Counterpoint Research Analyzes Premium Smartphone Sales Ahead of Apple Watch Launch

Seoul, Hong Kong, Mumbai and London – April 10th, 2015

The Apple Watch will go on sale in nine markets on 24th April with previews starting in a few markets on April 10th. The Apple Watch works in tandem with an iPhone 5 or newer and running the iOS 8.2 or later operating system. Therefore the market that Apple is aiming for with its new wearable device is anyone that has bought an iPhone in the recent past or can be persuaded to buy one in the near future. Apple Watch is a premium priced wearable starting at $349, but the likely average selling price will be greater than $500 considering all the different versions in the Apple Watch range. Estimates of first year sales of Apple Watch vary widely. Counterpoint Research expects sales in calendar 2015 of 20 million units across all markets. This implies an attach rate around 4% of the expected global iPhone user base at the end of 2015.

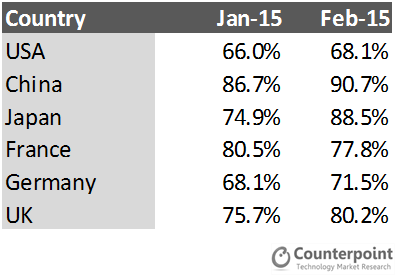

Counterpoint Research has investigated the market share of Apple iPhone in the premium smartphone segment. In all nine markets in which Apple is launching its Watch, Apple’s market share in the $500+ smartphone segment was greater than 50% in both January and February 2015. There is some potential for new iPhone buyers to be attracted to the Apple platform simply because they want to buy an Apple Watch – seduced by the marketing hype and halo effect, though we don’t expect this to be a substantial number.

We have focused on six of the Apple Watch launch markets: US, China, Japan, France, Germany and UK, all of which will start shipping the Apple Watch on April 24th and for preview at Apple stores on April 10th.

Exhibit 1: Apple’s Market Share in US$500+ Smartphone Segment

US – Home Market Advantage

Apple iPhone has enjoyed a strong position in the US market for several years. Its position as king of the premium smartphone segment has only been challenged sporadically by Samsung, but its preeminent position has never been seriously threatened. This strength can be seen in its position in January and February 2015 in the $500+ wholesale price segment where Apple’s market share was consistently two thirds or greater of the available market in this price category. The $500+ segment accounted for more than 40% of US smartphone sales by volume in January and February 2015.

Apple enjoys a strong base of users. At the end of 2014 Apple base of users accounted for around 26% of all smartphone users – not just those from the premium segment.

China – Dominant Position

China’s vast population is, on average, relatively poor. However there is a large and rapidly growing middle class for whom the Apple iPhone is a highly desirable status symbol. Apple’s position in the $500+ market segment is utterly dominant with almost 9 out of every 10 smartphones sold in the seasonally important Lunar New Year period of January and February being iPhones. The $500+ segment accounted for around 14% of China’s smartphone sales by volume in January and February 2015. Around 8% of smartphone users in China currently own an iPhone. This is relatively small share but from a huge and rapidly growing base of smartphone owners where the average smartphone price is low.

Japan – Staying Ahead

Japan has a long record of relatively high-priced mobile devices, most from local brands. Nevertheless, Apple has taken the country by storm and stands head and shoulders above its local rivals. This position continued in the early part of 2015 with Apple accounting for more than three quarters of all products above $500. The $500+ segment accounted for more than 40% of Japan’s smartphone sales by volume in January and February 2015.

Europe – Apple core to premium segment

Apple Watch will be launched in three European markets on April 24th – France, Germany and the UK. In all three Apple dominates the premium market segment with only Samsung offering any level of competition – Germany being Samsung’s strongest market of the three. The $500+ segment accounted for more around 30% of the smartphone sales by volume in January and February 2015 in each of the three markets.

Wearables Market and Competitive Position

Commenting on the analysis, Peter Richardson, Research Director with Counterpoint Research says, ‘While Apple’s strength in the premium smartphone segment is clear, the opportunity for the Apple Watch is not without risk. The wearables market has been characterized by a largely fragmented mix of activity trackers and so-called smart watches all seeking to solve a problem that few people really seem to have. Apple hasn’t demonstrated that it understands this usability issue any better than its rivals – it’s just seeking to do it with style’

Adding further comments, Neil Shah, Research Director with Counterpoint Research says, ‘Expectations for Apple Watch are sky-high, like its price. It will have to perform extremely well to meet those expectations. Poor battery life, limited app support and buggy software can quickly take the shine off the experience for initial Watch buyers. Nevertheless we are confident Apple will achieve good sales momentum from the start’.

Discussing the competitive landscape, Tom Kang, Research Director with Counterpoint Research commented, ‘Apple has enjoyed a period with relatively little competition at the high end of the smartphone market. However Samsung will soon launch the Galaxy S6 and S6 Edge, both of which will likely win mind share and market share in the premium smartphone segment. Samsung’s new products will launch just as demand for iPhone 6 and 6 Plus is expected to start waning after the initial excitement following the September 2014 launch. In addition, the smart watch market is becoming more crowded with even Swiss luxury brands dipping a toe in the water. So Apple doesn’t have all its own way.’

Methodology:

Our sales and market share data is based on sell-out (sales) surveyed at major mass retailers, distributors across different markets (37 countries) by Counterpoint Research team plus sanity checked with demand side surveys & expert Analyst estimates to complete the global monthly sales database.

Reference to pricing is wholesale price in US Dollars. Unsubsidized retail prices will be higher.

Background:

Counterpoint Technology Market Research is a global research firm based in Asia specializing in Technology products in the TMT industry. It services major technology firms and financial firms with a mix of monthly reports, customized projects and detailed analysis of the mobile and technology markets. Its key analysts are experts in the industry with an average tenure of 14 years in the high tech industry.

Analyst Contacts:

Peter Richardson

+44 20 3239 6411

peter@counterpointresearch.com

Neil Shah

+91 9930218469

Tom Kang

+82 10 2874 8133