica have partnered up to launch Alcatel One Touch Fire. A smartphone powered with Firefox OS. It is already available in seven markets in LATAM; Venezuela, Peru, Colombia, Uruguay, Brazil, Mexico and Chile. All the biggest mobile device markets with the exception of Argentina. According to Alcatel management, the sell-out of this device is slow. Alcatel does not expect to make any significant volume until at least 2nd half of 2014. Alcatel One Touch Fire is currently the most widely available Firefox device in LATAM. ZTE’s device, the only other Firefox partner, is as of the end of March 2014 only available in Colombia.

Alcatel, Mozilla and Telefonica have partnered up to launch Alcatel One Touch Fire. A smartphone powered with Firefox OS. It is already available in seven markets in LATAM; Venezuela, Peru, Colombia, Uruguay, Brazil, Mexico and Chile. All the biggest mobile device markets with the exception of Argentina. According to Alcatel management, the sell-out of this device is slow. Alcatel does not expect to make any significant volume until at least 2nd half of 2014. Alcatel One Touch Fire is currently the most widely available Firefox device in LATAM. ZTE’s device, the only other Firefox partner, is as of the end of March 2014 only available in Colombia.

Part of Alcatel OneTouch success in LATAM is likely down to the fact that the brand has been in the region longer than the other Chinese brands. TCL also leveraged the brand awareness Alcatel built before acquiring the company from the French group. The company also has strong regional management. Alcatel OneTouch has very aggressive target for LATAM the next few years. We believe the company has the product, organization and management to achieve its targets.

_______________________________________________________________________________________________

ZTE with 4% regional volume share (figure 1), is just slightly higher than Huawei’s. It is the only Chinese brand that has not had significant market share variation in the last few years in LATAM at the regional level. However this disguises significant intra-regional variation in LATAM’s constituent markets. ZTE has lost share in Brazil and Argentina but gained in other LATAM countries. Neither ZTE nor Huawei have any significant brand awareness in LATAM. This is because neither one has ever invested in promotion and marketing.

Mozilla and Telefonica have partnered with ZTE to launch the Firefox-based ZTE Open. However, as of March 2014 this devices is only available in Colombia.

ZTE is strong in Colombia, Mexico and Peru. The company currently has 7% share in Mexico (Figure 3). It has focused on the low end feature phone devices, which helped it to gain share, however it will now need to expand its smartphone presence. ZTE has gained about four points of share in Colombia during last three years. Colombia being the third largest market in LATAM has impacted positively in ZTE’s regional market share. However, the brand has lost some share in Peru during the last three years – ceding share to Huawei.

ZTE has lost a few points of share in Brazil since 2011. This loss has led the company to a major restructuring during 2012. It has named a new General Manager and is investing in a factory-assembly facility in Brazil that aims to produce 1.2M units per year. However this level of volume represents less than 2% of the Brazilian market total so is unlikely to make a dramatic difference to ZTE fortunes. What local manufacturing does allow though is a decrease in cost and an acceleration in time to market. The manufacturing plant will start in a partnership mode before ZTE takes full control of the facility.

________________________________________________________________________________________________

Although not as strong as either Alcatel One-Touch or ZTE on the mobile device business. Huawei is very aggressive in the carrier networking business and has reached good penetration levels in LATAM. It has been participating, with different degrees of success, in the rollout of the 4G network in four of the five carriers in Brazil. It has also been bidding actively, and winning contracts, in the roll out of many 4G networks in LATAM, such as Chile and Mexico. Carriers usually do not allocate the whole deal to just one party, instead break it down into few smaller contracts and allocating to different vendors. Under this format, Huawei has secured at least one part of the 4G roll out, in countries such as Brazil and Mexico. Huawei has even been facilitating the carriers, through the China Development Bank, to obtain extra financing on the bids. This help has increased the incentive of the carriers to grant the rollout bids to Huawei.

During 2013 Huawei moved its South American headquarters, from Brazil to Argentina. It was a surprising move, as Huawei has only had around 1% volume share in the Argentine mobile device market. Huawei has an assembly partnership with Compal Electronics in Brazil. The factory is located in Jundiaí, Greater Sao Paulo, and it currently produces two models, Huawei Ascend G510 and Huawei Ascend G506.

The office relocation can likely be attributed to the fact that Brazil is currently the most expensive country in which to run operations in LATAM. Having the offices in Argentina, should allow Huawei, to save significantly in both office cost and staffing costs. Furthermore, most of the 4G network roll out in Brazil is either already underway or done, while in most other LATAM countries, 4G network roll out is far behind Brazil. Argentina is definitely one of the most laggard markets in LATAM as far as 4G roll out is concerned. There is therefore significant growth opportunities.

Huawei on the mobile device side, is only strong in Peru and Chile. Huawei is the strongest Chinese brand in Chile (4% share in 2013), a market that Chinese brands have only managed to gain a small presence. Huawei fills the very low end smartphone segment need for Entel (local carrier) and Movistar. It also sells to Nextel, push-to-talk carrier as Huawei is one of the few vendors able to fulfill its low-end push-to-talk device needs. Huawei has almost 7% share in the Peruvian market (figure 3); the highest share among all the LATAM countries in which Huawei does business.

_______________________________________________________________________________________________

Other Brands

The “White” label brands together represent just under 10% of the total LATAM mobile device market, or around 35% of the total Chinese product market space. As none of these brands have local offices, they are all distributed by local importers and distributors. A very distinct characteristic of these products is that they are all sold directly to the end user, whether online or through physical stores of some sort. These brands are not sold through the carriers. Currently, most of these devices are dual SIM and low end Android smartphones.

Both Brazil and Argentina have highly protectionist regulatory environments. Brazil has imports duties of around 60%, while in Argentina the importation of handsets is almost banned. At the other extreme, neighboring country, Paraguay, has almost no imports duties. However border control between these three countries is slack, which means that Paraguay currently supplies most of the Chinese brands presently sold in the Southern-cone region. Paraguay is also the source of white label Chinese devices to Bolivia and Peru. The devices usually are smuggled into the neighboring country, transported by roads, alongside other electronics products.

These devices are sold online or in parallel market shops. These shops are usually located in old galleries or building situated in the old part of any major LATAM city.

For example in Brazil there is an area that consist of 3 or 4 blocks, located near the old Mercado Central (central market) of Sao Paulo. This area is commonly referred as Galeria Pagé, as this colorful building is the oldest and most emblematic building of the area. This area has many buildings, full of shops that sell everything from handbags to watches, and all sorts of electronics devices, including mobile devices and tablets. Most of these places do not pay local taxes, and most of the merchandise sold is fake, or products with an uncertain origin. Therefore, these places are often inspected by the police who usually shut them down. However, within a few days the stores reopen.

Colombia and Mexico both have relatively open market economic policies, which means no special restriction to imported products and reasonable import duty levels. These factors combined with a very high prepaid base provide Chinese brands a favorable environment for growth. On top of this, Colombia has high carrier interconnect charges so consumers seek dual SIM devices to arbitrage pricing differentials. Carriers are reluctant to offer dual SIM devices for this reason, so they tend to flourish in the open market. Colombia has a good open market channel with unlocked devices. OEMs have been able to exploit this channels to push products, but demand for dual SIM and entry level devices has exceeded supply.

Mexico on the other hand, does not have a well-functioning open distribution market. Telcel (AMX) pressures big brand OEMs from trading in the open market. This means white label Chinese brands are the only alternative for those who seek unlocked and low cost feature phones and smartphones.

Overall in LATAM, Chinese white label brands importers are very scattered. Most of them are small local distributors that typically don’t trade more than 200K units yearly. In most cases, they are not solely focused on mobile phone business; trading a wide portfolio of products, generally within the consumer electronics sector, such as cameras, MP3 players, tablets, TV, etc. Online sales of these devices are growing, as demand for smartphones increases, and white label devices are more affordable than big brands. Regional online markets include: MercadoLibre.com, OLX.com, DeRemate.com. There are also a few local browsers such as, iBazar.com.mx, linio.com.mx. etc.

Conclusion

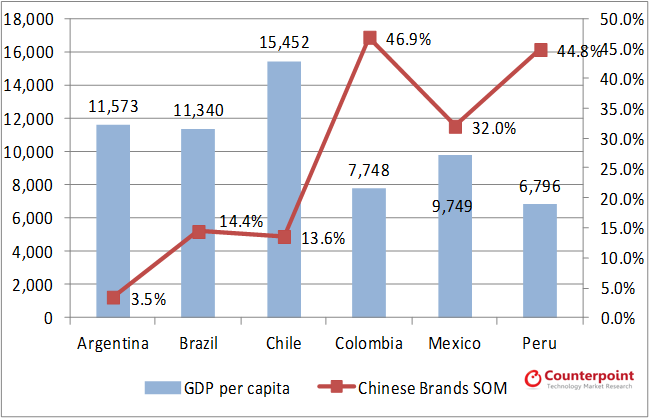

Aside from the highly regulated markets of Argentina and Venezuela, most other LATAM countries show an inverse correlation between GDP per capita and Chinese brands’ share; the higher the GDP, the lower the Chinese brands’ share. Therefore in Colombia and Peru, Chinese brands have higher share than Mexico and Brazil, which have the highest GDP per capita in LATAM. However correlation does not equal causation and the role of operator control is also a significant factor.

The generally positive economic situation will fuel further smartphone market growth. This rising tide will tend to lift all boats. However as economic power rises, consumers will likely become choosier about the brands they select. We therefore expect those vendors that do the best job at creating a strong rationale for purchase – through a mix of product and brand development, marketing and sales promotion – will fare best.

Exhibit 4: Chinese Brands & GDP per Capita in LATAM

Right now that is likely to favor the established players. However there is potential for local brands to partner with Chinese ODMs to create an attractive proposition based on brand familiarity among local consumers. This approach is working effectively in many South East Asian countries. This can also work in LATAM– especially in markets with lower carrier control. Of the Chinese brands, Alcatel OneTouch has the strongest local presence and is well positioned to consolidate and grow its market share position through smart marketing and strong channel relationships. Huawei and ZTE also stand to gain – especially with the coming 4G LTE transition. White label players will struggle to make headway. All these vendors can offer is a low price which is not a strong proposition long term.

This is an exclusive research extracted from our Monthly Market Pulse Research report sent out to our Market Pulse clients every month. Please feel free to contact us if you are interested.