Smartphone market grew 24% QoQ and 5% YoY driven by strong shipments ahead of the festive season.

Four of the top five brands (Xiaomi, Samsung, Vivo and OPPO) recorded individual highest ever shipments in a single quarter.

New Delhi, Hong Kong, Seoul, London, Beijing, San Diego, Buenos Aires – October 29th, 2018

According to the latest research from Counterpoint’s Market Monitor service, India smartphone shipments grew 24% sequentially and 5% YoY driven by strong shipments ahead of the festive season.

Commenting on the findings, Anshika Jain, Research Analyst stated, “Even though the quarter started modestly, smartphone shipments picked-up and reached an all-time record due to strong sell-in by brands in August and September. Key brands kicked-off their festive campaigns early this year by launching new models as early as August. This has given them ample time to prepare and align with festive season sales across online channels that started from early October.”

Commenting further Ms. Jain noted, “The record shipments happened at a time when the Indian Rupee has hit a record low against the US Dollar. This is already impacting supply chains and product planning for the brands. Any inventory accumulation after the festive season will put brands under pressure as they may need to pass on the resulting price rises to consumers. Hence, this festive season is not only crucial for brands to target new customers but also navigate the external headwinds”.

Commenting on the brand performance, Karn Chauhan, Research Analyst stated, “India’s shipments surpassed those of the USA during the quarter; the second time this has occurred. India is already the second largest smartphone market in the world after China; it exceeded 400 million smartphone users in June. Nevertheless, the market is underpenetrated relative to many other markets. As a result, top brands are expanding their reach in the country in a bid to acquire more customers and sustain growth. The success of new brands, like Realme, highlights the fact that the market still offers growth opportunities to new players if they have the right mix of market-entry strategies.”

Commenting further Mr. Chauhan noted, “Four of the top five brands recorded their highest ever shipments in a single quarter. The volume growth happened in the mid-tier due to the consumers steadily migrating toward higher price points. The $150-$250 segment contributed to almost one third of the volume during the quarter as many new products are launching at this level.”

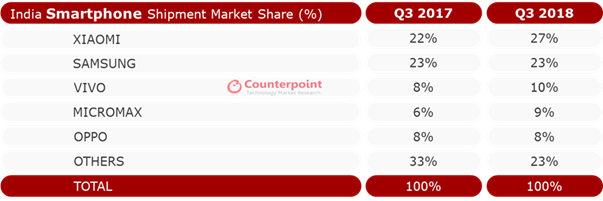

Exhibit 1: India Smartphone Market Share – Q3 2018

Source: Counterpoint Research Market Monitor Q3 2018

Note: *OPPO does not include Realme

Market Summary:

- Smartphone segment contributed to half of the total handset market during Q3 2018.

- Top five brands captured 77% share of the total smartphone market during the quarter.

- In the smartphone segment, Xiaomi recorded its highest ever shipments in India in a single quarter driven by the new Redmi 6 series and expansion in offline channels.

- Xiaomi also launched a new sub brand, Pocophone, during the quarter in a bid to target the growing mid to high tier segment. The initial shipments of Pocophone were strong.

- Samsung record shipments were driven by J series. Demand for J6 and J8 remained strong. Apart from this it also launched the Android Go edition, Galaxy J2 core, giving it a much-needed offering in the sub $100 segment.

- Vivo shipments reached their highest ever as it refreshed its V series with the launch of the V11 and V11 Pro. The V11 series started well as Vivo focused on key features like in-display fingerprint sensors, fast charging and improved camera capabilities.

- Micromax was back among the top five brands for the first in two years. Micromax, along with Reliance Jio, has won an order from the Chhattisgarh government under which it will be the sole supplier of five million smartphones to be distributed to the women and students in the state. However, shipments are likely to decline following completion of the order.

- OPPO shipments also increased during the quarter driven by refreshed product lines, notably the F9 series.

- Transsion Group, led by the itel, Tecno, Infinix brands continues to grow in the smartphone segment in India. Infinix grew 65% YoY as it expanded its product portfolio in online channels to take ground in the sub-$150 segment. Tecno shipments also doubled YoY driven by the Camon series.

- Other brands that did well during the quarter included, Realme, Honor, Asus, and Nokia HMD.

- Realme became the first ever smartphone brand to hit one million shipments within five months of launch across online channels. Realme 2 was the most popular model as users found the build quality (diamond design) and features (battery life) of the device attractive enough to drive upgrades in the sub-$150 segment.

- Honor shipments were driven by Honor 7A and Honor 9N. The breadth of its portfolio in India has increased in the past year.

- Asus Zenfone Max Pro drove the shipments for Asus as it was one of the popular devices with 6GB RAM in the sub-$200 segment.

- OnePlus 6 shipments in premium segment remained strong as it launched multiple offers during the quarter. This helped the brand to retain its number one spot in premium smartphone market.

- Nokia HMD refreshed its portfolio with the launch of 6.1 and 5.1 Plus, both of which started well. Nokia pivoted to a new design language for the launches, which was received positively by its target audience.

The comprehensive and in-depth Q3 2018 Market Monitor is available for subscribing clients. Please feel free to contact us at press(at)counterpointresearch.com for further questions regarding our in-depth latest research, insights or press enquiries.

The Market Monitor research is based on sell-in (shipments) estimates based on vendor’s IR results, vendor polling triangulated with sell-through (sales), supply chain checks and secondary research.

Analyst Contacts:

Tarun Pathak

+91 9971213665

tarun@counterpointresearch.com

Anshika Jain

+91 9873903650

anshika@counterpointresearch.com

+91 9816455600

karn@counterpointresearch.com

Follow Counterpoint Research

press(at)counterpointresearch.com

![]()