Counterpoint Research team of Analysts have completed preliminary sizing of the global handset and smartphone market as few OEMs have already released their Q1 2014 (Jan-Mar) performances. Following are our preliminary market share and rankings according to our quarterly Market Monitor service.

The key highlights of the quarterly performances so far include:

Market:

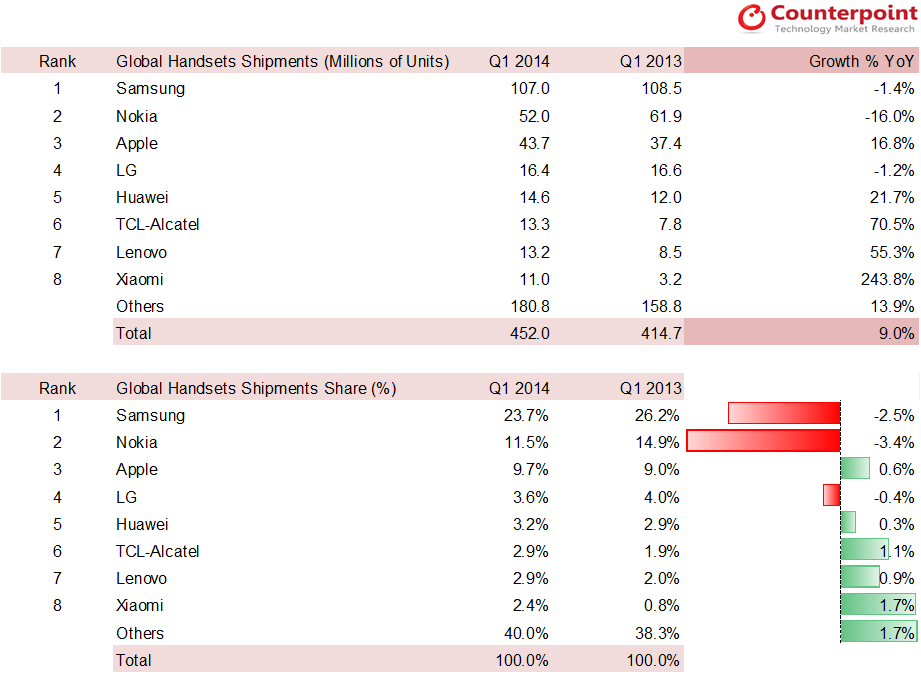

- Handset shipments reached a record March quarter high of under half a billion units for the Q1 2014 quarter (Growth 9% YoY)

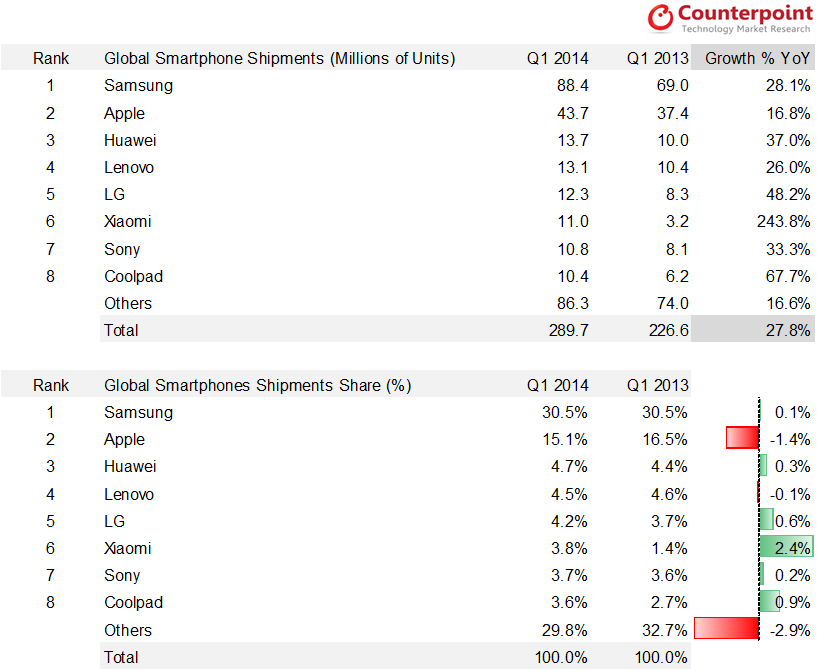

- Smartphone shipments were slightly under 300 million units, a first quarter record (Growth 28% YoY.)

- Smartphone now represent 64% of all mobile phones shipped during the quarter (55% in Q1 2013) as feature phone demand is briskly shrinking across globally. Consumers can buy a new branded smartphone now for less than $50 and will be for under-$40 by year end

- Demand across developed markets such as North America & Western Europe shrunk coming from a strong holiday season quarter while emerging markets continued to grow above industry average.

- Our Market Pulse data suggests healthy sell-out volumes for Samsung, Xiaomi, however, some Chinese OEMs and Apple saw some inventory build up post-February which could affect their Q2’14 performance.

OEMs

Overall Mobile Phones

- Samsung still ships a mammoth more than 100 million phones per quarter but growth was down 1% annually & 8% sequentially. Feature phone shipments declined & tough competition in low-end but mid- to high-tier remained steady during the quarter

- Nokia was the second largest OEM globally but declining feature phones and stagnating smartphone growth held back OEM. The growth down 16% YoY as the Devices & Services now will be part of Microsoft

- LG, Huawei, Alcatel & Lenovo continued to fiercely contest for the fourth and fifth spots.

- However, the biggest surprise was Chinese smartphone maker Xiaomi which almost quadrupled its volumes with rising demand for its expanding portfolio & reach extending beyond the domestic market. This has allowed Xiaomi to enter the top 10 global handset brand during the quarter for first time ever capturing 4% marketshare

- The long tail of Asian OEMs continued to grow moderately and below the industry average as they are high on consolidation curve with fight for survival in the fierce sub-$100 segment

Smartphones

- Samsung was the number one smartphone supplier during the quarter growing on par with industry average and hence maintaining its marketshare from a year ago but down from a high of 32% in Q3 2013

- Apple grew to its highest ever volume for the March ending quarter but a slip in marketshare as it grew slower than industry. Apple with expanding channels in key markets such as Japan, India & China extended its iPhone mania beyond home market

- Xiaomi jumped to sixth spot globally for the first time with impressive performance, guerrilla marketing, expanding portfolio at low-end and high-end and expanding beyond China during the quarter. As our Monthly Market Pulse research highlighted earlier in the quarter that Xiaomi’s two models enter the global top-sellers list for the February 2014 month.

- Huawei remained the number three but we believe its going to be a tough fight between these Asian OEMs for the third spot in coming quarters. Channel expansion, pricing & differentiation will be the key to success