- Intel reclaimed the #1 spot in terms of revenue in 2023 due to Samsung’s slowdown from memory downturn.

- NVIDIA capitalized on AI investments to almost double its revenues in 2023 and claim the #3 spot.

- The memory sector suffered the most in 2023 due to weak demand and oversupply.

- Artificial intelligence and memory rebound will be the revenue driver in 2024.

Seoul, Beijing, Boston, Buenos Aires, Hong Kong, London, New Delhi, San Diego – January 26, 2024

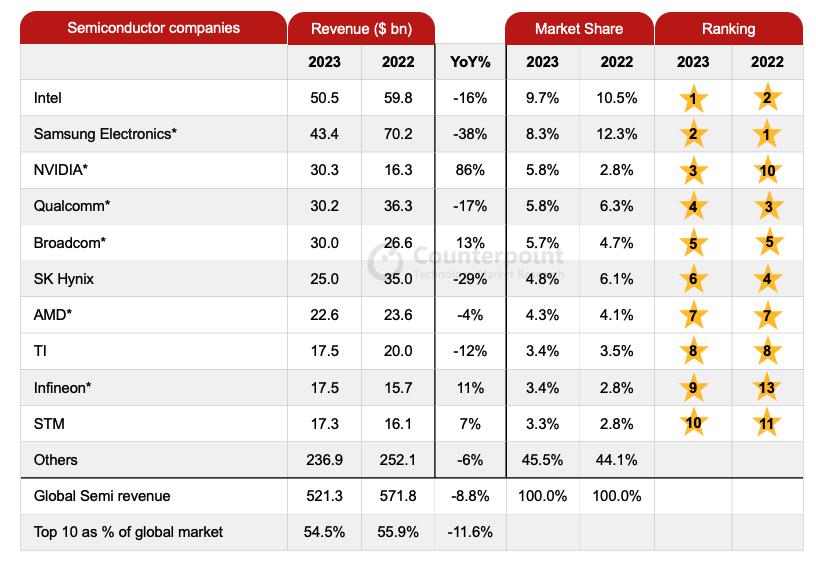

The global semiconductor industry’s revenue declined 8.8% in 2023 due to a slowdown in enterprise and consumer spending, according to preliminary results/forecasts from Counterpoint Research. Besides, the overall 2023 semiconductor revenue rankings saw some big changes from 2022, like Intel reclaiming the top spot from Samsung as the latter suffered a lot from the memory sector downtrend as well as lackluster smartphone business. AI provided positive news to the semiconductor industry, emerging as a key content and revenue driver, especially in the second half of the year. NVIDIA appeared to be the largest beneficiary, followed by AMD. Both will be growing their AI-related businesses in the coming years.

We believe 2023 was a year for semiconductor companies to fine-tune their strategies/outlook and manage inventory adjustments to prepare for the impending AI boom. According to Counterpoint’s semiconductor revenue tracker, only 6 out of the top 20 global semiconductor vendors reported YoY revenue growth. The memory sector, in particular, experienced strong headwinds and was down 43% YoY in terms of revenue in 2023. We also found that the top 20 global semiconductor vendors contributed to 71% of the market, down from 76% in 2022 and showing a 14% YoY revenue decline.

Top 10 Semiconductor Companies’ Revenue 55% of Global Revenue

(*) numbers are based on preliminary forecasts by Counterpoint Research

Intel reclaimed its first place in semiconductor revenue rankings in 2023, though it reported a 16% YoY decline in its revenue largely due to a double-digit YoY shipment decline in both the PC and server segments. Samsung too was massively affected by the memory market slowdown in both DRAM and NAND segments, reporting a 38% YoY decline in its revenue. The memory market was mainly hit by soft demand in the PC, server and smartphone segments as well as oversupply and excess inventory across the market. SK hynix and Micron, two other major players in the memory market, also reported huge declines in their revenues at 33% and 36% YoY, respectively.

NVIDIA was in the spotlight in 2023 thanks to the acceleration of AI deployments. We believe the company will continue to lead the semiconductor industry’s growth because of its high market share of general-purpose GPUs used in AI/high-performance computing. NVIDIA saw an 86% YoY revenue growth in 2023 to rank third in terms of revenue, its first-ever top-five position.

Commenting on the market dynamics, Senior Analyst William Li said, “In general, we believe artificial intelligence (AI server, AI PC, AI smartphone, etc.) will continue to be a major organic growth driver in the semiconductor industry in 2024, followed by the memory sector’s rebound due to normalizing oversupply situation and demand recovery. The automotive sector could be another driver for the market due to content growth, which was already a key revenue driver for Infineon and STMicroelectronics in 2023.”

Since we are at the end of the inventory correction cycle and the support from clients’ demand is relatively solid, supply constraints will likely be the key variants to keep an eye on. During its latest quarterly earnings call, the world’s largest foundry player, TSMC, maintained its solid capacity expansion plan for 2024. The company holds an optimistic view on its utilization rate in the coming quarters, which also reaffirms our view of strong demand throughout the year.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Related Posts