Counterpoint Research team of Analysts have completed preliminary sizing of the global handset and smartphone market as few OEMs have already released their Q3 2013 (Jul-Sep) performances. Following are our preliminary market share and rankings according to our quarterly Market Monitor service.

The key highlights of the quarterly performances so far include:

Market:

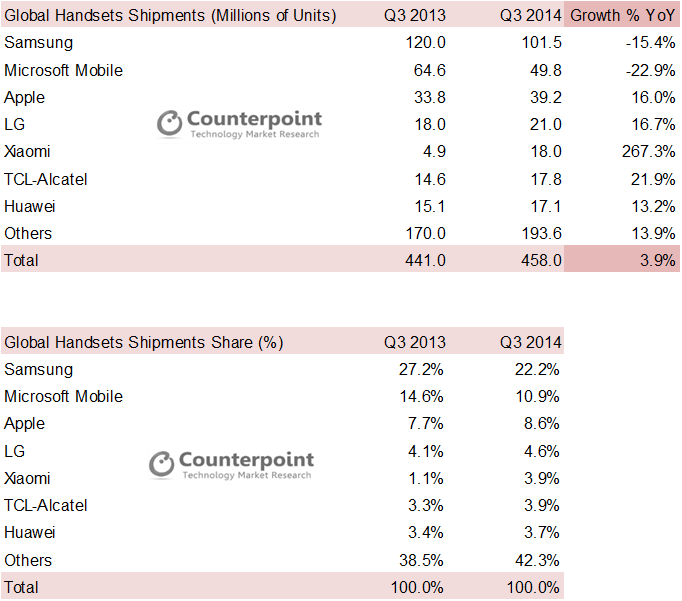

- Handset shipments reached a record September quarter high of under half a billion units for the Q3 2014 quarter registering modest growth (4% YoY) as feature phone market declined faster than smartphone segment’s growth

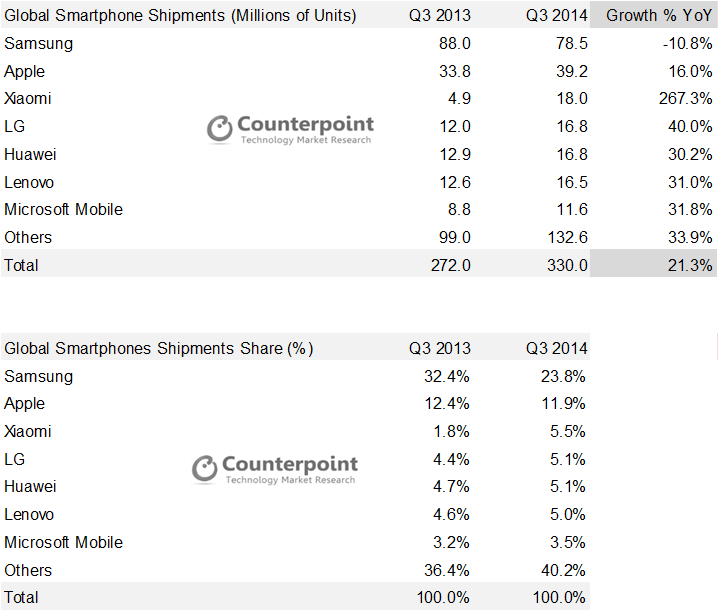

- Smartphone shipments crossed 300 million units, first time for the third quarter growing at a decent pace (21% YoY.)

- Smartphone now represent 72% of all mobile phones shipped during the quarter (62% in Q3 2013) as feature phone demand continued to shrink fast globally.

- Consumers can buy a new branded 3G smartphone now for less than $50 and will become a norm by the year end

- Chinese brands have rose significantly on smartphone experience curve in terms of hardware design as well as software and UI integration

- These brands are offering high to premium tier device at mid- to high-tier price respectively almost creating an “affordable premium” segment which has helped them grow faster beyond global market

- LTE smartphone growth in China is further fueled the overall smartphone growth during the quarter

Exhibit 1: Overall Mobile Handsets*

*preliminary estimates

Exhibit 2: Smartphones*

*preliminary estimates

OEMs

Samsung

- Overall handset shipment volumes declined 22% annually clocking 101.5 million phones

- Feature phone shipments declined (-28% YoY) with focus shifting more towards smartphones

- Q3 2014 did not gain any significant traction from Samsung’s flagship Galaxy S5 or the late September released Galaxy Note 4 which received a less warmer response as the sell-through in Q2 2014 for these models remained weak

- Samsung continued to clear channel inventory in markets such as USA, China and India as a result the Korean vendor had to slash prices in several markets to achieve sequential uptick in shipments

- As a result most of the volume mix shifted towards older mid-tier smartphone models affecting overall revenues, ASP and operating margins during the quarter

- Furthermore, Samsung also suffered a bit from intense pricing war started by aggressive Asian competitors in markets such as China, India, South East Asia and Europe selling aggressively through online channels challenging Samsung’s traditional offline channels which led to price erosion for Samsung

Apple

- Apple saw its iPhone shipments grow 16% annually shipping a record third quarter high shipment volumes of 39.2 million smartphones

- Apple’s overall handset market climbed to 9% but the smartphone marketshare dipped under 12% as the quarter did not see full effect of the newly launched iPhone 6 series

- Apple iPhone 6 series boosted Apple’s market share during the September month but supply issues held back the overall shipment volumes for Apple which would have been close to 42 million units if Apple had enough supply of iPhones at the launch

LG

- LG continues to impress with another strong quarter as shipments grew to 21 Mn units out of which 16.8 Mn were smartphones.

- Smartphone shipments grew by 40% Y-o-Y whereas the overall shipments grew by 16.7% Y-o-Y.

- For LG its flagship LG G3 sales have been strong and the overall demand for the phone has been positive

- LG also saw an uptick in demand for its mid-tier L series phones in Europe, Latin America as well as North America

- LG growth in emerging smartphone markets will be the key to consistently drive higher smartphone volumes

Xiaomi

- Xiaomi has been the other top performer during the quarter as the vendor’s smartphone shipments increased by 267% annually.

- Xiaomi is now one of the fastest growing vendor in Asia Pacific region as vendor entered into new markets like India, Indonesia, Malaysia etc.

- Like Huawei, Xiaomi is also growing fast in its domestic market and demand for its highly affordable Mi3,Mi4 and Hongmi redrice models is strong.

- Furthermore, Xiaomi is now selling its smartphones to more than five countries outside China which is helping the vendor to maintain the volume growth

- As Xiaomi expands it need to address the demand supply mismatch in countries like India and at the same time ramping up its after sales services too.

Lenovo & Motorola

- Lenovo and Motorola keep the momentum going as both the vendors grew their smartphone volumes 31% and 132% annually

- Lenovo was the Eighth largest handset and Sixth largest smartphone brand globally in Q3 2014 (without Motorola)

- Motorola continued to grow its volumes and revenues with leaner portfolio and go-to-market strategy allowing vendor to instantly to position its models at aggressive price-points and attract buyers

- The refreshed product portfolio helped Motorola to generate strong sales on account of positive product reviews from end consumers.

- Latin America, USA and India were some of the strong markets for Motorola during the quarter with presence and demand for its models quickly expanding in key European markets as well.

- Going forward majority of the smartphone growth will come from emerging smartphone markets as compared to China.

Micromax continued to grow voluems and maintained its spot in top 10 handset makers during the quarter and in top 15 smartphone vendors alongside ZTE, Sony and Coolpad.

The other long tail of Asian OEMs continued to grow moderately with some players such as Lava, Celkon, Gionee, Oppo, Vivo, Qmobile grew above industry average while some brands grew below the industry average due to fierce competition in sub-$100 wholesale mobile phone segment.

For press enquiries or additional questions reach out to us at analyst@counterpointresearch.com