Counterpoint Research team of Analysts have completed preliminary sizing of the global handset and smartphone market as few OEMs have already released their Q2 2014 (Apr-Jun) performances. Following are our preliminary market share and rankings according to our quarterly Market Monitor service.

The key highlights of the quarterly performances so far include:

Market:

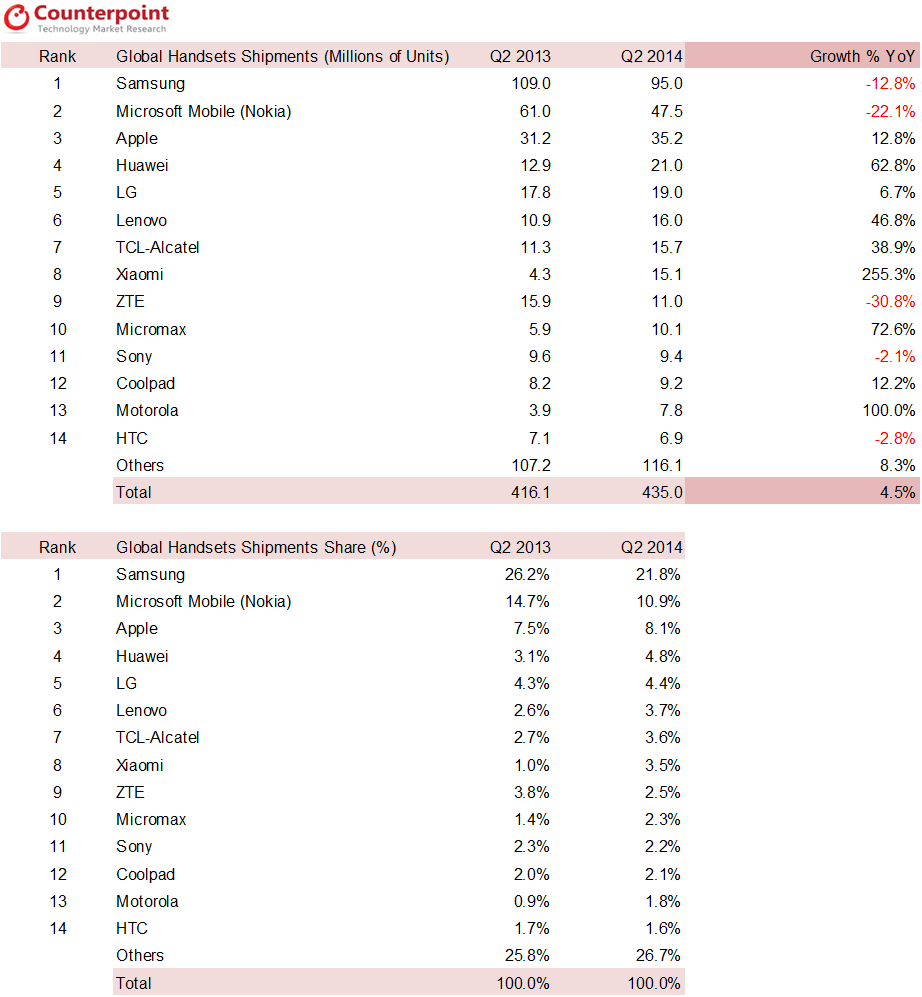

- Handset shipments reached a record June quarter high of under half a billion units for the Q2 2014 quarter registering modest growth (4.5% YoY) as feature phone market declined at the pace of smartphone segment’s growth

- Smartphone shipments crossed 300 million units, first time for second quarter,though slowing down a bit (21% YoY.)

- Smartphone now represent 69% of all mobile phones shipped during the quarter (59% in Q2 2013) as feature phone demand is shrinking fast globally.

- Consumers can buy a new branded 3G smartphone now for less than $50 and will become a norm by the year end

Exhibit 1: Overall Mobile Handsets*

*preliminary estimates

Exhibit 2: Smartphones*

*preliminary estimates

OEMs

Samsung

- Overall handset shipment volumes declined 13% annually clocking 95 million phones

- Feature phone shipments declined (-42% YoY) with focus shifting more towards smartphones

- Q2 2014 was the launch quarter for Samsung’s flagship Galaxy S5 which received a less warmer response as sell-through was weaker than expected and Samsung had to slash prices in several markets to reach closer to shipment volume targets

- Furthermore, Samsung’s strength, the mid-tier smartphone segment, also suffered a bit from intense pricing war started by aggressive Asian competitors in markets such as China, India, South East Asia and Europe

- However, North America was the bright spot for Samsung as the shipments rose annually in spite of an overall seasonally slow quarter

Apple

- Apple saw its iPhone shipments grow 13% annually shipping 35.2 million smartphones in Q2 2014

- Apple’s overall handset market climbed to 8% but the smartphone marketshare dipped under 12% as the smartphone users await the new iPhone being unveiled in Q3 2014

- Apple registered decent growth outside its home market especially in BRIC countries but the overall ASP has been declining as the iPhone mix shifts towards lower priced models such as iPhone 4S as consumers in emerging markets get their hands on to their first ever iPhone

- The upcoming iPhone if launched in a bigger form-factor should help Apple cement its position and increase its share in the premium smartphone market

Huawei

- Huawei was one of the star performers during the quarter as the smartphone volumes almost doubled compared to last year

- China remained the strongest market as Huawei ate into Samsung”s market share with smartphone shipments in the domestic market climbing 59% annually

- Europe and Latin America performed well but declining performance in important North America market will be one of the big concerns for Huawei’s future growth prospects

LG

- LG had a relatively strong quarter as handset shipments grew above the industry average to 19 million units out of which 14.5 million were smartphones

- For LG its flagship LG G3 began rolling out in late Q2 2014 and the overall demand for the phone has been positive

- LG also saw an uptick in demand for its mid-tier L series phones in Europe, Latin America as well as North America

- LG will have to refocus its portfolio, pricing and go-to-market strategy in key high-growth and high-volume markets such as China, India to consistently drive higher smartphone volumes

Xiaomi

- Xiaomi has been the other top performer during the quarter as the vendor’s smartphone shipments have almost quadrupled compared to last year

- Xiaomi is now the world’s fifth largest smartphone brand in terms of volumes surpassing LG for the first time

- Like Huawei, Xiaomi is also growing fast in its domestic market with healthy demand for its highly affordable Mi3 and Hngmi redrice models

- Furthermore, Xiaomi is now selling its smartphones to more than five countries outside China which is helping the vendor to maintain the volume growth

- As Xiaomi expands to key high volume markets such as India and with ongoing momentum it should challenge likes of Lenovo and Huawei for the third spot in smartphone segment soo

Lenovo & Motorola

- Another surprise growth story during the quarter include Lenovo and Motorola as both the vendors grew their smartphone volumes 48% and 110% annually

- Lenovo was the sixth largest handset and fourth largest smartphone brand globally in Q2 2014 (without Motorola)

- Motorola continued to grow its volumes and revenues with leaner portfolio and go-to-market strategy allowing vendor to instantly to position its models at aggressive price-points and attract buyers

- Latin America, USA and India were some of the strong markets for Motorola during the quarter with presence and demand for its models quickly expanding in key European markets as well

- Once the Lenovo-Motorola acquisition goes through, the combined volumes for Lenovo would be close to 25 million units per quarter to become the third largest smartphone supplier and lead ahead of likes of Huawei, Xiaomi and LG

Microsoft Mobile (Nokia)

- Microsoft completed its acquisition of Nokia Devices & Services division during the quarter and formed Microsoft Mobile as a devices hardware business unit

- Microsoft Mobile shipped roughly under 10 million smartphones in Q2 2014 with almost 8 million Lumias and 2 million AOSP based Nokia X smartphones

- Nokia Lumia smartphones are shipping at a run-rate of roughly 2.6-2.7 million per quarter with Lumia 630/635 and Lumia 930 rolling out whereas the Nokia X, XL and XL+ started rolling out to more countries during the quarter as well

- However, we see Nokia X series channel shipments to drop considerably in Q3 as Microsoft Mobile will stop pushing it and channels will start rejecting it similar to what happened to Symbian

- Nokia’s feature phone volumes were down 30% annually and 12% sequentially

Micromax from India became the tenth largest global handset supplier for the first time and 14th largest smartphone supplier. The long tail of Asian OEMs continued to grow moderately with some players such as Lava, Celkon, Gionee, Oppo, Vivo, Qmobile grew above industry average while some brands grew below the industry average due to fierce competition in sub-$100 wholesale mobile phone segment.

Author

Neil Shah

Research Director

Counterpoint Research