India is the world’s largest democracy, with 1.2 billion people and the third largest economy based on GDP (PPP basis). Furthermore the economy is expected to grow 7.7% annually in 2015 and 2016. India is slowly converting into a major manufacturing hub for mobile handset brands. The India government has set targets for local manufacturing as well as raising costs of importing finished goods. It’s ‘Make in India’ initiative is starting to bear fruit. Samsung, Micromax, Lava, Intex have been manufacturing mobile phones in India. Other players like Xiaomi, Motorola, Asus, Gionee are opting for contract manufacturing.

The key drivers for this shift are:

- India smartphone shipments are estimated to grow by 30% YoY in CY 2015.

- Over 100 smartphone brands compete in the market with the top 20 smartphone brands capturing 94% of the total smartphone market.

- Over 15 brands currently have their assembly operations in India either through contract manufacturing or through their own assembly facilities.

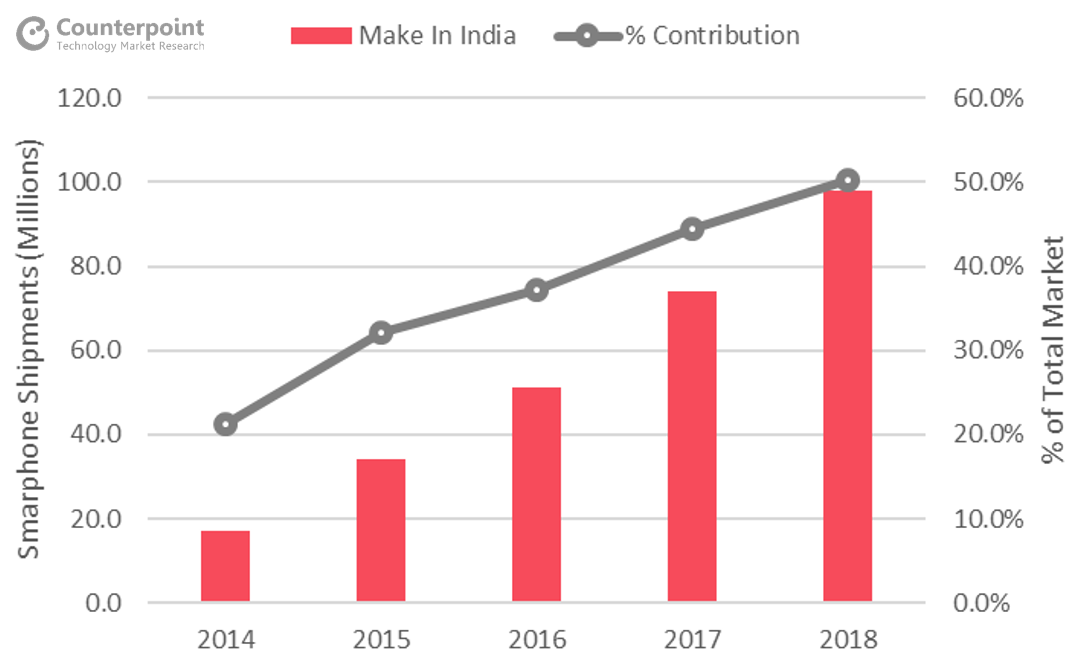

- Currently, 25% of smartphones are assembled in India, mostly at semi-knock-down (SKD) level.

- This is forecast to rise to almost 50% in the next five years with a mix of SKD and complete-knock-down (CKD) level.

- The component ecosystem is estimated to grow in coming quarters with some of the Chinese and Taiwanese key component players planning to set up their facilities in India. Until components are being manufactured in India production will primarily be SKD in nature from kits of parts imported for local assembly.

Smartphones Present Special Challenges:

- Lack of Experience: For young Indian handset manufacturers with no manufacturing experience, creating high-end products such as smartphones or tablets is stretching their core-competence.

- Missing Ecosystem: Manufacturing a smartphone requires an entire ecosystem with close inter-working of internal R&D and production teams with chip makers and other component vendors, application developers, carriers and others. Component manufacturers such as Sharp, Toshiba, Samsung, LG and even the major app developers, are not present in India.

- Transparency: The prevalence of corruption in planning processes has also had a negative impact, especially for global companies that profess a strong ethical stance. While not without its own issues, China is viewed as inherently less risky.

Role of Government:

- Governments can have a significant influence in the development of local manufacturing by setting out the right incentives. Under Prime Minister Modi, India is offering more carrots but also a bigger stick. In the Union budget, duty on imported handsets doubled to 12.5%. Duty on local manufacturing is only 2%, so brands importing will be harming profitability – provided local manufacturing can be established efficiently.

- The government has made efforts to promote manufacturing by reducing taxes and also offering other incentives, such as providing land at lower costs. However, a lot needs to be done in terms of providing other facilities, such as: cultivating home-grown component companies; encouraging software vendors to collaborate with handset manufacturers; and providing a well-structured logistics framework.

Conclusion for India Manufacturing: Two steps forward, one back

- Mobile phone manufacturing which has been centered in China is slowly moving to other Asian countries. India offers one of a number of possible locations. Indian government initiatives such as relaxed taxation, setting up Special Economic zones (SEZ) and gradual improvements to infrastructure all help.

- All stakeholders: the government, device vendors, component manufacturers, and associated software companies, all have a role to play in developing India as a manufacturing hub. There are lessons on how auto manufacturers, both domestic and international, have developed India into one of the world’s biggest manufacturing/assembly hubs. At present only a handful of device vendors are assembling or manufacturing in India, they alone won’t be able to build a manufacturing ecosystem in India. It will be a collaborative effort and will likely take several years to be fully realized.

For more information on this feel free to reach out to us at analyst@counterpointresearch.com for further questions regarding our in-depth latest research, insights or press enquiries.

Author: Tarun Pathak