According to the latest research from Counterpoint’s Market Monitor service, the smartphones shipments in China grew a modest 4% annually during Q1 2017 (Jan-Mar) and declined a massive 20% sequentially.

Commenting on the results, Research Director, James Yan, highlighted, “We are seeing the Chinese holiday season quarter shipments remain soft, as most of the sell-in to the channel has now shifted to the end of December. Demand has reduced during the first quarter as most of the brands exited Q4 with higher channel inventory ahead of the Chinese New Year season, but the overall sell-through was relatively healthy, up 12% annually. However, the market continues to concentrate around a few players with the top five brands, out of hundreds of brands in the market, contributing to almost three-quarters of the market volume.”

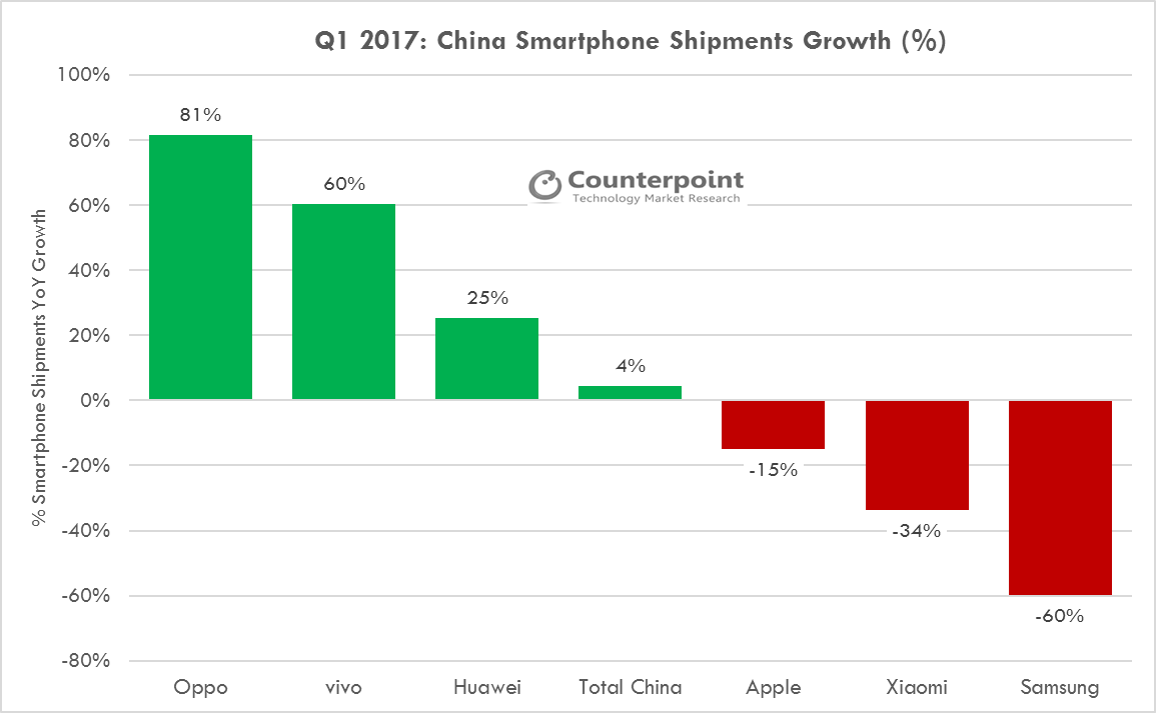

Oppo and vivo were the fastest growing brands followed by Huawei, together cementing the top three spots and extending their lead over Apple, Xiaomi and Samsung by a widening margin. Apple’s performance has become very seasonal, while Xiaomi and Samsung are losing to Huawei (Honor) and the Oppo-Vivo onslaught respectively.

Exhibit 1: % Smartphone Shipment Growth for OEMs and Market in Q1 2017

The Chinese smartphone market saw a healthy sell-through in the first two months of the quarter with March sell-through slowing considerably as most of the effort was in re-building inventory after clearance in the first two months. This is in contrast to last year’s first quarter where the first two months were weaker in terms of both consumer demand (sell-through) as well as supply (sell-in or shipments). We estimate the shipments to be healthy from May onwards, as the market comes back from inventory corrections.

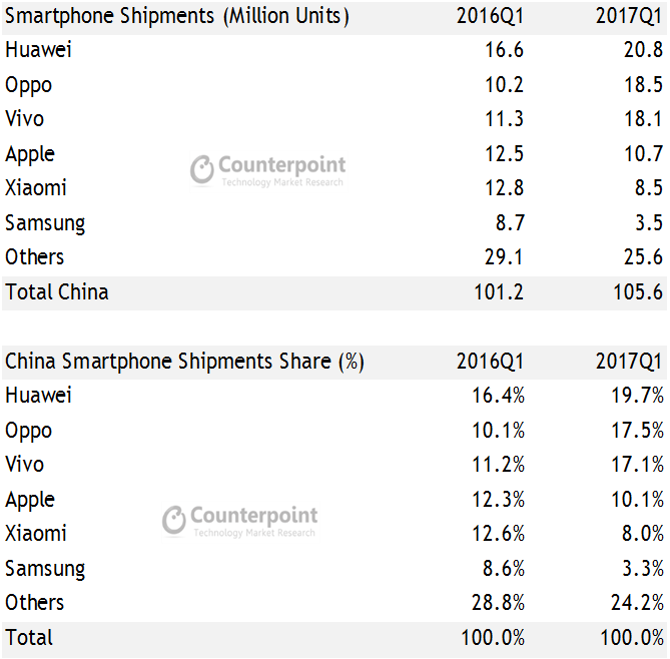

Exhibit 2: % OEM Smartphone Shipment Share in Q1 2017

Source: Market Monitor – Q1 2017

Commenting on the vendor performance, Research Analyst, Mengmeng Zhang noted, “Huawei regained the top spot this quarter surpassing Oppo, shipping higher volumes into the channels. Huawei’s Honor-branded 6x led the shipments, followed by the newly-launched flagship P10 series.”

Zhang continued, “Oppo’s shipments into the channels declined sequentially during the quarter, thus slipping to the second spot. Oppo focused on clearing the excess inventory build-up due to the higher sell-in at the end of December quarter. However, compared to a year ago, Oppo was the fastest growing brand in China with shipment volumes up 81% annually. Oppo continued to focus on building a stronger channel presence from tier-1 to tier-4 cities, aided by effective and very visible ATL and BTL promotional marketing. This has helped to create a consistent demand-pull. Furthermore, razor sharp focus on product quality, design, and integrating the latest and greatest camera technology to capitalize on the selfie mania, has contributed to its success.”

“Vivo, adopting almost a similar, Oppo-like strategy, has also cemented its position in the top three with a steady performance, as its shipments which grew a healthy 40% annually. Vivo’s X9 series continues to remain popular, making Vivo the number one brand in the fast-growing $300-$400 segment in Q1 2017.”

“The competition between Huawei, Oppo and Vivo continues to be fierce with the race for the top spot always up for grabs, especially in the new models launch quarter.”

Sharing insights on the different smartphone segments, Research Director, Neil Shah noted, “The mid-tier $100-$199 and $300-399 segments were fastest growing segments, mainly driven by Huawei, Oppo and vivo with strong offline plays. However, Apple has not been able to grow at the same pace in this segment which has capped its total-addressable-market to the 4000 rmb or $600+ wholesale segment. This is one of the key reasons that has put the brakes on Apple’s growth in China.”

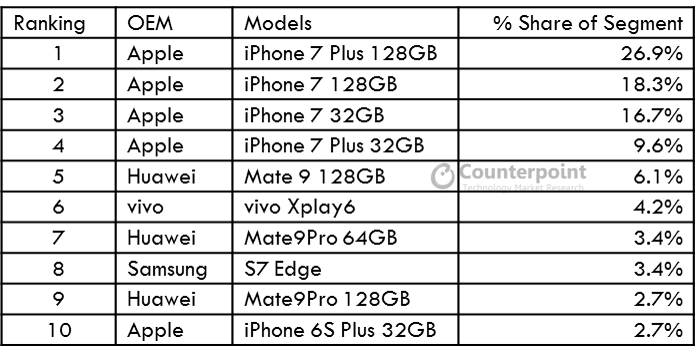

“The premium segment $600+ or 4000rmb remained flat annually but shrunk 33% sequentially. Apple’s share of this super-premium segment remains at 80%, with five out of the top ten model SKUs belonging to Apple. The 4000 rmb and above segment mostly peaks during the Apple iPhone launch quarter and shrinks for the rest of the year. This volatility is because of Apple and affects Apple, as competition in the premium space is still weak. Though we are seeing Huawei with its Mate 9 series and players such as Vivo trying to make some movement in this segment to attract premium Android users.

Below are some of the top selling smartphone model variants in the 4000 rmb and above segment.

Exhibit 3: Top-Selling Smartphones Sales Share (4000 RMB+ segment) in China in Q1 2017

Source: Model Sales Tracker – Q1 2017

For press comments and enquiries please reach out to analyst (at) counterpointresearch.com