We have extensively followed HTC since its Windows Mobile heyday, more than a decade ago, and when it was more of an ODM (Original Design Manufacturer). It then changed strategy attempting to becoming a major brand, liked by platform vendors (Google, Android) as well as operators and retailers. However, the growth story for such a potential smartphone manufacturer was short lived. Fast forward to 2017 and Google is buying $1.1 billion worth assets or rather access from HTC, especially to the R&D and IP resources, to solidify its own Pixel portfolio and potentially more.

However, we have seen this before where Google bought Motorola in 2011. Let’s deep dive in to what Google’s play is here with HTC and earlier with Motorola, and the implications:

HTC History:

- HTC was the first partner for Google’s Android phone called T-Mobile G1 launched at T-Mobile USA in Q4 2008 almost a year after iPhone’s launch

- HTC started to ascend since then until its peak in 2011 with multiple flagships (e.g. HTC Incredible at Verizon, HTC Evo Shift 4G at Sprint, HTC Hero, HTC Thunderbird and more) at multiple carriers in USA, Europe and Japan.

- HTC’s growth in share also aligned to its marketing spend and growing brand awareness – for example from 2009-2011 it sponsored one of the most successful professional cycling teams.

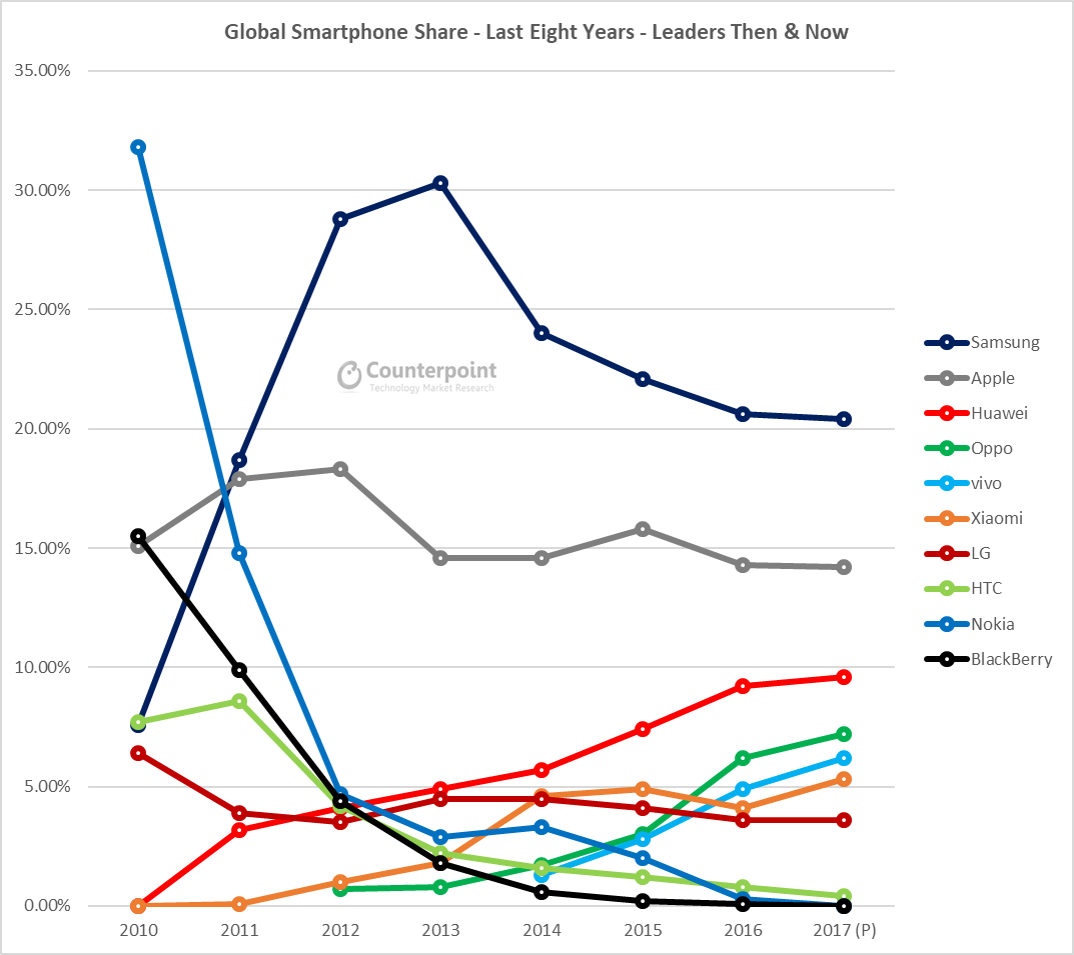

- HTC though was over dependent on its flagship series and operators’ subsidy budgets. Since iPhone’s expansion and the development of the Samsung Galaxy S series, HTC lost mindshare, declined in operators’ priorities and thus lost market share.

- Though Google now and then helped HTC by selecting it as an ODM for its Nexus and Pixel program, the brand was already on a downward trajectory.

- For Google, apart from seeing HTC as a loyal partner it also believed in its smartphone R&D and manufacturing expertise; HTC had a deserved reputation for making some of the best smartphones available at the time in terms of performance and quality.

Detailed analysis here on HTC’s Riches to Rags story (see here).

Motorola-Google deal

- With Motorola, for Google it was all about becoming vertically integrated like Apple, sooner or later.

- The growing clout of Apple raking-in robust top and bottom lines, as well as premium smartphone users, could have been a part of decision to acquire Motorola (apart from Moto had strong IP portfolio) and Google can create its own branded franchise when the time comes.

- However, this was a drag on its operational revenues and performance as Moto was not adding to any profits and losing money

- Also, there was a potential backlash from some OEM partners on this move and Samsung was already in process of getting close to Facebook (a big rival to Google in ad revenue) and build its own services on top of Android, indirectly nullifying Google’s control over Android

- And with investors’ pressure, Google let go of Motorola, just keeping the IP portfolio

Entry of Pixel & need for an R&D team (HTC)

- As the premium market has been dominated solely by Apple and Samsung since then, Google felt a need to get a direct slice of the premium users, which is important for the Android platform and business model

- This has prompted Google to offer the best premium Android experience to its users via its Pixel phones which Samsung wouldn’t be able to or want to offer

- To have a tighter integration of hardware and software and build own branded products, Google needs access to a good R&D team

- HTC being known for its R&D expertise, hardware design and integration, it is the natural fit and has been Google’s partner since 2008

- So this investment, while is a business decision to have access to one of the best R&D team but also I believe is a sort of emotional decision to save its close partner

- However, with influx of $1.1 billion in HTC, HTC has another lifeline to build its business – focus on a narrow portfolio, be leaner and better operationally than before and be more agile

- There was never anything wrong with HTC products, they were industry leading, but the sales, marketing and operational strategies have always been ineffective against competition, diluting all the hard work put in by the R&D and manufacturing teams

- So this time around, this a special partnership and well worded by Google, “they will have access to HTC R&D and IP” rather than full acquisition and upset its OEM partners

- But it remains to be seen if HTC invests more in smartphones as it is going to be tough to compete with the likes of Xiaomi with its completely aggressive price-spec, go-to-market model, or take that investment from Google and build a big VR/AR and IoT business. The latter is perhaps the more plausible and prudent scenario

Implications of HTC deal

- So for Chinese brands, it doesn’t impact directly as very few Chinese brands are competing in $700+ premium segment and Pixel (built via HTC team now in-house) is designed to actually woo away iPhone users and keep a check on Samsung as it wanders away close to Facebook

- So Samsung will be the biggest one to lose as it is head on with its portfolio as well as smaller brands who do have one or two flagship phones like LG or Huawei

- For Samsung, obviously, if Google goes with OLED screens it is a big win and maybe an opportunity for other components like battery, memory and other passive components

- Apple may also see some churn to Pixel. But this is likely to be minimal compared to premium Android users from Samsung or others

- Google will have to scale-up the Pixel portfolio beyond a handful of markets to make its billion dollar investment worthwhile

- In summary, this is a big step for both parties, to (re)build their smartphone ambitions