Our latest Market Monitor Q2 2014 is out for clients and its very interesting to witness how rapidly the mobile devices landscape is changing every quarter from fierce competitive landscape to faster new technologies penetration to evolving device form-factors to OEMs struggling to catch up with each others on product portfolio, go-to market and pricing strategies. China remains the bright spot for entire mobile phone value chain and crux of all the growth.

The major trends coming out of our China specific research is highlighted below:

- Global smartphone market grew to a record all-time-high shipment volumes surpassing 300 million units in Q2 2014 surpassing the Q4 2013 holiday season surge

- Smartphone shipments now account to 70% of all mobile phone shipped during the quarter, highest ever

- China was the big factor this quarter clocking record high smartphone shipments, more than 100 million units

- China now accounts to more than a third of the global smartphone volumes up from a fourth, eight quarters ago

- The major growth in China is as a result of unparalleled demand for smartphones, almost 94% of the total phones shipped compared to the US where smartphone still represents 88% of the total phones shipped in Q2 2014

- During the quarter, LTE was one of the big factor driving smartphone volumes and the LTE phenomenon is just getting started in China

- Within three quarters or so, China has raced to become the second largest market globally in terms of LTE smartphone volumes, almost a fourth of global LTE volumes and almost non-existent LTE volumes in the same quarter a year ago

- We predict China will overtake USA as the number one LTE market in terms of LTE smartphone sales in the second half of 2014

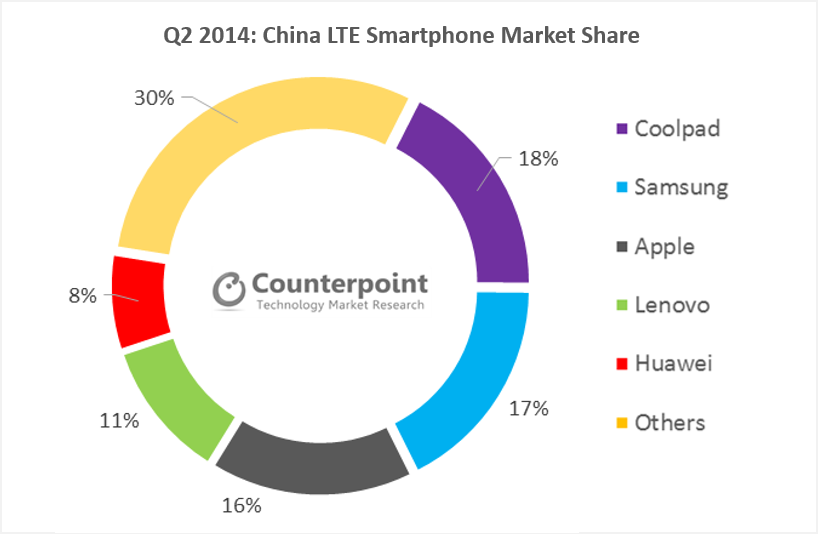

- While Apple & Samsung dominated the global LTE smartphone market with more than 57% share combined, situation in China is changing fast

- Coolpad became the top supplier of LTE smartphones in China during the quarter surpassing Samsung & Apple followed by growing tail of Chinese OEMs

- OEMs are launching five-mode TDD&FDD LTE ready smartphones through open channels alongside cheaper three-mode TDD-LTE only smartphones for China Mobile Network

- The LTE volume ramp up in China is as a result of local OEMs benefiting from the strong supply-chain dynamics locally

- There are now more than 250 LTE models being sold in China wit h average selling prices already hitting close to 1000 yuan which should help China Mobile allocate less subsidies to keep the LTE momentum going and achieve its target 50 million subscriber mark this year easily

- Qualcomm was the key beneficiary and driver so far in the China LTEscape and will continue to dominate mid- to premium-tier

- However, MediaTek will be the key driver here moving forward with its LTE solutions being adopted with fast-growing brands such as Lenovo, Xiaomi, will be disruptive in sub-1500 yuan LTE segment

- Watch out for Xiaomi and Lenovo in coming quarters with their aggressive LTE play to put pressure on Coolpad and Huawei whereas Apple with larger screen LTE iPhones will put pressure on Samsung in the premium segment

To summarize, this quarter it was all about China LTE smartphones and Chinese OEMs ramping up. Though replicating similar LTE growth in Western markets is going to be challenging but will still enjoy the scale in their domestic market.

The comprehensive and in-depth series of Q2 2014 Market Monitor reports is available for Counterpoint’s paid clients. Please feel free to reach out to us at analyst@counterpointresearch.com for further questions regarding our in-depth latest research, insights or press enquiries.