China has traditionally had peak handset sales around a few clearly defined periods. These periods still exist as sales drivers but are now being supplemented by additional periods. This means China’s seasonal sales peaks are now shifting somewhat toward a more traditional ‘western’ seasonal high in 4Q.

China’s new peak selling seasons:

- New Year festival: the date moves according to the lunar calendar but main sales occur in January.

- Labor Holiday in May.

- E-Commerce promotional ‘holiday’ on November 11th or 11/11, also known as Singles’ Day.

- Apple’s new iPhone launch which typically occurs in September with the main ramp in sales neatly coinciding with October National Days

- December: while Christmas has not been a Chinese tradition, retailers are driving sales around this winter holiday and toward the calendar as well as Lunar new year.

- July: students’ summer holidays – equivalent to the ‘Back-to-School’ sales elsewhere in the world.

China’s slow selling seasons are months where there are no significant holidays or festivals:

- February: not only is February the shortest month, it also includes vacation time after the Lunar New Year, when stores are either closed or working at a slower pace.

- March, April, June and September, these months don’t have long holidays

Following Alibaba’s lead on creating the Singles’ Day concept, some other smart phone vendors and e-commerce platforms are trying to setup their own holidays. For example LeTV – September 19th, JD.com – June 18th, and Huawei and Xiaomi – both on April 8th. These promotional days are trying to stimulate consumer purchasing during the slower sales periods.

Singles’ Day promotions by channel:

Singles’ Day was started by Alibaba Group’s TMall (www.tmall.com) to motivate e-commerce sales in 2009. As the concept caught on, other vendors began to join the Nov 11th Singles Day celebration with their own promotional activity.

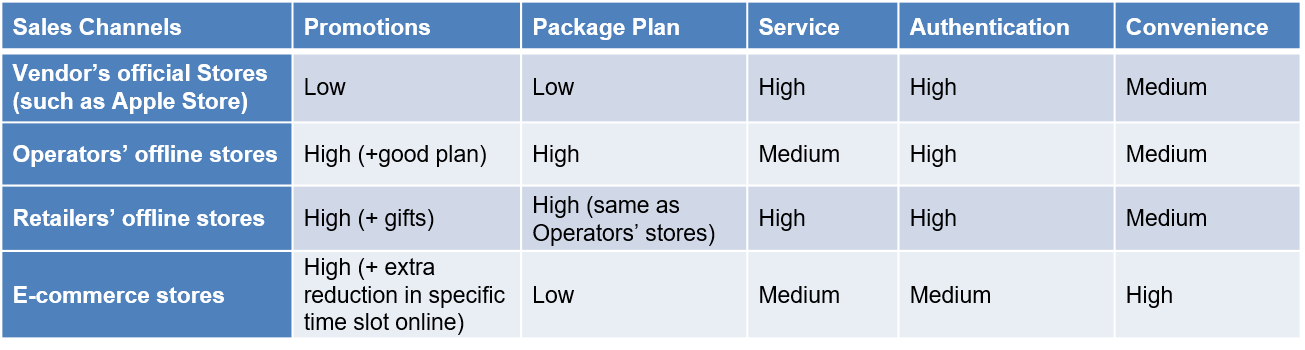

The Singles’ Day promotions started on November 1st and differed somewhat from channel to channel as follows:

1. Operator Stores

- Operators applied a promotional discount of 200-400RMB (US$30-60) to prices of Apple and Samsung flagship products. Official prices from both vendors was not lowered for Singles’ Day. Consumers taking a new package plan could obtain an incremental 200 RMB allowance – returned in call/data rates.

- For domestic brands including Huawei, Xiaomi, Oppo, ViVo, the vendors themselves offered discounts and promotions meaning the level of discount was often deeper than Apple & Samsung. For example Xiaomi’s Mi4 was discounted by 600RMB (US$90) and consumers could also receive other gifts such as Xiaomi bracelets. Additional discounts were also offered for taking a new operator call/data plan.

2. Retailers (Offline & vendor/operator authorized).

- During Singles’ Day promotions, the prices from the retailer’s offline stores were the same as e-commerce or operator’s stores and even a little lower. Moreover these offline stores offer services to consumers that e-commerce stores do not.

- From the offline stores, the range of promotion is almost the same as the operators’ stores. Generally, Apple/Samsung’s prices are 200-400RMB reduced, and the domestic brands are 200-600RMB reduced. If the consumers choose the operator’s package plan, they will get more benefits or gifts. Furthermore, the service level from the retailers’ offline stores are better than those from the operators’ stores.

3. TMall Online Store

- Vendors start their marketing activities via TMall from November 1st . For example prices of iPhone 6s/Plus are lowered by RMB 200-400 (US$30-60) in the run up to 11th November.

- Samsung did not have a special promotion for its new products in Tmall

- Xiaomi offered a wide range of promotional opportunities in the run up to the November 11th holiday. The price reductions and gifts are generous in comparison with domestic rival Huawei. In addition, during certain time slots Xiaomi applied extra reductions of between RMB 50-100 (US$ 7.50-15)

- Other domestic brands like Oppo/ViVo/MeiZu all have reduction range from 200-400RMB for some models.

4. JD Online Store

- JD is the second biggest e-commerce store in mainland China. The range of price promotion in JD is almost the same as TMall: the prices for iPhone6s/plus are lowered by 200-400RMB, and the new products of Samsung like S6 edge/Plus also don’t have special promotions on JD.

- Other domestic brands like Huawei/Xiaomi/Oppo/ViVo/MeiZu have the same price reduction range (200-400RMB) as TMall.

Winners and Losers:

Winners:

- We would say Huawei, MeiZu, QiKu and LeTV, were the winners. The 4 had maximum exposure during the period.

- Xiaomi did well on online but this is its traditional channel and its performance was merely good enough to defend its turf. Huawei also has good offline channel distribution so having equal performance online with Xiaomi is a huge boost.

- Meizu, Qiku and LeTV are tier 2 brands so exposure and performance were less but almost on par with the tier 1.

- Apple didn’t do any marketing activities and price promotions during Nov.11th; all the advertising and promotions were done by e-commerce platforms, but it still got good sales. This was helpful but considering the launch of new models it should have gotten much more fanfare. We suspect November sales will be down compared to October.

- MeiZu (invested by Alibaba and running YunOS developed by Alibaba as well) is the first ‘Dark Horse’. It got good advertising spot in TMall, and searching ranking is better than others.

- QiKu (joint venture of Coolpad & Qihoo360), is the second ‘Dark Horse’. It got good sales performance with QiKu Youth Edition and flagship Edition on Nov.11th. The price reduction was around 400RMB. Qiku is running 360OS.

- LeTV is a new player in 2015 and the third ‘Dark Horse’ on Nov.11th. LeTV 1s was a hit. LeTV 1s is sold at RMB 999 (US$155). Its hardware configuration is on par with models costing 2000RMB.

Losers:

- Lenovo and Samsung‘s performance on Nov.11th were not good. In many channels, Lenovo and Samsung barely made the top 10 list. Samsung didn’t have much price reduction on Nov.11. Lenovo didn’t have a real flagship model to compete, and was not good at internet marketing and sales like Xiaomi. The usage of internet media marketing, including topic sales, hot talking with fans via Weibo/Wechat, flash sales online, etc were very weak.

Authored by Tom Kang and Peter Richardson