Chinese brands such as Huawei, OPPO, vivo, and Xiaomi are expected to determine the future direction of the China foldable smartphone market. In the second half of 2022, Huawei, OPPO, and Xiaomi are expected to launch new foldable smartphones and continue to provide growth momentum to the segment.

Apple performed well in 2021 by successfully occupying the space vacated by Huawei in the Chinese smartphone market’s premium segment of $600 and above. But with no foldable in its portfolio, Apple’s dominance of this segment is strongly challenged by Samsung, the global leader in foldables, and Chinese brands.

China’s foldable market is expected to see significant growth in 2022

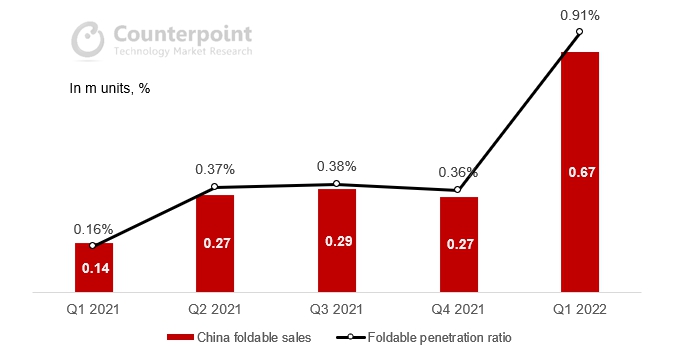

The Chinese smartphone market is expected to see big gains in foldable sales in 2022. This, in turn, will prove to be an important factor in pushing the overall growth of the global foldable market in 2022. The Chinese foldable smartphone market saw a sales volume of 0.67 million units in Q1 2022 to register 391% YoY and 152% QoQ growth. As foldable sales have maintained their momentum in April and May, China’s foldable market is expected to grow 225% YoY to reach 2.7 million units in terms of shipments.

China Smartphone Sales Trends

Patriotic consumption or brand recognition or product quality?

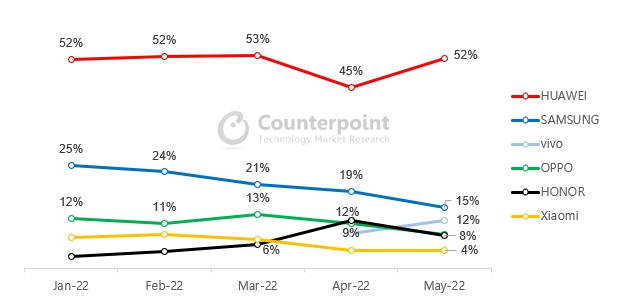

The Chinese foldable smartphone market’s growth in 2022 will make clear the market’s characteristics, like the preference for domestic brands. The sales volume for the Chinese foldable market for January-May 2022 shows Huawei occupying 50% of the foldable sales in China, followed by Samsung with 20%, and OPPO and Xiaomi in third and fourth places, respectively. vivo has been present in the Chinese foldable market since April 2022 and, based on the April and May sales only, it is showing a good start with a 10.3% market share.

China Foldable Smartphone Market Share by Brand

Source: Counterpoint Foldable Model Tracker

Huawei is aggressively targeting China’s foldable smartphone segment, which accounted for about 7% of smartphone sales in China from January to May 2022. As smartphone sales in China are mainly 5G, Huawei seems to emphasize a new form factor – foldable.

With the overall Chinese smartphone market expected to show weakness in 2022, Chinese OEMs are aiming to strengthen their penetration in the premium segment. Other Chinese brands such as OPPO, Xiaomi, and vivo also focus on foldables to target the Chinese premium market. At least 4-5 new foldable products are expected to be launched in the second half of 2022.

Global foldable leader Samsung is also expected to strengthen its position in the Chinese market. The new Galaxy Z series coming in Q3 2022 is expected to perform better than its predecessor, thanks to the rising popularity of foldables in China.

Clamshell-type foldables’ influence is expected to increase in China in 2022

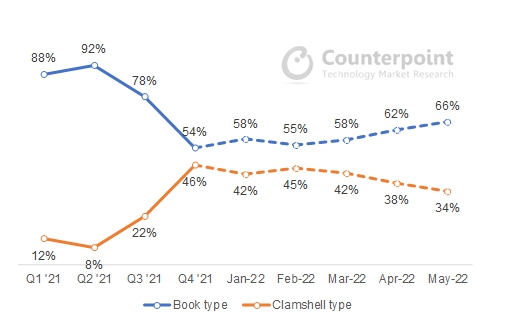

The sales volume of book-type foldables in the Chinese market was significantly higher than that of the clamshell type until 2021. Looking at the sell-through trend for January-May 2022, book-type foldables account for about 77% of the sales share for the foldable market, showing a different trend from the overall global foldable market.

China Foldable Smartphone Market Share by Folding Type

Source: Counterpoint Foldable Model Tracker

However, this trend is likely to change in 2022.

The market share of the clamshell type in China remained at 22% until Q3 2021, before Huawei launched its P50 Pocket. But after this launch, the clamshell type started showing a growing trend to reach 46% in Q4 2021. The share is expected to exceed 50% in H2 2022 as new clamshell-type models are launched. Clamshell-type foldables are relatively more accessible due to their low price, besides being easier to carry compared to the book type due to their less weight and size.

Intensifying foldables competition in China to intensify competition in its premium market

Given the recent downward trend in the prices of foldables, the segment is likely to see big growth in the Chinese premium smartphone market in 2022 and 2023. After Huawei’s retreat, Chinese global brands have continuously tried to advance into the Chinese premium market. Therefore, we believe that they will take an aggressive approach with foldables as well. It is here that Apple, currently a strong player in the Chinese premium market, will have to reconsider its market strategies.

Related reports

China Foldable Smartphone Market Trends, 2022

Global Foldable Market Analysis, Q1 2022

Global Foldable Smartphone Market Tracker, Q1 2022: May 2022

Global Foldable Smartphone Market Forecast, Q1 2022: May 2022 Update