New Delhi, Mumbai, Hong Kong, Seoul, London, Buenos Aires

February 22nd, 2019

The Ministry of Electronics & Information Technology’s Phased Manufacturing Programme is running behind schedule. This has meant that the ‘Make in India’ plan for mobile phones has remained limited to assembly operations.

With the ‘Make in India’ plan for mobile phone manufacturing remaining largely about assembling, India had to import $13 billion worth of components in 2018, the latest analysis from Counterpoint Research shows.

According to Tarun Pathak, Associate Director at Counterpoint Research, “Not many high-value components are being sourced from India. As a result, local value addition in India was at 17% during 2018. This helped the country save US$2.5 billion in forex but increased assembly operations in India led to imports of mobile phone components going up to US$13 billion.”

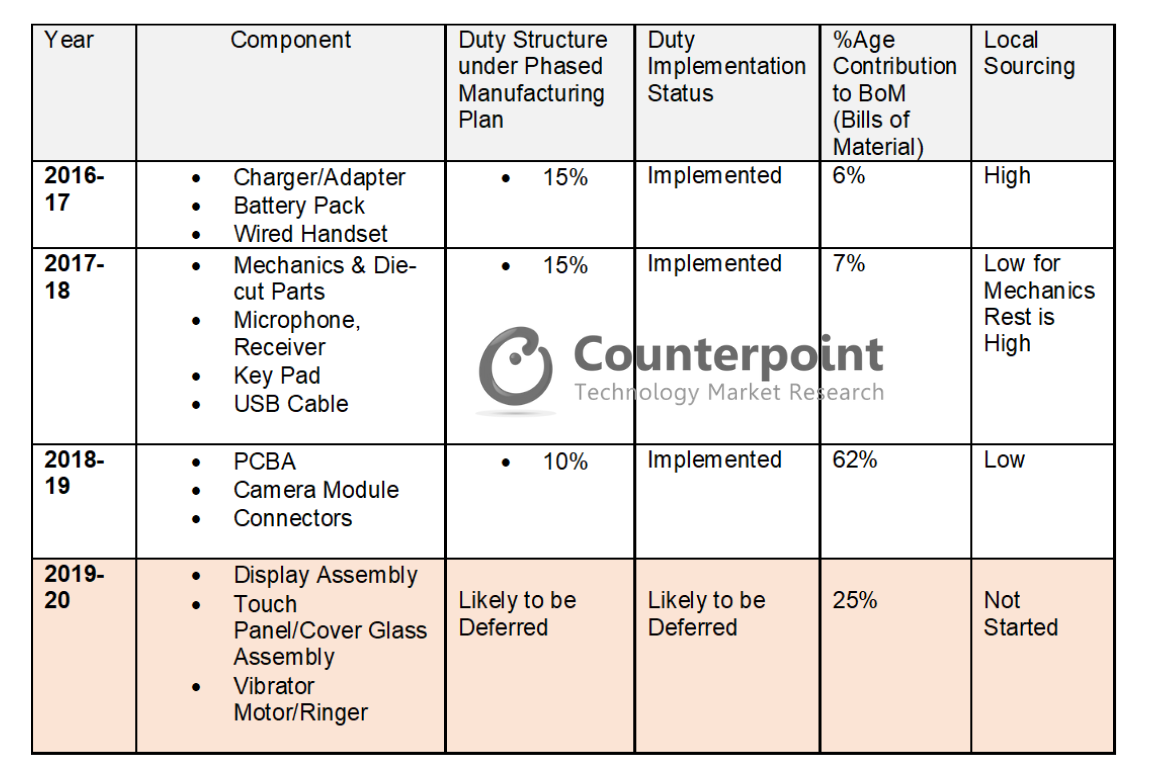

Counterpoint Research believes that the Ministry of Electronics & Information Technology’s Phased Manufacturing Programme (PMP) is running behind schedule as the implementation of customs duties under Phase III, which targets Display Assembly, Touch Panel/Cover Glass Assembly and Vibrator/Motor Ringer have been delayed.

Exhibit 1: Progress of PMP for mobile manufacturing in India

According to Pathak, the possibility of original equipment manufacturers (OEMs), like Reliance Jio and several Chinese brands, to source chips locally is still nearly four to five years away. “Sourcing of chips locally will happen only once the component ecosystem for low-value components is strengthened and export incentives are brought into force,” he added.

Counterpoint Research finds that Reliance Jio was still catching up on the PMP and imported 40% of Jio Phones in 2018. In fact, Chinese players like Xiaomi, OPPO, and Vivo had transitioned better from semi-knocked down (SKDs) to completely knocked down units (CKDs). These companies also have plans to scale up their local manufacturing operations, albeit limited to assembling only.

Half of the handsets sold in India in 2018 were imported as SKDs while only 34% were imported as CKDs. However, by the end of 2019, handsets imported as CKDs are forecasted to reach 75% while 25% will be in the form of SKDs.

“We think that the government will first push to localize the components or sub-components under PMP to drive value addition. This can lead a transition from SKDs to CKDs quickly over the next two years,” Pathak added.

While there has been a delay in the implementation of the PMP, India has made significant strides in developing its mobile manufacturing ecosystem. Local value addition has risen from a meagre 6% level in 2016 to 17% in 2018 and there are now 120 assembling plants in the country as compared to just two in 2014.

“India competes with China, Vietnam, and Indonesia when it comes to global smartphone manufacturing hubs. While China and Vietnam seem to be way ahead in terms of local value addition, India has surpassed Vietnam to become the second largest mobile phone manufacturer by volume. In doing so, the mobile phone manufacturing ecosystem in India has advanced and made the country a destination of interest for global component suppliers looking to expand their manufacturing,” said Hanish Bhatia, Senior Analyst at Counterpoint Research.

According to Bhatia, India offers a promising proposition for component suppliers, looking to set up a manufacturing base, with its low-cost and educated labor, a strong local market as well as its export potential thanks to the country’s proximity to the SAARC region, the Middle East and Africa.