It is extremely rare these days when a corporate announcement catches everyone by surprise. But in early June, AMD and Samsung shocked the tech world. The two announced a multi-year strategic partnership wherein Samsung will license mobile graphics IP from AMD and develop an in-house graphics processing unit (GPU) for its future mobile devices. The partnership marks the return of AMD in the mobile devices space, albeit through an IP licensing partnership.

It is a crucial diversification for AMD, which already has a strong portfolio of products for PCs, gaming consoles, cloud computing, and High-Performance Computers. Even AMD’s rival NVIDIA has not been successful in the mobile devices space. While NVIDIA has been present in this space since 2008, adoption of its products remains limited to a few devices like the Nintendo Switch.

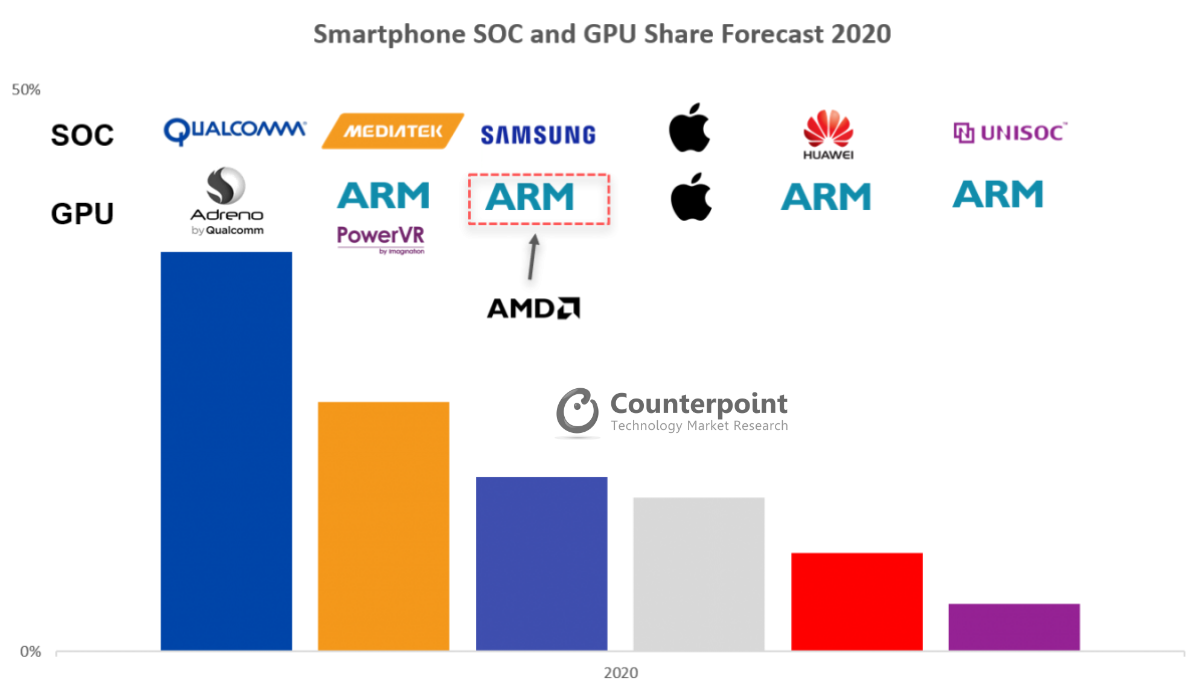

AMD had exited the mobile GPU space in 2009, after selling the Imageon line of graphics processors for handheld devices to Qualcomm’s handset division for US$65 million. Qualcomm renamed Imageon to Adreno, an anagram of AMD’s Radeon brand of graphics processors. That was even before the smartphone market had matured. In the years that followed, Qualcomm Adreno became to the mobile space what AMD is in the PC, laptop, and gaming console industry. According to Counterpoint’s data, 33% of the smartphones sold in 2018 had Qualcomm SoC and a Qualcomm Adreno GPU.

As part of the deal, AMD will license custom graphics IP, based on its recently announced highly-scalable RDNA graphics architecture, to Samsung. This will enable Samsung to integrate custom AMD Radeon graphics IP into future system-on-a-chips (SoCs) for mobile devices, including smartphones and other products that complement AMD’s product offerings. Samsung will pay AMD both technology licensing fees and royalties. In essence, this deal also opens up a new revenue stream for AMD as it will get a royalty amount on every device that Samsung sells using AMD’s graphics IP. According to data from Counterpoint’s Market Monitor service, Samsung is the largest smartphone brand by shipments, and in 2018 alone, it shipped 292 million smartphones.

Does it mean AMD will seek more such IP licensing partnerships? Yes and no, according to Ruth Cotter, Senior Vice President – Marketing, Human Resources & Investor Relations. At the Bank of America Merrill Lynch 2019 Global Technology Conference, Cotter made it clear that AMD remains product company and that will be the number one focus for the company. However, Cotter added that AMD is open to helping other companies through IP licensing partnerships, as long as the potential partners don’t end up competing with AMD.

For Samsung, the partnership allows it the flexibility to tweak its GPU, already rumored to be under-development, for high performance and potentially taking it up to the same level as Apple and Qualcomm. It also fits in with Samsung’s strategy of vertical integration. Interestingly, Samsung announced the partnership with AMD exactly four years after it announced a partnership with ARM to source the British company’s Mali range of mobile graphics processing units. We expect that Samsung to start using AMD based GPU from end 2020 or 2021 onwards.

In fact, ARM is the only one who loses out. According to Counterpoint’s data, ARM’s GPU technology powered 52.6% of the smartphones sold in 2018. That share will come down substantially as ARM can no longer do business with Huawei and its subsidiary HiSilicon due to the US’ trade ban. With only MediaTek and Unisoc SoCs expected to use the Mali GPUs from ARM, we expect the British chipmaker’s share in the mobile GPU market to come down to under 30% in the coming years.

For a detailed report on the Smartphone SoC market, click here

For a detailed report on the Smartphone SoC market, click here