- Online sales more than doubled in the region.

- Motorola’s share increased by 7.1 percentage points.

- Smartphone shipments in LATAM declined 19.5% QoQ.

New Delhi, Hong Kong, Seoul, London, Beijing, San Diego, Buenos Aires – August 31, 2020

Smartphone shipments in the LATAM market continued to fall during Q2 2020, showing a drop of 19.5% QoQ and 36% YoY, according to the latest research from Counterpoint’s Market Monitor service. However, the shipments started recovering after hitting a record low in April due to the COVID-19 lockdowns.

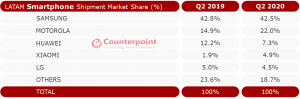

Commenting on the Q2 2020 LATAM market OEM performance, Senior Analyst Tina Lu said: “In Q2 2020, we experienced further market concentration. Large brands grabbed shares from the smaller ones. As a result, ‘others’ volume suffered the biggest impact, declining to around half of last year’s level. Top five brands represented more than 81% of the shipments in Q2 2020, a 4.8 percentage points increase compared to Q2 2019. Motorola and Xiaomi drove this growth, together registering more than 10 percentage points increase in their share. Huawei, on the other hand, lost 4.8 percentage points, despite its global leadership.”

Exhibit 1: Smartphone Shipment Market Share, Q2 2020

Source: Counterpoint Research Market Monitor, Q2 2020

Commenting on the handset demand, Research Analyst Parv Sharma said: “Online sales more than doubled in the region. But they were low before the lockdown. Online events such as the ‘Hot Sales’ event in Mexico increased online sales share. Some other events also stimulated consumption. In May, it was Mother’s Day across many countries while Colombia had the ‘No VAT day’ in June.”

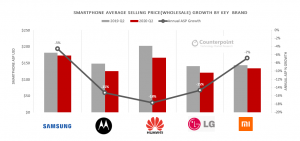

On the average selling price (ASP), Lu said: “The lockdowns also drove currency depreciation against the US dollar in most LATAM markets. Hence, most mobile devices saw price increases, placing additional pressure on the ASP. All top OEMs’ ASPs were impacted. Samsung was the most resilient OEM as its flagship model sales remained unaffected compared to the same quarter last year. On the other hand, Huawei ASP had the highest YoY drop. It lacks competitive models in the high and premium segment, affected by the ban on having Google Play Store on its devices.”

Exhibit 2: Smartphone ASP Decline by Brand, Q2 2019 vs Q2 2020

Source: Counterpoint Research Market Pulse, Q2 2020

Key Takeaways

- Motorola’s share increased by 7.1 percentage points compared to the same quarter last year. This is almost 48% growth YoY.

- Motorola increased its share in most markets of the region. Mexico was the main booster. However, Brazil is still Motorola’s most important market in terms of volume.

- Samsung continues to be the absolute market leader in LATAM.

- It was quick to react to the market movement. It revived its Galaxy J2 Core model production. This model was in line to be phased out after the introduction of Galaxy A01. However, now it has become one of the bestselling models in the region

- However, Samsung lost its leadership crown in Peru while it was somewhat challenged by Motorola in Mexico. Brazil remains its biggest market in terms of volume.

- Huawei’s performance through the quarter had its ups and downs. In April, it recaptured the second spot in the region after almost one year of remaining third. But its share declined in the following months.

- Huawei’s volume declined 63% YoY, impacted by the lack of components due to a trade ban, and the overall regional crisis.

- Xiaomi was the only brand that saw a YoY volume increase. While its share more than doubled YoY, this growth was not without controversy. Its biggest market, Brazil, had most of the volume entering unlawfully through Paraguay. This fact has invited much criticism in Brazil.

The Market Monitor research relies on sell-in (shipments) estimates based on vendor’s IR results, vendor polling triangulated with sell-through (sales), supply chain checks and secondary research.

The comprehensive and in-depth Q2 2020 Market Monitor is available for subscribing clients. Please feel free to contact us at press(at)counterpointresearch.com for further questions regarding our latest in-depth research and insights, or for other press enquiries.

Background:

Counterpoint Technology Market Research is a global research firm specializing in Technology products in the TMT industry. It services major technology firms and financial firms with a mix of monthly reports, customized projects and detailed analysis of the mobile and technology markets. Its key analysts are experts in the industry with an average tenure of 13 years in the high-tech industry.

Analyst Contacts:

Parv Sharma

Follow Counterpoint Research

press(at)counterpointresearch.com